Get the free 5-YEAR LOAN APPLICATION - ALL TIERS - Mail.kenton.k12.ny.us

Show details

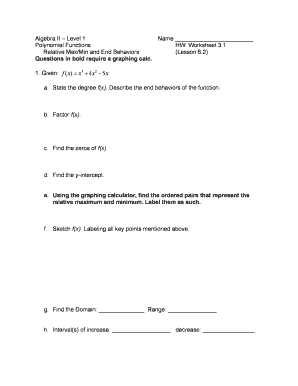

LON-26 (5/05) NY NEW YORK STATE TEACHERS' RETIREMENT SYSTEM 10 Corporate Woods Drive, Albany, NY 12211-2395 STARS 5-YEAR LOAN APPLICATION ALL TIERS TO BE ELIGIBLE FOR A LOAN YOU MUST: Have at least

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 5-year loan application

Edit your 5-year loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5-year loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 5-year loan application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 5-year loan application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 5-year loan application

Point by point, here is how to fill out a 5-year loan application:

01

Start by gathering all necessary documents: Gather your personal identification information, such as your social security number, driver's license, and contact details. Additionally, gather financial documents like bank statements, tax returns, and proof of income.

02

Research the lending institutions: Look for reputable banks or financial institutions that offer 5-year loans. Compare their interest rates, terms and conditions, and eligibility criteria. Choose the one that best fits your needs.

03

Fill out the application form: Obtain the loan application form from the chosen lending institution. Carefully read through the instructions and provide accurate information. Typically, you'll need to provide personal details, financial information, employment details, and the purpose of the loan.

04

Attach necessary documents: Staple or attach the necessary documents as per the instructions on the application form. Make sure to include all the required documents, such as identification proof, income proof, and others mentioned on the application.

05

Review and double-check: Before submitting the application, thoroughly review all the information you have provided. Ensure that there are no errors or omissions. It is crucial to provide accurate information as any inconsistencies can affect the loan approval process.

06

Submit the application: Once you are confident that the application is completed accurately, submit it to the lending institution. Depending on the lender, you may be able to submit it online, via mail, or in-person at a branch office.

Now, let's move on to who needs a 5-year loan application:

01

Individuals planning to make a large purchase: If you are looking to make a major purchase, such as buying a car, renovating a home, or paying for a wedding, you might need a 5-year loan to finance these expenses.

02

Small business owners: Entrepreneurs or small business owners who need funds for expansion, purchasing equipment, or managing cash flow might require a 5-year loan.

03

Students pursuing higher education: Students who are planning to pursue higher education may need a 5-year loan to cover their tuition fees, living expenses, or other educational costs.

04

Individuals consolidating debt: If you have multiple debts with high-interest rates, consolidating them into a 5-year loan might help simplify your finances and potentially save on interest payments.

05

Homeowners looking to refinance: Homeowners who wish to refinance their existing mortgage or take out a home equity loan for home improvements or other purposes might consider a 5-year loan.

Remember, the specific situations in which someone might need a 5-year loan application can vary. It's essential to assess your financial needs and consult with a financial advisor or lending institution to determine if a 5-year loan is the right option for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 5-year loan application?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the 5-year loan application. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in 5-year loan application?

With pdfFiller, the editing process is straightforward. Open your 5-year loan application in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my 5-year loan application in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 5-year loan application directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is 5-year loan application?

A 5-year loan application is a document where an individual or business applies for a loan that has a 5-year repayment term.

Who is required to file 5-year loan application?

Anyone who needs a loan with a 5-year repayment term is required to file a 5-year loan application.

How to fill out 5-year loan application?

To fill out a 5-year loan application, you need to provide personal or business information, details about the loan amount and purpose, as well as financial documents.

What is the purpose of 5-year loan application?

The purpose of a 5-year loan application is to request financing for a specific need or project that requires a longer repayment period.

What information must be reported on 5-year loan application?

Information such as personal or business details, loan amount, purpose of the loan, financial statements, and credit history may need to be reported on a 5-year loan application.

Fill out your 5-year loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

5-Year Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.