Get the free pan card -Government of India - Search - GOI Search

Show details

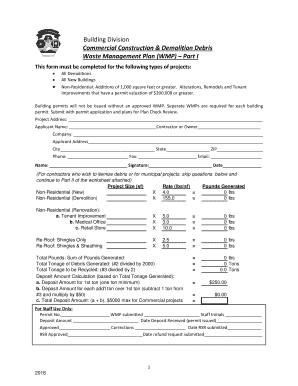

“STANCH PUNJAB RIGHT TO SERVICE ACT 2011 FORM FOR SEEKING SERVICE(POLICE DEPARTMENT, GOVT. OF PUNJAB) Service asked for CHARACTER VERIFICATION / POLICE CLEARANCE CERTIFICATE DATED D M M Y Y Y Y

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pan card -government of

Edit your pan card -government of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pan card -government of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pan card -government of online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pan card -government of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pan card -government of

Point by point on how to fill out PAN card -Government of:

01

Start by visiting the official website of the Income Tax Department of India or any authorized facilitation center.

02

Find the form for the PAN card application, which is usually Form 49A for Indian citizens or Form 49AA for foreign citizens.

03

Fill out the form with accurate personal details including your name, date of birth, address, contact information, etc.

04

Provide the necessary proof of identity and address documents as required by the application form. This can include documents such as Aadhaar card, passport, driving license, voter ID card, utility bills, etc.

05

Pay the applicable fee for the PAN card application. This can be done online or through a demand draft, depending on the method accepted by the authorities.

06

If applying online, submit the filled form and make sure to note down the acknowledgment number for future reference.

07

If applying through a facilitation center, submit the completed form along with the supporting documents and fee payment.

08

Once the application is submitted, you will receive an acknowledgment receipt or reference number. Hold on to this for tracking purposes.

09

The application will be processed by the Income Tax Department, and if all the details are found correct, you will receive your PAN card by mail within a few weeks.

Who needs PAN card -Government of:

01

Any individual or entity carrying out financial transactions in India, including earning an income, is required to have a PAN card.

02

It is mandatory for individuals who fall under the taxable income bracket to possess a PAN card.

03

PAN card is necessary for various financial and non-financial transactions such as opening a bank account, applying for loans, purchasing or selling assets, filing income tax returns, etc.

04

Even if an individual does not have taxable income, having a PAN card can be useful for conducting various business transactions or availing government services.

05

Foreign citizens who engage in financial transactions in India are also required to obtain a PAN card. This includes foreign investors, non-resident Indians (NRIs), and individuals involved in foreign business transactions in India.

06

PAN card is also essential for claiming tax refunds, applying for a credit or debit card, and participating in the stock market or mutual funds.

Remember to always ensure the accuracy of the information provided on the PAN card application form to avoid any delays or rejections in the process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pan card -government of in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your pan card -government of and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I modify pan card -government of without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your pan card -government of into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make changes in pan card -government of?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your pan card -government of to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your pan card -government of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pan Card -Government Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.