Get the free Traditional 403(b) PRE TAX - sccoe.org

Show details

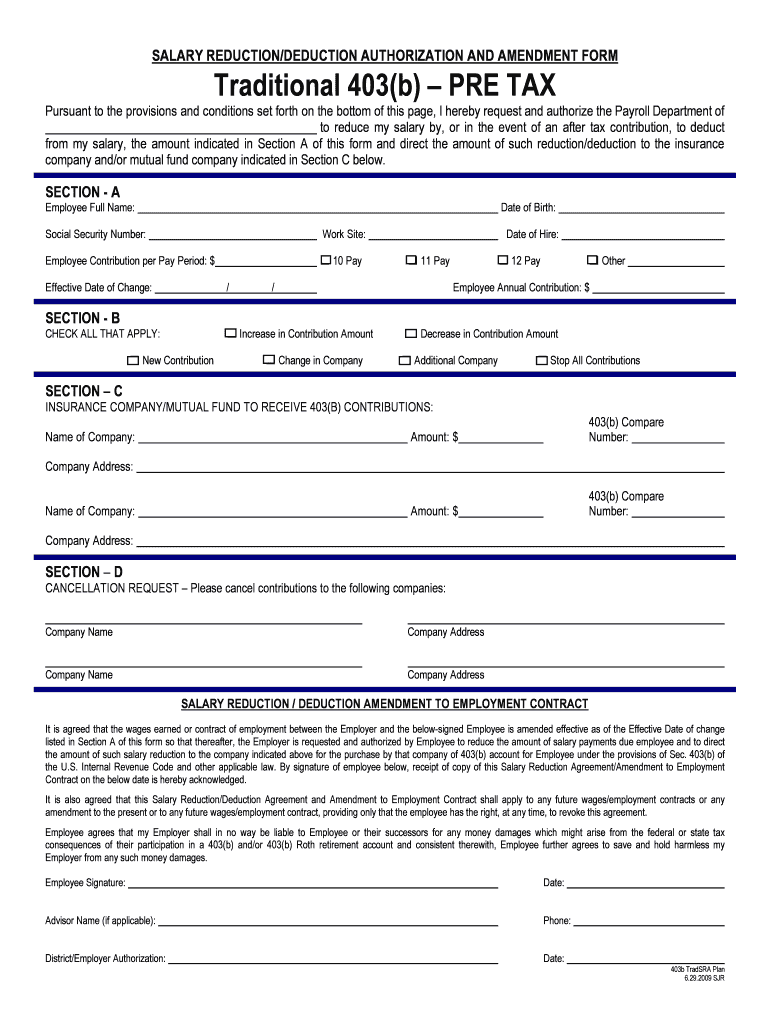

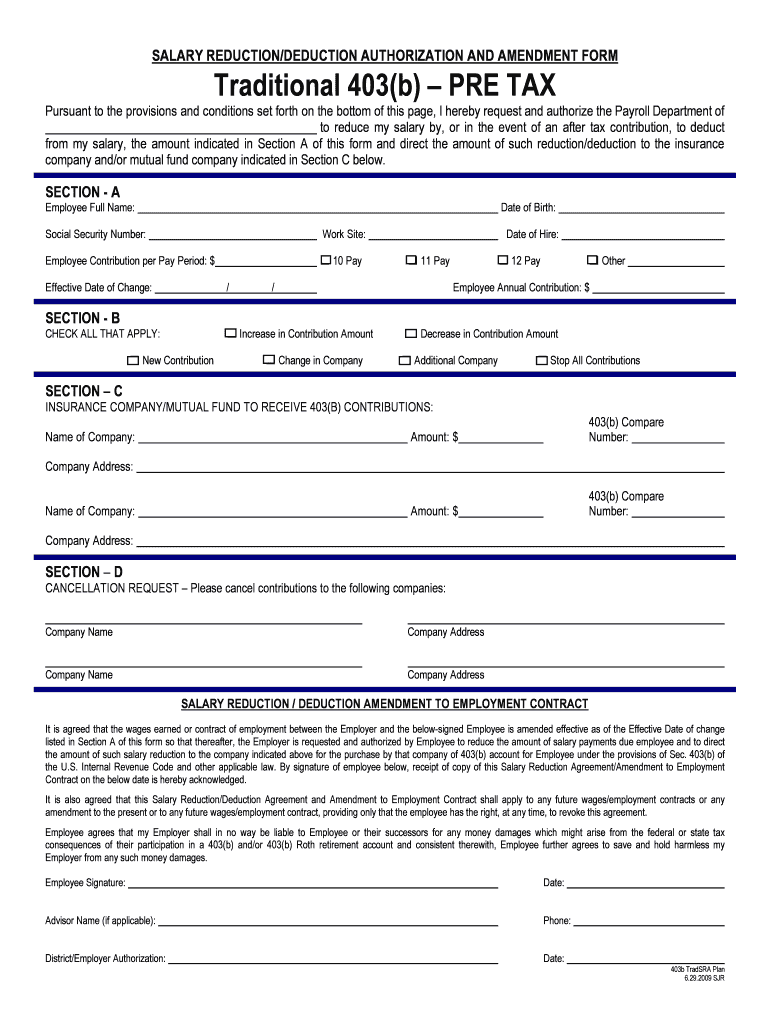

SALARY REDUCTION/DEDUCTION AUTHORIZATION AND AMENDMENT FORM Traditional 403(b) PRE TAX Pursuant to the provisions and conditions set forth on the bottom of this ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional 403b pre tax

Edit your traditional 403b pre tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional 403b pre tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing traditional 403b pre tax online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit traditional 403b pre tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional 403b pre tax

How to fill out traditional 403b pre tax:

01

Obtain the necessary forms: Start by getting the appropriate paperwork from your employer or the financial institution administering your traditional 403b plan. This may include a salary reduction agreement and an enrollment form.

02

Understand contribution limits: Before filling out the forms, it's essential to understand the contribution limits for a traditional 403b pre-tax plan. As of 2021, the limit is $19,500 per year, with an additional catch-up contribution of $6,500 for individuals aged 50 or older.

03

Complete the salary reduction agreement: The first form you'll likely encounter is the salary reduction agreement. This document authorizes your employer to deduct a specific amount from your paycheck and contribute it to your traditional 403b plan on a pre-tax basis. Fill out this form accurately, specifying the desired contribution amount.

04

Provide personal information: Alongside the salary reduction agreement, you may need to complete an enrollment form. This form typically requires personal information such as your full name, address, contact details, social security number, and employment details.

05

Select investment options: In some cases, you may have the opportunity to choose the investment options for your traditional 403b plan. Evaluate the available investment choices and select those that align with your financial goals and risk tolerance. If you're unsure, consider seeking advice from a financial advisor.

06

Review and sign the forms: Before submitting the completed forms, carefully review all the information provided. Look for any errors or missing details that could lead to processing delays. Once you're satisfied, sign the forms, indicating your consent and understanding of the terms and conditions.

Who needs traditional 403b pre-tax:

01

Employees in the nonprofit sector: Traditional 403b pre-tax plans are primarily designed for employees of public schools, universities, colleges, and certain nonprofit organizations. If you work in any of these sectors, you may be eligible for this retirement savings option.

02

Individuals seeking pre-tax contributions: The traditional 403b plan allows participants to contribute to their retirement savings on a pre-tax basis. If you want to reduce your taxable income in the present year while saving for retirement, a traditional 403b pre-tax plan might be suitable for you.

03

Those who value tax-deferred growth: With a traditional 403b pre-tax plan, your contributions grow tax-deferred until withdrawal during retirement. If you prefer tax advantages during the accumulation phase and are willing to pay taxes later when you withdraw the funds, a traditional 403b pre-tax plan could be a good fit.

Please note that while this information provides a general understanding, it's crucial to consult with a financial advisor or tax professional to fully understand your specific situation and make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the traditional 403b pre tax in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your traditional 403b pre tax and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit traditional 403b pre tax on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share traditional 403b pre tax from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out traditional 403b pre tax on an Android device?

Use the pdfFiller mobile app to complete your traditional 403b pre tax on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is traditional 403b pre tax?

Traditional 403b pre tax is a retirement savings plan offered by certain employers, where contributions are made with pre-tax dollars.

Who is required to file traditional 403b pre tax?

Employees of certain non-profit organizations, public schools, and certain other tax-exempt organizations are eligible to contribute to a traditional 403b pre tax plan.

How to fill out traditional 403b pre tax?

To fill out a traditional 403b pre tax plan, individuals need to work with their employer to set up contributions and choose investment options.

What is the purpose of traditional 403b pre tax?

The purpose of traditional 403b pre tax plans is to help individuals save for retirement while receiving tax benefits.

What information must be reported on traditional 403b pre tax?

Contributions, investment earnings, and distributions must be reported on traditional 403b pre tax plans.

Fill out your traditional 403b pre tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional 403b Pre Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.