Get the free Hollard Retirement Annuity Additional Contribution Form 040814

Show details

Holland Life Assurance Company Limited (Reg. No.1993/001405/06), FSP No.17697 and Holland Investment Managers (Pty) Ltd (Reg. No.1997/001696/07), FSP No ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hollard retirement annuity additional

Edit your hollard retirement annuity additional form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hollard retirement annuity additional form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hollard retirement annuity additional online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hollard retirement annuity additional. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

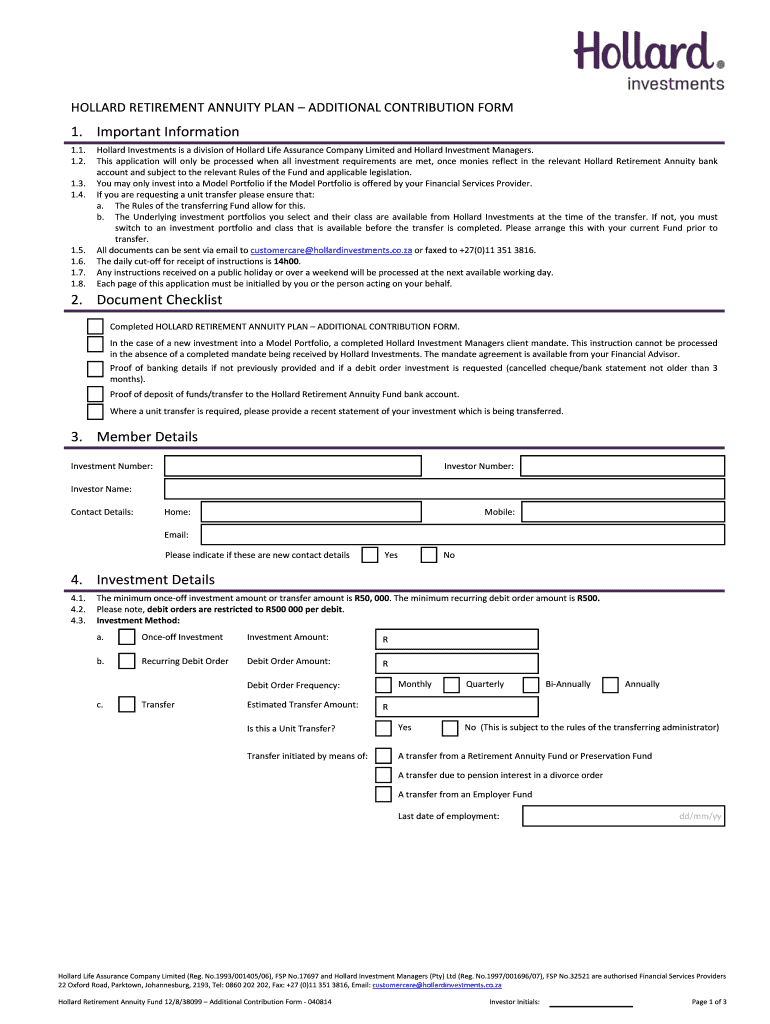

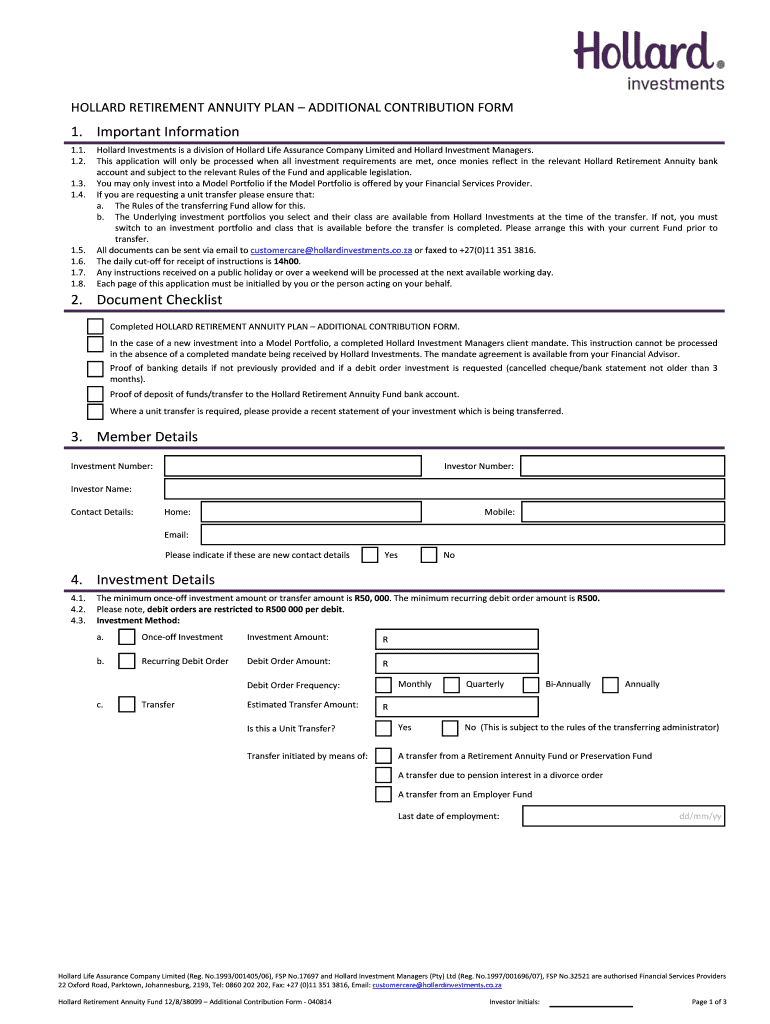

How to fill out hollard retirement annuity additional

How to fill out Hollard Retirement Annuity additional:

01

Gather necessary information: Before filling out the form, make sure you have all the required information handy. This may include your personal details, contact information, and any relevant financial information.

02

Review the form: Carefully read through the Hollard Retirement Annuity additional form to understand the information it requests. This will help ensure you provide accurate and complete details.

03

Complete personal details: Start by filling out your personal information, such as your full name, date of birth, and identification number. Double-check the accuracy of these details as errors may cause delays in processing.

04

Provide contact information: Include your phone number, email address, and residential address. It is important to provide current and up-to-date contact information to ensure effective communication.

05

Specify contribution amount: Indicate the amount you wish to contribute to your Hollard Retirement Annuity. This can usually be done by either specifying a fixed amount or a percentage of your income.

06

Review beneficiary details: If you want to designate a beneficiary to receive the funds in case of your death, provide their relevant information, such as their full name, relationship to you, and contact details.

07

Attach supporting documents: Some Hollard Retirement Annuity additional forms may require you to attach supporting documents, such as proof of identity or proof of address. Ensure you have copies of these documents readily available and attach them as requested.

08

Seek professional advice if needed: If you are unsure about any aspect of filling out the form or if you have complex financial circumstances, consider consulting a financial advisor or contacting Hollard directly for assistance.

Who needs Hollard Retirement Annuity additional?

01

Individuals planning for retirement: Anyone who wants to secure their financial future and ensure a stable income during retirement can benefit from the Hollard Retirement Annuity additional. It provides an additional layer of financial security and allows people to grow their retirement savings.

02

Those looking for tax advantages: The Hollard Retirement Annuity additional offers tax benefits, allowing individuals to reduce their taxable income by contributing to their retirement savings. This can be advantageous for those seeking to minimize their tax liabilities.

03

Individuals seeking flexibility: The Hollard Retirement Annuity additional often offers flexible contribution options, allowing individuals to adjust their contributions based on their financial situation. This flexibility can be particularly useful for those with varying incomes or irregular cash flow.

04

Those without an employee pension plan: Individuals who do not have access to an employer-sponsored pension plan can opt for the Hollard Retirement Annuity additional as a means of building a retirement nest egg. It allows individuals to take control of their own retirement savings and tailor their contributions according to their needs.

05

Persons looking for investment options: The Hollard Retirement Annuity additional often offers various investment options, allowing individuals to choose the investment strategy that aligns with their risk tolerance and financial goals. This can be appealing to those who want to grow their retirement savings through investment returns.

It is important to consult with a financial advisor or Hollard representatives to determine if the Hollard Retirement Annuity additional is a suitable option for your specific financial circumstances and retirement goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete hollard retirement annuity additional online?

pdfFiller has made it easy to fill out and sign hollard retirement annuity additional. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the hollard retirement annuity additional in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your hollard retirement annuity additional right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit hollard retirement annuity additional on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute hollard retirement annuity additional from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is hollard retirement annuity additional?

Hollard retirement annuity additional refers to additional contributions made to a retirement annuity policy with Hollard.

Who is required to file hollard retirement annuity additional?

Individuals who have a retirement annuity policy with Hollard and choose to make additional contributions are required to file hollard retirement annuity additional.

How to fill out hollard retirement annuity additional?

To fill out hollard retirement annuity additional, individuals need to provide details of the additional contributions made to their Hollard retirement annuity policy.

What is the purpose of hollard retirement annuity additional?

The purpose of hollard retirement annuity additional is to boost retirement savings by making extra contributions to a retirement annuity policy with Hollard.

What information must be reported on hollard retirement annuity additional?

The information that must be reported on hollard retirement annuity additional includes the amount of additional contributions made, the date of contributions, and any other relevant details.

Fill out your hollard retirement annuity additional online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hollard Retirement Annuity Additional is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.