Get the free Loan Advances & Payments

Show details

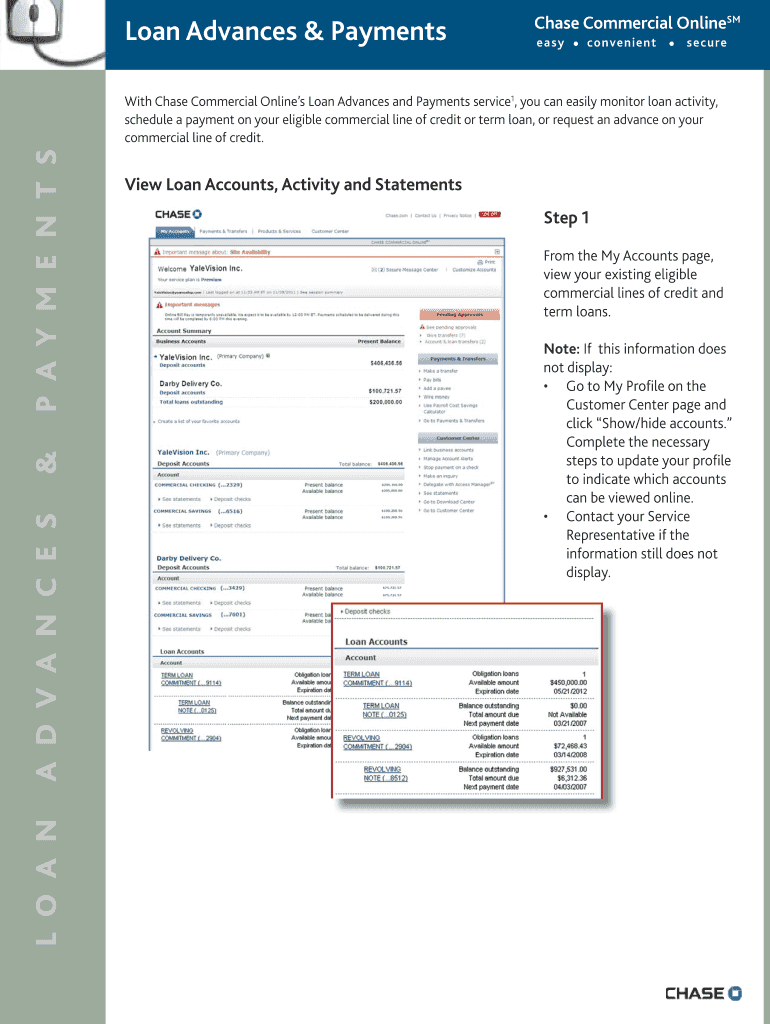

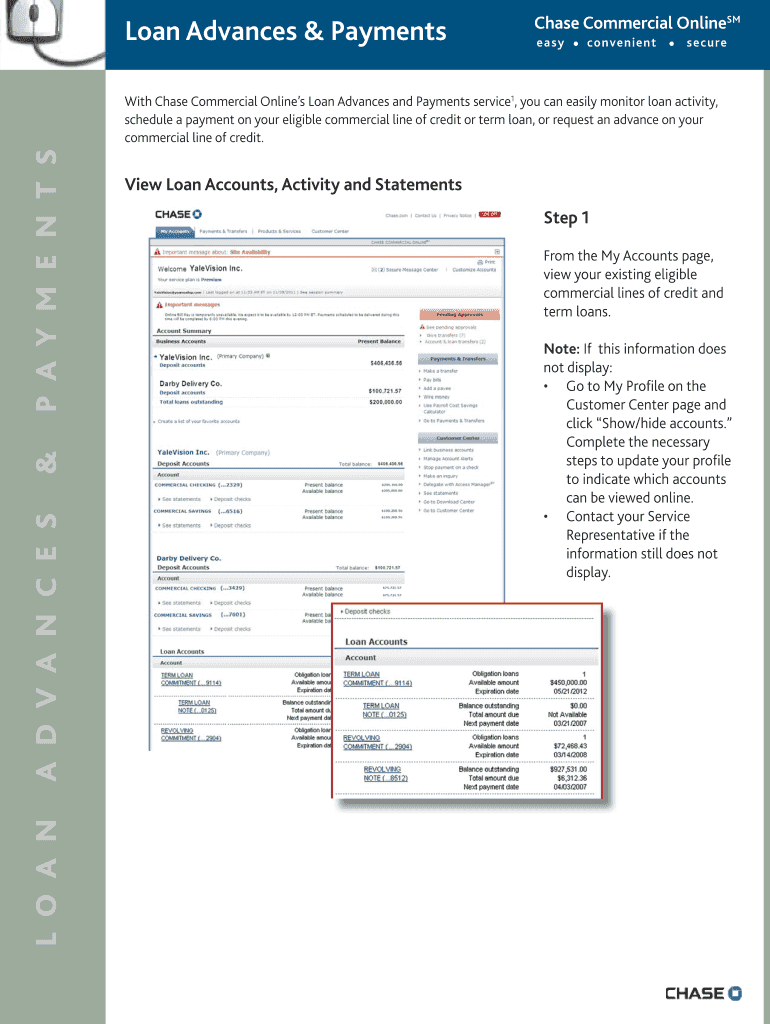

Loan Advances & Payments Chase Commercial Online SM easyconvenientsecureL O A NA D V A N C E S&P A Y M E N TS With Chase Commercial Online Loan Advances and Payments service1, you can easily monitor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan advances amp payments

Edit your loan advances amp payments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan advances amp payments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan advances amp payments online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan advances amp payments. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan advances amp payments

How to fill out loan advances & payments:

01

Gather all necessary documents: Before filling out the loan advances and payments form, make sure you have all the required documents handy. This may include identification proof, income statements, previous loan details, and any other relevant financial information.

02

Understand the form: Take the time to carefully read and understand the loan advances and payments form. Familiarize yourself with the sections and fields you'll need to complete, as well as any instructions or guidelines provided.

03

Provide accurate information: Ensure that you provide accurate and up-to-date information while filling out the form. Double-check all the details you enter, including personal information, loan amount, repayment terms, and any other relevant details.

04

Calculate loan advances: If you are applying for a loan advance, calculate the exact amount you need based on your financial requirements. Be mindful of whether you need the entire loan amount or only a partial advance and enter the corresponding figure accurately.

05

Specify payment method: Determine the payment method you prefer, whether it's through monthly installments, automatic deductions, or any other arrangement offered by the loan provider. Clearly specify your preferred payment method on the form.

06

Review and sign: Once you have filled out all the necessary sections of the loan advances and payments form, take a moment to review all the information you have provided. Ensure that there are no errors or omissions. Finally, sign the form in the designated area as per the instructions provided.

Who needs loan advances & payments:

01

Individuals facing financial emergencies: Loan advances can be useful for individuals who find themselves in urgent financial need, such as unexpected medical expenses, home repairs, or other unforeseen circumstances. Advances help bridge the financial gap until alternative sources of funds are available.

02

Businesses requiring additional capital: Entrepreneurs and small business owners may require loan advances to support expansion, purchase inventory, or invest in growth initiatives. Loan advances provide the necessary capital to meet short-term financial requirements.

03

Borrowers managing existing loans: Loan payments are essential for individuals who have an existing loan, whether it is a personal loan, mortgage, or vehicle financing. Prompt and regular payments ensure that borrowers maintain a good credit history and avoid any penalties or negative consequences.

04

Financially responsible individuals planning for the future: Some individuals choose to take out loans and make regular payments as part of their financial planning strategy. By borrowing and repaying responsibly, they can build credit history, establish relationships with lending institutions, and meet various financial goals.

Note: It is essential to consult with the appropriate financial advisor or institution to determine whether loan advances and payments are suitable for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send loan advances amp payments to be eSigned by others?

Once your loan advances amp payments is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit loan advances amp payments on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing loan advances amp payments right away.

How do I fill out loan advances amp payments on an Android device?

On an Android device, use the pdfFiller mobile app to finish your loan advances amp payments. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is loan advances amp payments?

Loan advances amp payments refer to the amount of money borrowed and repaid by a borrower to a financial institution.

Who is required to file loan advances amp payments?

Individuals or businesses who have taken out loans and made payments on those loans are required to file loan advances amp payments.

How to fill out loan advances amp payments?

Loan advances amp payments can be filled out by providing information on the amount borrowed, payment dates, interest rates, and any other relevant details.

What is the purpose of loan advances amp payments?

The purpose of loan advances amp payments is to accurately track and report the financial transactions between a borrower and lender.

What information must be reported on loan advances amp payments?

The information that must be reported on loan advances amp payments includes the borrower's name, loan amount, payment schedule, and any applicable interest rates.

Fill out your loan advances amp payments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Advances Amp Payments is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.