Get the free Pay cycles and Pay Dates

Show details

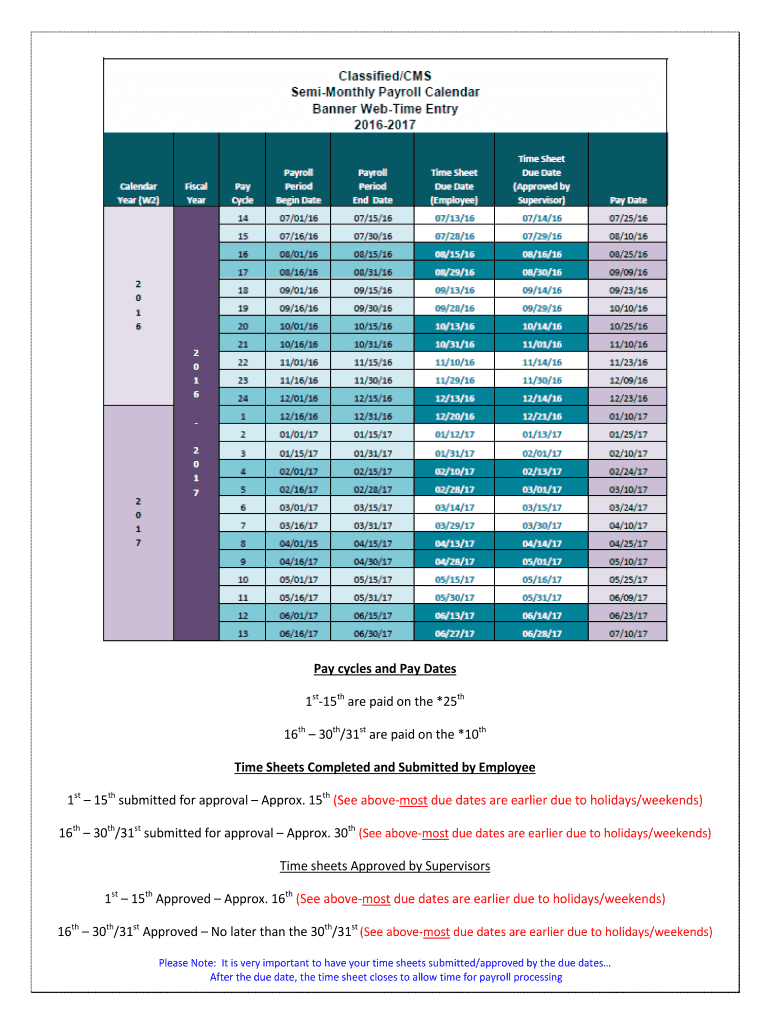

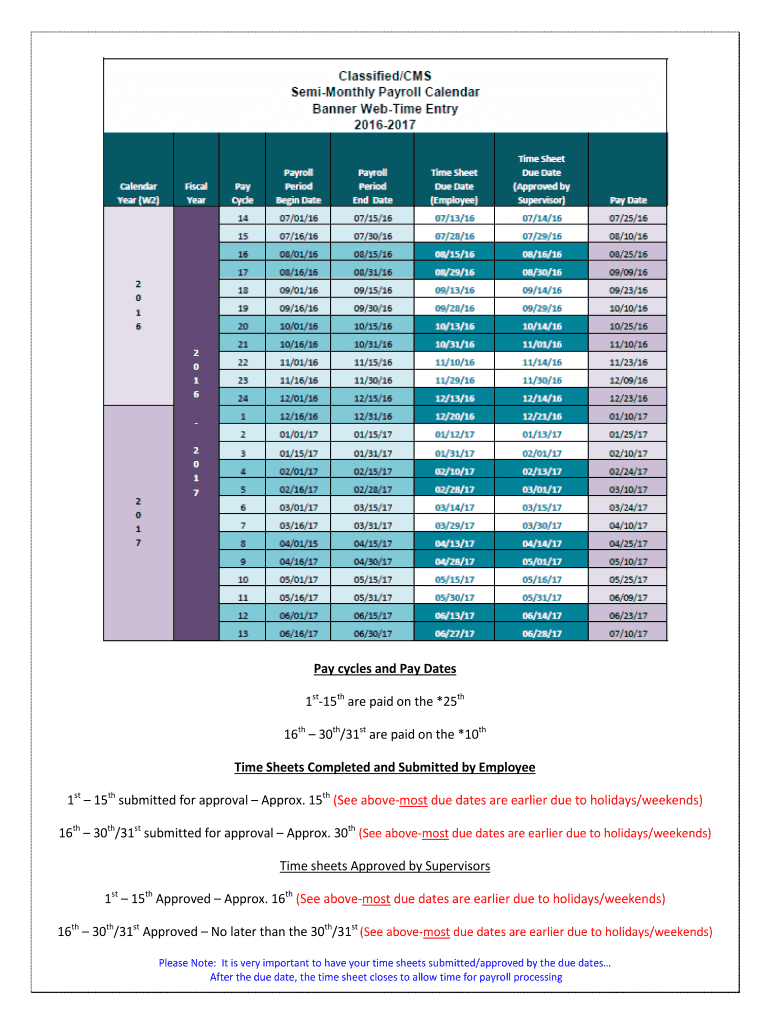

Pay cycles and Pay Dates 1st15th are paid on the *25th 16th 30th/31st are paid on the *10th Time Sheets Completed and Submitted by Employee 1st 15th submitted for approval Approx. 15th (See above

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pay cycles and pay

Edit your pay cycles and pay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pay cycles and pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pay cycles and pay online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pay cycles and pay. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pay cycles and pay

How to fill out pay cycles and pay:

01

Determine the pay period: Decide on the frequency at which employees will be paid, whether it is weekly, bi-weekly, monthly, etc. This will be the length of your pay cycle.

02

Calculate gross earnings: Add up the total amount earned by each employee during the pay cycle. This includes regular wages, overtime pay, bonuses, or any other forms of compensation.

03

Deduct taxes and withholdings: Subtract any taxes or withholdings required by law, such as income tax, Social Security, Medicare, or retirement contributions. These deductions may vary depending on the employee's salary and location.

04

Evaluate additional deductions: Consider any voluntary deductions that employees have authorized, such as health insurance premiums, retirement contributions, or other benefits.

05

Calculate net pay: Subtract the total deductions from the gross earnings to determine the net pay or take-home pay that the employee will receive.

06

Prepare pay stubs or statements: Generate pay stubs or statements that clearly outline the employee's gross earnings, deductions, and net pay for the pay period. This serves as a record for both the employee and the employer.

07

Distribute pay: Transfer the funds to each employee according to their payment preferences, whether it is through direct deposit, checks, or any other agreed-upon method.

08

Keep accurate records: Retain comprehensive records of all pay cycles and pay data for future reference, reporting, and compliance purposes.

Who needs pay cycles and pay?

01

Employers: Pay cycles and pay are essential for employers to accurately compensate their employees and fulfill their obligations as an employer. It helps in maintaining transparency and ensuring that employees receive their due wages on time.

02

Human resources departments: HR departments are responsible for managing payroll processes, setting up pay cycles, calculating wages, and ensuring that all deductions and legal requirements are met. They rely on pay cycles and pay information to maintain accurate records and facilitate smooth salary disbursements.

03

Employees: Pay cycles and pay are crucial for employees as they provide them with a clear understanding of their earnings, deductions, and net pay. It helps them manage their personal finances, plan expenses, and budget effectively. Additionally, pay cycles ensure timely and consistent payments, bringing financial stability to employees' lives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pay cycles and pay to be eSigned by others?

When your pay cycles and pay is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find pay cycles and pay?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the pay cycles and pay in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in pay cycles and pay?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your pay cycles and pay to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is pay cycles and pay?

Pay cycles refer to the frequency with which employees are paid, such as weekly, bi-weekly, or monthly. Pay refers to the compensation employees receive for their work.

Who is required to file pay cycles and pay?

Employers are required to file pay cycles and pay for their employees.

How to fill out pay cycles and pay?

Pay cycles and pay can be filled out using payroll software or manually inputting the information into a payroll system.

What is the purpose of pay cycles and pay?

The purpose of pay cycles and pay is to ensure that employees are compensated accurately and on time.

What information must be reported on pay cycles and pay?

Pay cycles and pay typically include hours worked, pay rate, deductions, and total compensation.

Fill out your pay cycles and pay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pay Cycles And Pay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.