Get the free Guidelines for Expenditures and/or Match Documentation

Show details

Guidelines for Expenditures and/or Match Documentation Expenditures must pass the following test: allowable, allocable and reasonable to ensure the purchase is perceived as a good use of taxpayer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidelines for expenditures andor

Edit your guidelines for expenditures andor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidelines for expenditures andor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guidelines for expenditures andor online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit guidelines for expenditures andor. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidelines for expenditures andor

How to fill out guidelines for expenditures andor:

01

Start by gathering all relevant financial documents and records, such as receipts, invoices, and bank statements. This will help you accurately track and document your expenditures.

02

Identify any specific categories or budgets that need to be included in the guidelines. For example, if you have separate budgets for travel expenses, marketing expenses, and office supplies, make sure to mention them in the guidelines.

03

Clearly outline the purpose and objectives of the guidelines. Explain why it is important to accurately track expenditures and how it contributes to the overall financial management of the organization.

04

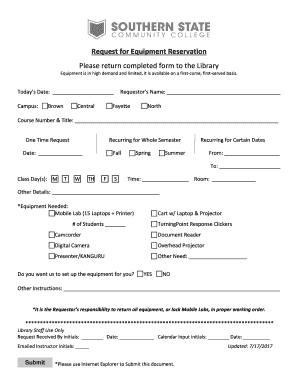

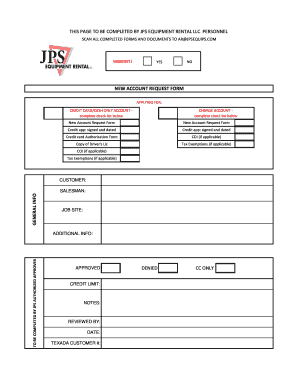

Provide detailed instructions on how to fill out the necessary forms or templates. This may include information on what information needs to be included, how to categorize expenditures, and any specific formatting requirements.

05

Include any relevant policies or procedures that need to be followed when filling out the guidelines. For example, if there are any approval processes or restrictions on certain types of expenditures, make sure to mention them.

06

Provide examples or sample entries to help guide users in correctly filling out the guidelines. This can be particularly helpful for individuals who may be filling out the guidelines for the first time.

07

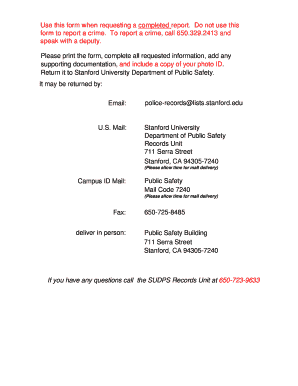

Clearly communicate the deadline or submission date for the guidelines. This ensures that all expenditures are documented in a timely manner and helps maintain organization and accountability.

08

Review the guidelines for accuracy and completeness before finalizing them. Make sure that all necessary information is included and that the guidelines are easy to understand and follow.

09

Distribute the guidelines to all relevant stakeholders, such as department heads, financial managers, or employees responsible for tracking expenditures.

10

Regularly review and update the guidelines as needed to ensure they remain relevant and aligned with any changes in financial processes or policies.

Who needs guidelines for expenditures andor?

01

Organizations of all sizes and sectors can benefit from having guidelines for expenditures andor.

02

Small businesses may find guidelines helpful in maintaining financial transparency and ensuring expenditures are properly tracked.

03

Non-profit organizations often have strict guidelines for expenditures to ensure funds are used in accordance with their mission.

04

Government entities typically have regulations and guidelines in place to ensure accountability and transparency in public spending.

05

Large corporations often have complex financial systems and guidelines to manage their expenditures effectively.

06

Individuals responsible for financial management, such as accountants or finance managers, can use guidelines for expenditures andor to ensure accurate documentation and reporting.

07

Employees who are authorized to make expenditures on behalf of an organization may also need guidelines to understand the process and requirements for documenting their expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify guidelines for expenditures andor without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including guidelines for expenditures andor, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send guidelines for expenditures andor for eSignature?

When your guidelines for expenditures andor is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an eSignature for the guidelines for expenditures andor in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your guidelines for expenditures andor right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is guidelines for expenditures andor?

Guidelines for expenditures andor provide instructions and rules for how to allocate funds for specific purposes.

Who is required to file guidelines for expenditures andor?

Any organization or individual that is responsible for managing and allocating funds for specific purposes is required to file guidelines for expenditures andor.

How to fill out guidelines for expenditures andor?

Guidelines for expenditures andor can be filled out by providing detailed information on how funds will be allocated, what purposes they will be used for, and any reporting requirements.

What is the purpose of guidelines for expenditures andor?

The purpose of guidelines for expenditures andor is to ensure transparency and accountability in how funds are allocated and spent.

What information must be reported on guidelines for expenditures andor?

Information that must be reported on guidelines for expenditures andor includes details on budget allocations, spending restrictions, and any reporting milestones.

Fill out your guidelines for expenditures andor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidelines For Expenditures Andor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.