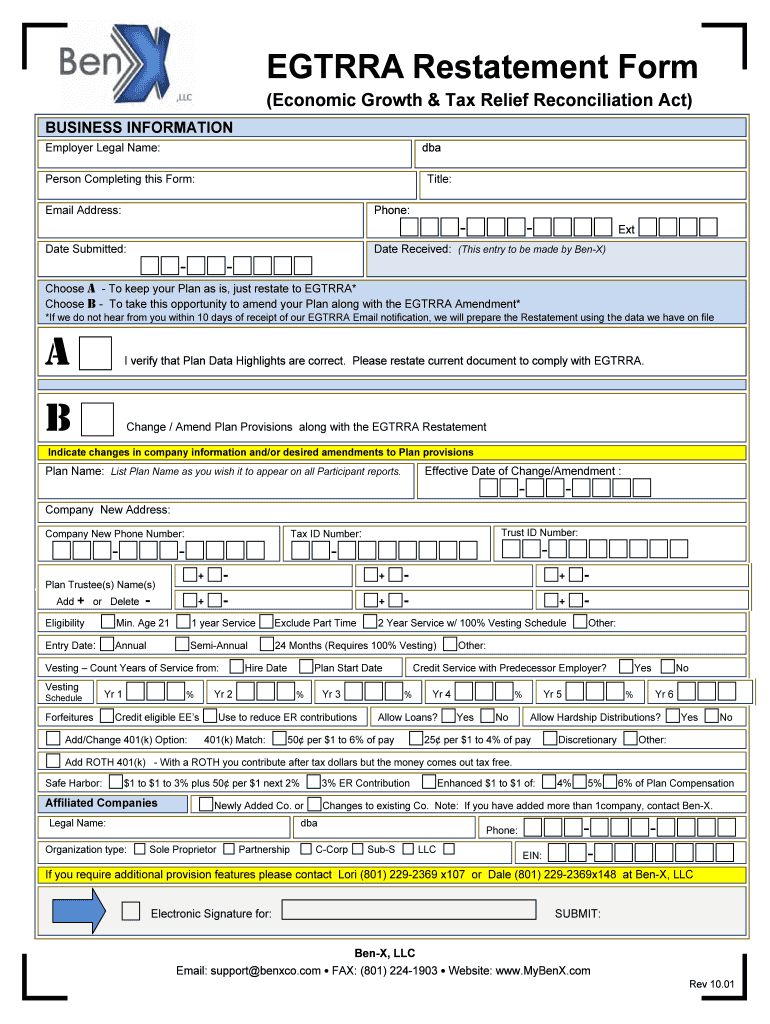

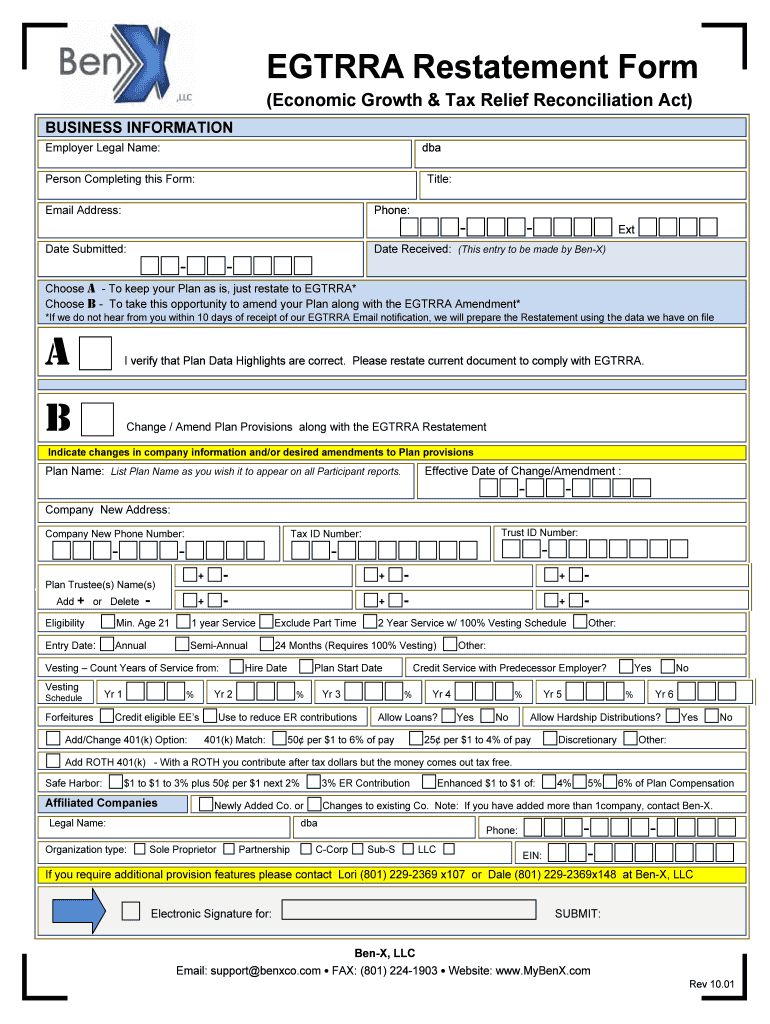

Get the free BenX Pension Plan - EGTRRA Restatement Form

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign benx pension plan

Edit your benx pension plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your benx pension plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit benx pension plan online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit benx pension plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out benx pension plan

How to fill out benx pension plan:

01

Gather necessary documents - Before starting to fill out the benx pension plan, make sure you have all the required documents at hand. This may include your identification documents (such as passport or driver's license), social security number, employment history, and any other relevant financial information.

02

Understand the plan features - Take the time to thoroughly read through the benx pension plan guidelines and understand its features. This will help you make informed decisions regarding contribution amounts, investment options, and potential benefits.

03

Determine your eligibility - Check whether you meet the eligibility criteria for the benx pension plan. This could vary depending on factors such as age, employment status, and company policies. If you have any doubts, reach out to the plan administrator or human resources department for clarification.

04

Calculate contribution amounts - Assess your financial situation and determine how much you can contribute to the benx pension plan. Consider factors such as your income, expenses, and long-term financial goals. It is advisable to contribute as much as you can afford to take full advantage of any employer matching contributions.

05

Enroll in the plan - Contact the plan administrator or your employer's human resources department to initiate the enrollment process. They will provide you with the necessary forms and guidance on how to complete them accurately. Pay close attention to deadlines and any additional information or signatures required.

06

Choose investment options - Most benx pension plans offer a range of investment options to choose from. Evaluate these options carefully, considering your risk tolerance, time horizon, and investment goals. Seek professional advice if needed to make the best investment choices for your specific circumstances.

07

Review and update periodically - Once enrolled, make it a habit to review your benx pension plan periodically. Life circumstances change, and it is important to ensure that your plan aligns with your evolving financial goals. Consider making adjustments, such as increasing contributions or reallocating investments, as necessary.

Who needs benx pension plan:

01

Employees seeking retirement income - The benx pension plan is primarily designed to provide retirement income to employees. If you are looking for a reliable and structured way to save for retirement, this plan can be beneficial.

02

Individuals without a pension plan - If your employer does not offer a pension plan or if you are self-employed, the benx pension plan can be a valuable tool to establish a retirement savings strategy. It allows you to contribute regularly and benefit from potential employer matching contributions and tax advantages.

03

Long-term financial planners - Those who prioritize long-term financial planning can benefit from the benx pension plan. By consistently saving for retirement, you can ensure a more secure financial future and potentially enjoy a comfortable retirement lifestyle.

04

Individuals seeking tax advantages - The benx pension plan often offers tax advantages, allowing for pre-tax contributions and potential tax-deferred growth. This can result in reduced taxable income in the present and potential tax savings in retirement.

05

Individuals looking for employer contributions - Many employers may offer matching contributions to the benx pension plan. By participating in the plan, you can take advantage of these employer contributions, effectively increasing your retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my benx pension plan in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your benx pension plan and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute benx pension plan online?

With pdfFiller, you may easily complete and sign benx pension plan online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit benx pension plan straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing benx pension plan right away.

What is benx pension plan?

The benx pension plan is a retirement savings plan sponsored by an employer that allows employees to contribute a portion of their income towards their retirement.

Who is required to file benx pension plan?

Employers who offer benx pension plans are required to file the necessary paperwork with the appropriate regulatory agencies.

How to fill out benx pension plan?

To fill out a benx pension plan, employees must provide information about their contributions, investment selections, and beneficiary designations.

What is the purpose of benx pension plan?

The purpose of a benx pension plan is to help employees save for retirement by allowing them to contribute a portion of their income towards their retirement savings.

What information must be reported on benx pension plan?

Information such as employee contributions, employer contributions, investment selections, and beneficiary designations must be reported on a benx pension plan.

Fill out your benx pension plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Benx Pension Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.