Get the free Bar Code : PAN : A H Y P R 5 3 0 0 B FORMNO. 15G - icsin

Show details

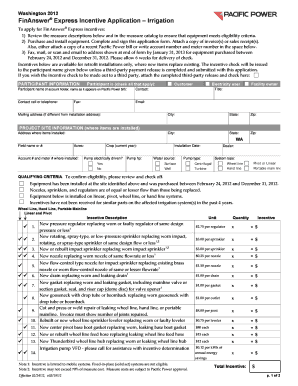

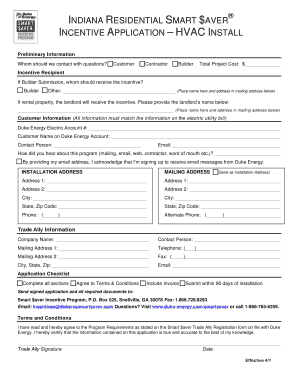

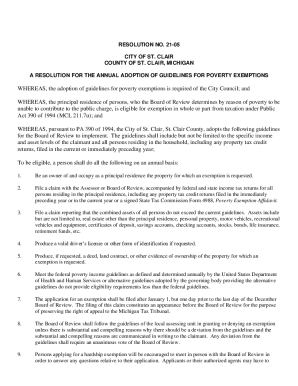

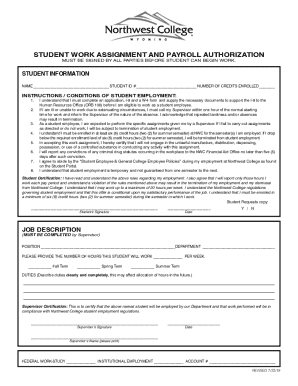

Bar Code : PAN : A H Y P R 5 3 0 0 FORM NO. 15G See section 197 A(1), 197 A(1A) and rule 29C Declaration under section 197A(1) and section 197A(1A) of the Income tax Act, 1961 to be made by an individual

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bar code pan a

Edit your bar code pan a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bar code pan a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bar code pan a online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bar code pan a. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bar code pan a

How to fill out bar code pan a:

01

Start by locating the bar code pan a form. It is usually provided by the organization or institution that requires it, such as a government agency or educational institution.

02

Fill in your personal information accurately. This may include your full name, address, contact details, and identification number. Make sure to double-check the information to avoid any mistakes.

03

Look for the specific fields designated for the bar code. It is typically a series of numbers or a combination of letters and numbers that uniquely identify you or the document.

04

Use a black or blue pen to accurately write or type the bar code information into the designated fields. Ensure the characters are clear and legible, as any inaccuracies or smudges could cause issues when the document is scanned or processed.

05

Review the entire form to ensure all the required fields are filled out correctly. If there are any additional instructions or sections, make sure to complete them accordingly.

06

Once you have filled out the bar code pan a form, make a copy for your records, if necessary. Submit the original form to the relevant authority, following their instructions on where and how to submit it.

07

Keep a record or proof of submission, such as a receipt or acknowledgment, in case it is needed in the future.

Who needs bar code pan a:

01

Individuals applying for a personal identification document, such as a passport, driver's license, or national ID card, may need a bar code pan a. This ensures accurate identification and tracking within the system.

02

Educational institutions, government agencies, or employers may also require bar code pan a from individuals to facilitate record-keeping, attendance tracking, or access control purposes.

03

Bar code pan a may be necessary in various industries, such as healthcare, logistics, and manufacturing, to improve efficiency, inventory management, or product tracking.

Please note that the specific requirements and purposes of bar code pan a may vary depending on the country, organization, or industry involved. It is important to follow the guidelines or instructions provided by the relevant authority when filling out bar code pan a forms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete bar code pan a on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your bar code pan a. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit bar code pan a on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as bar code pan a. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete bar code pan a on an Android device?

Use the pdfFiller mobile app and complete your bar code pan a and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is bar code pan a?

Bar code pan a is a unique identification number assigned to each individual or entity for tax purposes.

Who is required to file bar code pan a?

Individuals and entities that are subject to income tax or any other tax in a particular country are required to file bar code pan a.

How to fill out bar code pan a?

Bar code pan a can be filled out online on the official tax website of the country or by submitting a physical form to the tax authorities.

What is the purpose of bar code pan a?

The purpose of bar code pan a is to ensure that each taxpayer is uniquely identified and can be tracked for tax purposes.

What information must be reported on bar code pan a?

Bar code pan a typically requires information such as full name, date of birth, address, income details, and tax deductions.

Fill out your bar code pan a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bar Code Pan A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.