Get the free SURETY BOND FOR SAFEKEEPING OF PUBLIC PROPERTY AND GUARANTEEING REIMBURSEMENT TO THE...

Show details

DA FORM 4881-3-R, SEP 1984, IS OBSOLETE. ... FOR SAFEKEEPING OF PUBLIC PROPERTY AND GUARANTEEING REIMBURSEMENT TO THE. GOVERNMENT FOR EXPENSES INCIDENT TO THE LOAN OF ARMY ... DA FORM 4881-3, JUL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond for safekeeping

Edit your surety bond for safekeeping form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond for safekeeping form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing surety bond for safekeeping online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit surety bond for safekeeping. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

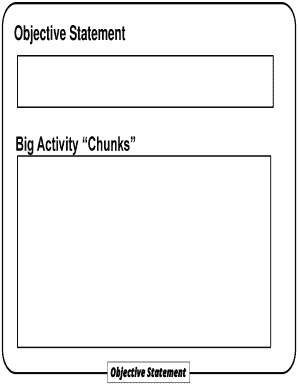

How to fill out surety bond for safekeeping

How to fill out surety bond for safekeeping:

01

Obtain the necessary forms: Begin by contacting a surety bonding company or checking online for the required forms to fill out. These forms will typically include the bond application and any additional documentation needed.

02

Provide personal and business information: In the application form, you will be asked to provide personal and business details such as your name, address, contact information, and the name of your business or organization. Make sure to provide accurate and up-to-date information.

03

Determine the bond amount: The surety bond amount required for safekeeping may vary depending on the jurisdiction and specific requirements. Verify the required bond amount with the relevant government agency or entity. This information is typically provided in the regulations or guidelines related to safekeeping.

04

Identify the obligee: The obligee is the entity that requires the surety bond for safekeeping. It could be a government agency, a regulatory body, or any other organization with oversight in this area. Fill out the obligee's information accurately, including the name, address, and contact details.

05

Complete the indemnity agreement: In many cases, surety bonding companies will require an indemnity agreement to be filled out. This agreement holds the bonded party responsible for any losses or damages that may occur due to their actions. Make sure to read and understand the terms before signing this agreement.

06

Obtain necessary signatures: Once you have completed all the required forms and filled in the necessary information, ensure that all relevant parties sign the documents. This may include your own signature as the bonded party, the surety company representative, and any other required signatories.

Who needs surety bond for safekeeping:

01

Contractors: In some cases, contractors may need to obtain a surety bond for safekeeping to ensure they properly handle and protect any items or materials entrusted to them during a project.

02

Storage facilities: Facilities that offer safekeeping services, such as storage units, warehouses, or vaults, may require a surety bond to provide assurance to their clients that their valuables will be kept secure.

03

Financial institutions: Banks or other financial institutions that offer safe deposit boxes or similar services may be required to hold a surety bond to protect their clients' assets and provide additional security measures.

04

Licensed professionals: Certain licensed professionals, such as estate planners, trustees, or guardians, may be required to obtain a surety bond for safekeeping to ensure they fulfill their duties in managing and safeguarding clients' assets.

05

Public officials: Public officials who handle public funds or assets may need to acquire a surety bond to protect against potential mishandling or misuse of those resources.

It's important to note that the specific requirements for a surety bond for safekeeping may vary depending on the jurisdiction and the industry. Therefore, it is advisable to consult with legal or industry professionals to ensure compliance with all relevant regulations and obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit surety bond for safekeeping from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including surety bond for safekeeping. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get surety bond for safekeeping?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the surety bond for safekeeping in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out surety bond for safekeeping on an Android device?

Use the pdfFiller mobile app to complete your surety bond for safekeeping on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is surety bond for safekeeping?

Surety bond for safekeeping is a type of bond that ensures that a person or entity will properly handle and safeguard assets or funds entrusted to them by another party.

Who is required to file surety bond for safekeeping?

Certain professionals such as accountants, attorneys, and fiduciaries may be required to file a surety bond for safekeeping depending on state laws and regulations.

How to fill out surety bond for safekeeping?

To fill out a surety bond for safekeeping, one must typically provide information about the principal, the obligee, the amount of the bond, and any relevant terms and conditions.

What is the purpose of surety bond for safekeeping?

The purpose of a surety bond for safekeeping is to protect the assets or funds entrusted to a person or entity by ensuring that they will be properly managed and returned to the rightful owner.

What information must be reported on surety bond for safekeeping?

Information such as the name of the principal, the name of the obligee, the amount of the bond, and any specific terms or conditions must be reported on a surety bond for safekeeping.

Fill out your surety bond for safekeeping online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond For Safekeeping is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.