Get the free CORPORATE BANKING GROUP

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate banking group

Edit your corporate banking group form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate banking group form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate banking group online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporate banking group. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

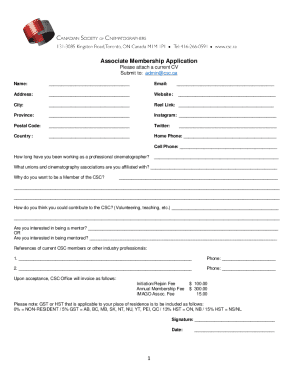

How to fill out corporate banking group

How to fill out corporate banking group:

01

Research the different corporate banking options available in your area. Look for banks that offer services tailored to the specific needs of businesses.

02

Contact the bank or schedule a meeting to discuss your requirements and gather information about the application process. This may involve filling out an application form and providing necessary documentation such as financial statements, business plans, and identification documents.

03

Prepare your business documentation. This includes your company's legal structure, tax identification numbers, and any other relevant legal paperwork.

04

Provide financial statements that showcase your business's financial health and stability. This may include balance sheets, income statements, and cash flow statements. Banks typically require historical financial data as well as projected future financials.

05

Be prepared to showcase your business plan and financial forecasts. This helps the bank assess your business's viability and growth potential.

06

Evaluate and compare the terms and conditions offered by different banks. Consider factors such as interest rates, fees, loan options, online banking capabilities, and customer service. Select the bank that best aligns with your business requirements.

07

Follow the bank's instructions and complete the application form accurately and truthfully. Double-check all the information provided to ensure accuracy.

08

Submit the completed application form along with the required documentation to the bank. Keep copies of all submitted documents for your records.

09

Wait for the bank's response. The processing time may vary depending on the bank and the complexity of your application.

10

Once approved, review the terms and conditions of the corporate banking group offered by the bank. Understand the account features, access to digital banking services, transaction limits, and any associated fees.

11

If necessary, schedule a meeting with a representative from the bank to discuss any further questions or details regarding your corporate banking group account.

Who needs corporate banking group:

01

Large corporations and multinational companies often require corporate banking groups to handle their extensive financial needs. This includes managing large cash flow, international transactions, credit facilities, and investments.

02

Small and medium-sized businesses that aim to expand and grow may benefit from a corporate banking group's services. These services could include providing financial advice, credit lines, trade financing, and treasury management.

03

Startups and entrepreneurs who anticipate significant growth in their business may find value in partnering with a corporate banking group. These institutions can offer expertise in raising capital, managing cash flow, and providing financial solutions tailored to the specific needs of startups.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify corporate banking group without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like corporate banking group, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I get corporate banking group?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific corporate banking group and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete corporate banking group on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your corporate banking group from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is corporate banking group?

The corporate banking group is a division within a bank that provides services to corporate clients, such as lending, cash management, and treasury services.

Who is required to file corporate banking group?

Companies that have corporate accounts or engage in corporate banking activities are required to file corporate banking group information.

How to fill out corporate banking group?

Corporate banking group information can be filled out electronically through the designated platform provided by financial regulatory authorities.

What is the purpose of corporate banking group?

The purpose of corporate banking group is to gather information about corporate banking activities and accounts for regulatory and compliance purposes.

What information must be reported on corporate banking group?

Information such as corporate account balances, transactions, and customer details may need to be reported on the corporate banking group form.

Fill out your corporate banking group online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Banking Group is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.