Get the free 2013 Schedule M1CR Credit for Income Tax Paid to Another State

Show details

With your Form M1. Minnesota Residents Working in Michigan or North Dakota If you had 2013 state income tax withheld by Michigan or North Dakota from person-

We are not affiliated with any brand or entity on this form

Instructions and Help about 2013 schedule m1cr credit

How to edit 2013 schedule m1cr credit

How to fill out 2013 schedule m1cr credit

Instructions and Help about 2013 schedule m1cr credit

How to edit 2013 schedule m1cr credit

To edit the 2013 schedule m1cr credit form, you can utilize pdfFiller's editing tools. Upload the completed form to your pdfFiller account, then use the editing features to make necessary changes. Additionally, you may securely save your edits online or print the updated version for your records.

How to fill out 2013 schedule m1cr credit

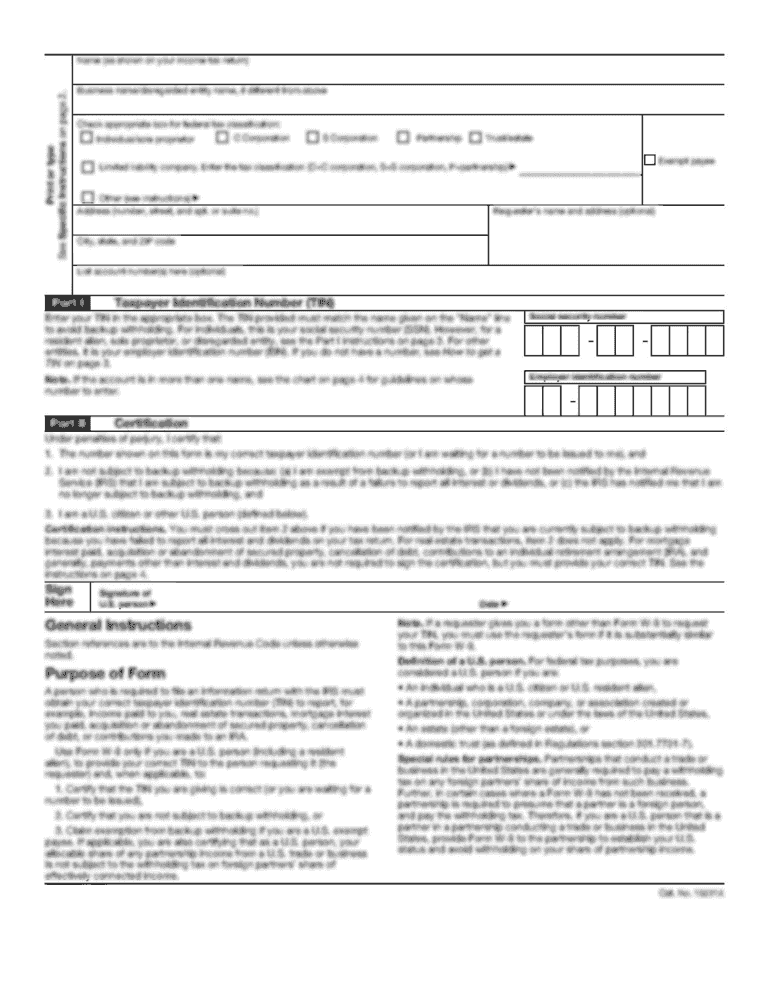

To fill out the 2013 schedule m1cr credit, gather all necessary documentation, including your federal tax return and any receipts for applicable expenses. Follow these steps:

01

Download the form from the IRS website or a trusted source.

02

Fill in your personal information at the top of the form, including your Social Security number.

03

Report any qualifying credit amounts based on your eligible expenses.

04

Review the instructions provided with the form to ensure compliance with IRS guidelines.

05

Use pdfFiller to ensure accuracy and clarity before submitting.

Latest updates to 2013 schedule m1cr credit

Latest updates to 2013 schedule m1cr credit

There are no significant updates to the 2013 schedule m1cr credit form as it pertains to previous tax years. Ensure that you are using the correct version for your tax filing.

All You Need to Know About 2013 schedule m1cr credit

What is 2013 schedule m1cr credit?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2013 schedule m1cr credit

What is 2013 schedule m1cr credit?

The 2013 schedule m1cr credit is a tax form used to claim certain tax credits in the United States. It assists eligible taxpayers in reporting specific expenditures that qualify for credit against their overall tax liability.

What is the purpose of this form?

The purpose of the 2013 schedule m1cr credit is to allow taxpayers to report qualifying purchases and expenses to receive credits that reduce their taxable income. It helps in lowering the overall tax burden for eligible individuals or businesses.

Who needs the form?

Taxpayers who have incurred qualifying expenses in previous years and are looking to claim credits on their tax returns need to fill out the 2013 schedule m1cr credit. This includes individuals and businesses that meet the eligibility criteria specified in IRS guidelines.

When am I exempt from filling out this form?

You may be exempt from filling out the 2013 schedule m1cr credit if you did not incur any qualifying expenses during the applicable tax year or if your total tax owed is zero. Always review IRS regulations to determine your specific eligibility.

Components of the form

The 2013 schedule m1cr credit typically consists of personal identification fields, sections for reporting qualifying expenses, and space for calculating the total credit amount. Ensure that all sections are filled out correctly to avoid delays in processing.

What are the penalties for not issuing the form?

Failure to issue the 2013 schedule m1cr credit form when required can lead to penalties, including fines imposed by the IRS. Additionally, not filing may result in missing out on potential tax credits that could reduce your tax liability.

What information do you need when you file the form?

When filing the 2013 schedule m1cr credit, you need your personal information, the total amount of qualifying expenses, and any necessary documentation that supports your claims for the credit. Accurate reporting is crucial to avoid discrepancies.

Is the form accompanied by other forms?

The 2013 schedule m1cr credit may require accompanying forms, such as your primary tax return, to provide a comprehensive view of your financial situation. Check IRS instructions to identify any additional forms that should be submitted alongside the schedule m1cr.

Where do I send the form?

You should send the completed 2013 schedule m1cr credit form to the address specified in the IRS instructions for your particular filing type. If filing electronically, follow the specified procedures in your tax software or service provider.

See what our users say