Get the free Income and Expenses Date: Pre-Assessment Name: - osymigrant

Show details

Income and Expenses Date: PreAssessment Name: Circle the correct answer. 1. Is a budget a plan for spending your money? 2. Which of the following is income? 3. Which of these things is a need? Yes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income and expenses date

Edit your income and expenses date form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income and expenses date form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income and expenses date online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income and expenses date. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income and expenses date

How to fill out income and expenses data:

01

Gather all relevant documents: Start by collecting all the necessary documents related to your income and expenses. This may include pay stubs, bank statements, receipts, invoices, and any other financial records.

02

Categorize your income and expenses: Create categories to organize your income and expenses. Common categories may include income sources (such as salary, freelance work, rental income) and expense categories (such as rent/mortgage, utilities, groceries, transportation).

03

Record your income: Start by listing all your sources of income. This can include your salary, any side gigs or freelance work, investment income, rental income, etc. Make sure to enter accurate and complete information for each income source.

04

Track your expenses: Once you have categorized your expenses, start recording them. Determine whether they are fixed expenses (such as rent or loan payments) or variable expenses (such as groceries or entertainment). Keep track of all your expenses by entering the date, description, and amount spent.

05

Be thorough and accurate: Pay attention to detail while filling out your income and expenses data. Make sure to include all transactions and cross-check your records to avoid any errors. It is crucial to have accurate information to gain a clear understanding of your financial situation.

Who needs income and expenses data?

01

Individuals and families: Managing income and expenses is essential for individuals and families to maintain a healthy financial life. By tracking and analyzing their income and expenses, individuals can budget effectively, identify areas of overspending, and plan for future financial goals.

02

Small business owners: For entrepreneurs and small business owners, keeping accurate income and expenses data is crucial for financial management. It allows them to assess the profitability of their business, identify areas of cost reduction, track cash flow, and fulfill tax obligations.

03

Financial institutions and lenders: Banks, credit unions, and other financial institutions often require income and expenses data to assess an individual's or business's creditworthiness. This information helps them determine if the applicant can manage their finances responsibly and repay loans or credit.

04

Tax authorities: Income and expenses data play a crucial role during tax season. Individuals and businesses need to accurately report their income and expenses to calculate their tax liability and file tax returns. It helps tax authorities verify income declarations and ensures compliance with tax laws.

In conclusion, filling out income and expenses data requires careful organization, accurate record-keeping, and attention to detail. It is essential for individuals, families, small business owners, financial institutions, and tax authorities to have access to this data for various financial purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send income and expenses date for eSignature?

Once your income and expenses date is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the income and expenses date in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your income and expenses date in seconds.

How can I fill out income and expenses date on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your income and expenses date. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

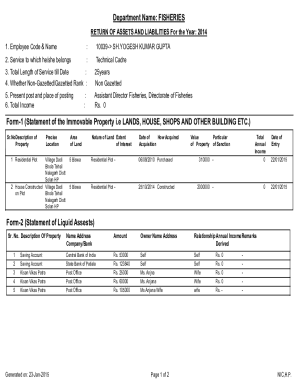

What is income and expenses date?

Income and expenses date refers to the period of time for which financial transactions are being recorded, typically on a monthly, quarterly, or yearly basis.

Who is required to file income and expenses date?

Individuals, businesses, and organizations are required to file income and expenses date to accurately track their financial performance and ensure compliance with tax laws.

How to fill out income and expenses date?

Income and expenses date can be filled out manually using spreadsheets or accounting software, where all income and expenses are recorded and categorized.

What is the purpose of income and expenses date?

The purpose of income and expenses date is to track and analyze the financial performance of an individual, business, or organization, and make informed decisions based on the financial data.

What information must be reported on income and expenses date?

Income and expenses date typically include details of all income sources, expenses incurred, assets owned, and liabilities owed during the specified period.

Fill out your income and expenses date online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income And Expenses Date is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.