Get the free CONSUMER CREDIT

Show details

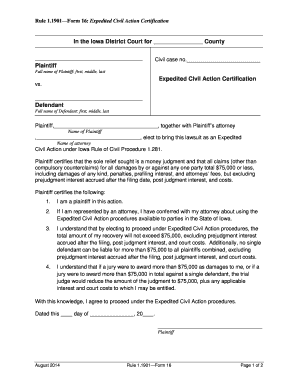

Auto Loan Application Name/Address Name Social Security Number Address: City: State: ZIP: Phone: Employment History Employer: Job Title: Address: Supervisor: City: State: Phone: ZIP: Salary: Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer credit

Edit your consumer credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer credit online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer credit

How to fill out consumer credit:

01

Gather the necessary documents: Before filling out a consumer credit application, make sure you have all the required documents such as proof of identity, proof of income, and any other relevant financial information.

02

Research and compare options: Take the time to research different consumer credit options available to you. Compare interest rates, repayment terms, and any additional fees or charges associated with each option. This will help you choose the best credit option that suits your needs.

03

Understand the terms and conditions: Carefully read and understand the terms and conditions of the consumer credit agreement. Pay attention to the interest rate, repayment schedule, penalties for late payments, and any potential hidden charges. It is important to fully comprehend what you are agreeing to before signing the application.

04

Fill out the application accurately: Fill out the consumer credit application accurately and provide all required information truthfully. Be thorough and double-check the details before submitting the application. Incomplete or incorrect information may delay the approval process.

05

Attach necessary supporting documents: Ensure that you include all the required supporting documents with your application. This may include proof of income, bank statements, identification documents, and any other relevant paperwork. Providing all the necessary documentation will help expedite the application process.

06

Review and sign the application: Before submitting the application, carefully review all the information you have filled in. Make sure there are no errors or omissions. Once you are satisfied with the application, sign it as required. By signing, you acknowledge that you have read and understood the terms and conditions.

Who needs consumer credit:

01

Individuals facing unexpected expenses: Consumer credit can be beneficial for individuals who encounter unforeseen expenses such as medical bills, car repairs, or home repairs. It provides them with the necessary funds to cover these expenses when they do not have immediate cash available.

02

Small business owners: Business owners may need consumer credit to finance their operations, purchase inventory or equipment, or manage cash flow. Acquiring credit can provide immediate funding to meet business needs and cover expenses during periods of growth or when awaiting payment from customers.

03

Individuals looking to make significant purchases: Consumer credit can be helpful for individuals who want to make big-ticket purchases such as buying a car or financing a home. It allows them to make these purchases upfront and repay the loan over time, making it more financially manageable.

04

Students and education expenses: Student loans or education credit fall under consumer credit. Many students rely on credit to finance their education expenses, including tuition fees, textbooks, accommodation, or other educational needs.

05

Those looking to build credit history: Consumer credit can be a valuable tool for individuals who have limited or no credit history. By responsibly using credit, they can establish a positive credit history, which may be essential for future borrowing needs such as obtaining a mortgage or financing a vehicle.

Remember, it is crucial to use consumer credit wisely and borrow within your means. Consider your repayment capabilities and ensure that you can comfortably meet the monthly payments before taking on any consumer credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete consumer credit online?

Filling out and eSigning consumer credit is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the consumer credit electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your consumer credit in seconds.

How do I edit consumer credit on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign consumer credit. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is consumer credit?

Consumer credit is a type of credit given to individuals to purchase goods and services.

Who is required to file consumer credit?

Lenders and financial institutions are required to file consumer credit.

How to fill out consumer credit?

Consumer credit can be filled out by providing financial information and details of the credit being extended.

What is the purpose of consumer credit?

The purpose of consumer credit is to allow individuals to make purchases and pay back the amount owed over time.

What information must be reported on consumer credit?

Consumer credit reports typically include information on credit accounts, payment history, and credit inquiries.

Fill out your consumer credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.