Get the free pizza hut w2 login

Show details

HOME

NCC practice test answers 7th edition

video full movies'

status post AAA stent ICD 9 code

glass player 128 160 java apps download

personal prophecy

Register Log in View Cart

By accessing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pizza hut w2s form

Edit your how to get my pizza hut w2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pizza hut w 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pizza hut employee w 2 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to get pizza hut w2 former employee. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pizza hut w2 form

How to fill out pizza hut w2:

01

Obtain the W2 form from Pizza Hut. You can request it from your manager or find it online on the Pizza Hut employee portal.

02

Fill out your personal information, including your full name, social security number, and address, in the designated fields on the form.

03

Provide your employment information, such as the Pizza Hut store number, employer identification number (EIN), and the address of the Pizza Hut location where you worked.

04

Enter the earnings and taxes information in the appropriate boxes on the W2 form. This includes reporting your wages, tips, and other income, as well as any federal, state, or local taxes withheld.

05

Review the completed form to ensure all the information is accurate and complete. Make any necessary corrections or adjustments if needed.

06

Sign and date the W2 form before submitting it to Pizza Hut or your designated employer representative.

Who needs pizza hut w2:

01

All current and former employees of Pizza Hut who received wages or compensation during the tax year are required to have a W2 form.

02

This includes both full-time and part-time employees, as well as seasonal workers.

03

Individuals who have worked at Pizza Hut as independent contractors or had income that is subject to tax withholding may also require a W2 form.

Fill

pizza hut w2

: Try Risk Free

People Also Ask about w2 from pizza hut

Can I get a copy of my W-2 online?

In the event you lose your Form W–2, or require a duplicate copy you can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office.

How do I get a copy of my W-2?

To get copies of your current tax year federal Form W-2 contact your employer; contact the Social Security Administration (SSA); or. visit the IRS at Transcript or copy of Form W-2 for information. The IRS provides the following guidance on their website:

How can I get my W-2 form online?

In the event you lose your Form W–2, or require a duplicate copy you can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office.

How can I get my W-2 without a job?

How to request a W-2 from the IRS? If there is no way for you to contact a past employer, you can request that the IRS send you a copy directly. The IRS advises those in this situation to give them a call at 800-829-1040.

How do I get my W-2 from a job?

Otherwise, you'll need to contact your employer or SSA for a copy. The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.

Can you get your W-2 online?

Can I get a transcript or copy of Form W-2, Wage and Tax Statement, from the IRS? You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.

How do I get my W-2 from an employee?

If you do not receive your Form W–2 by the end of January, you should contact your Personnel/Payroll Office. In the event you lose your Form W–2, or require a duplicate copy you can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office.

How to get my W-2 from taco bell if i don t work there anymore?

You will need to contact your employer in order to get your W-2. If you still don't get your W-2, contact the IRS and tell them your employer didn't send it. You may call the The IRS toll free number is 800-829-1040.

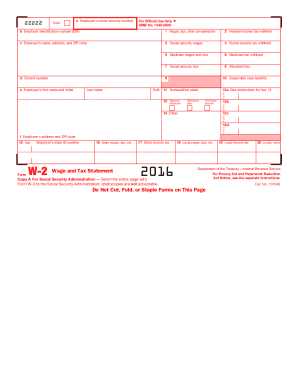

How does a W-2 work?

Form W-2 is completed by an employer and contains important information that you need to complete your tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck. It may also contain information about: Tips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send how to get w2 from pizza hut for eSignature?

Once you are ready to share your how do i get my w2 from pizza hut, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an eSignature for the pizza hut w2 former employee in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your how can i get my pizza hut w2 online and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit pizza hut w2 request on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing pizza hut former employee w2.

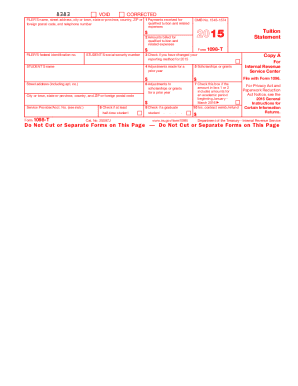

What is pizza hut w2?

Pizza Hut W-2 is a tax form that reports the annual wages and withholdings for employees of Pizza Hut to the Internal Revenue Service (IRS).

Who is required to file pizza hut w2?

Employees of Pizza Hut who received wages during the tax year are required to have a W-2 filed on their behalf by Pizza Hut.

How to fill out pizza hut w2?

To fill out a Pizza Hut W-2, you need to input your personal information, including your name, address, and Social Security number, as well as your total earnings and tax withholdings for the year.

What is the purpose of pizza hut w2?

The purpose of the Pizza Hut W-2 is to provide employees with a summary of their earnings and tax deductions for the year, which they will use when filing their personal income tax returns.

What information must be reported on pizza hut w2?

The information reported on a Pizza Hut W-2 includes the employee's name, address, Social Security number, total wages, tips, other compensation, federal and state tax withholdings, and any additional benefits or deductions.

Fill out your pizza hut w2 login online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pizza Hut Tax Forms is not the form you're looking for?Search for another form here.

Keywords relevant to how to get my w2 from pizza hut

Related to pizza hut payroll number

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.