Get the free POST CLOSE CHECKLIST Lender Contact Email IHDA Loan 1st 2 - ihda

Show details

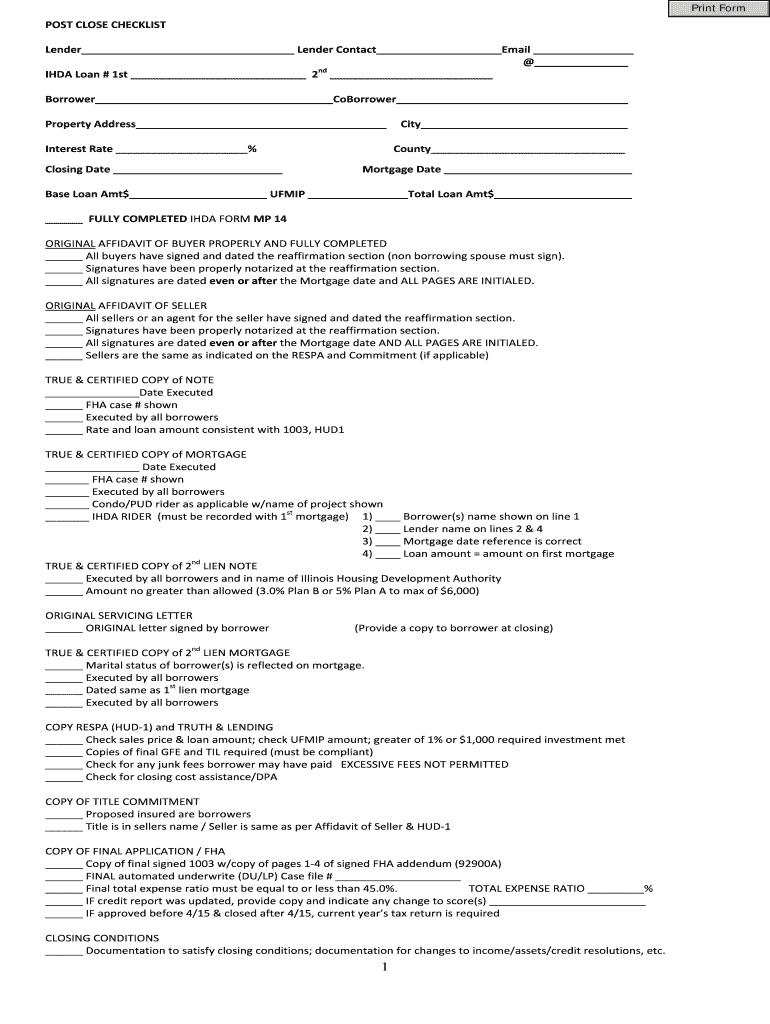

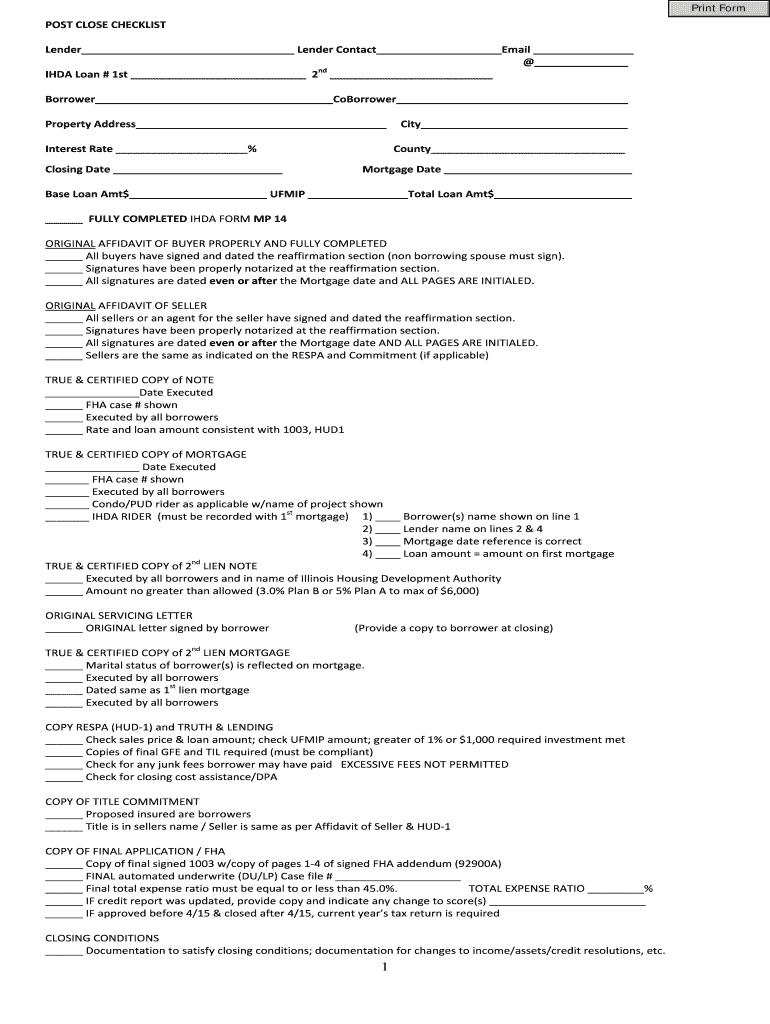

Print Form POST CLOSE CHECKLIST Lender Contact Email ISDA Loan # 1st 2nd Borrower Property Address Interest Rate % Closing Date City County Mortgage Date Base Loan Amt FLIP Total Loan Amt FULLY COMPLETED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign post close checklist lender

Edit your post close checklist lender form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your post close checklist lender form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit post close checklist lender online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit post close checklist lender. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out post close checklist lender

How to fill out a post close checklist for a lender:

01

Start by reviewing all the necessary documents related to the loan closing, such as the promissory note, deed of trust, and any other relevant agreements.

02

Verify that all necessary signatures and dates are present on the documents and ensure they are executed properly.

03

Check for any missing or incomplete information on the documents, such as borrower's name, loan amount, or property details, and make sure to address these issues.

04

Review any outstanding conditions or contingencies that were required for the loan approval and ensure they have been met before closing.

05

Double-check all calculations, such as loan amounts, interest rates, and any applicable fees, to ensure accuracy.

06

Confirm that all required disclosures and notices have been provided to the borrower as per regulatory requirements.

07

Check if any specific lender requirements or documentation have been met, such as verifying flood insurance or obtaining a title insurance policy.

08

Ensure that the closing statement or HUD-1 settlement statement accurately reflects all the financial aspects of the transaction, including loan amounts, prorated taxes, and fees.

09

If applicable, initiate any post-closing activities, such as disbursing funds, recording the mortgage, or filing any necessary lien releases.

10

Finally, organize and maintain all the documents and checklist items, creating a complete loan file for future reference or audit purposes.

Who needs a post close checklist lender:

01

Lenders or loan officers who want to ensure that all necessary steps and procedures have been followed after the loan closing.

02

Compliance officers or quality control personnel who need to verify that all regulatory requirements have been satisfied.

03

Underwriters or loan processors who review the loan file for completeness and accuracy after closing.

04

Auditors or examiners who may conduct audits or reviews of the lender's loan files to ensure compliance with industry standards and regulations.

05

Investors or secondary market purchasers of loans who need to evaluate the quality and completeness of the loan package before purchasing it.

06

Legal or risk management departments who want to maintain proper documentation and mitigate any potential legal or financial risks associated with the loan closing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit post close checklist lender online?

The editing procedure is simple with pdfFiller. Open your post close checklist lender in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the post close checklist lender in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your post close checklist lender directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit post close checklist lender on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing post close checklist lender right away.

What is post close checklist lender?

Post close checklist lender is a document that outlines the necessary steps and requirements that must be completed after closing a loan.

Who is required to file post close checklist lender?

The lender or loan servicer is typically required to file the post close checklist lender.

How to fill out post close checklist lender?

To fill out the post close checklist lender, the lender must carefully review the document and provide the necessary information and documentation.

What is the purpose of post close checklist lender?

The purpose of the post close checklist lender is to ensure that all necessary steps and requirements have been completed after closing a loan.

What information must be reported on post close checklist lender?

The post close checklist lender typically requires information such as loan details, borrower information, and documentation of completed requirements.

Fill out your post close checklist lender online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Post Close Checklist Lender is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.