Get the free aegon lump sum payment instruction

Show details

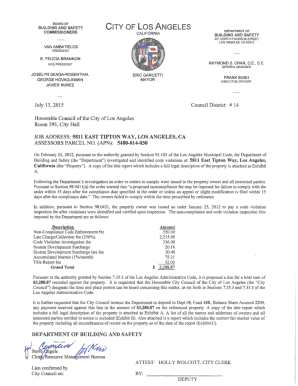

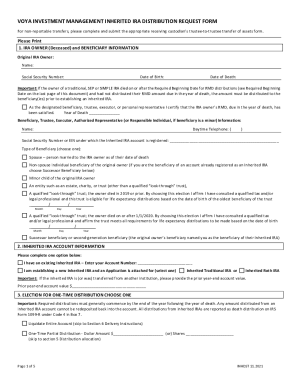

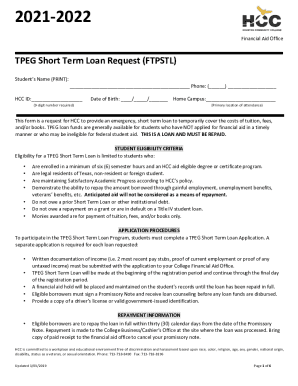

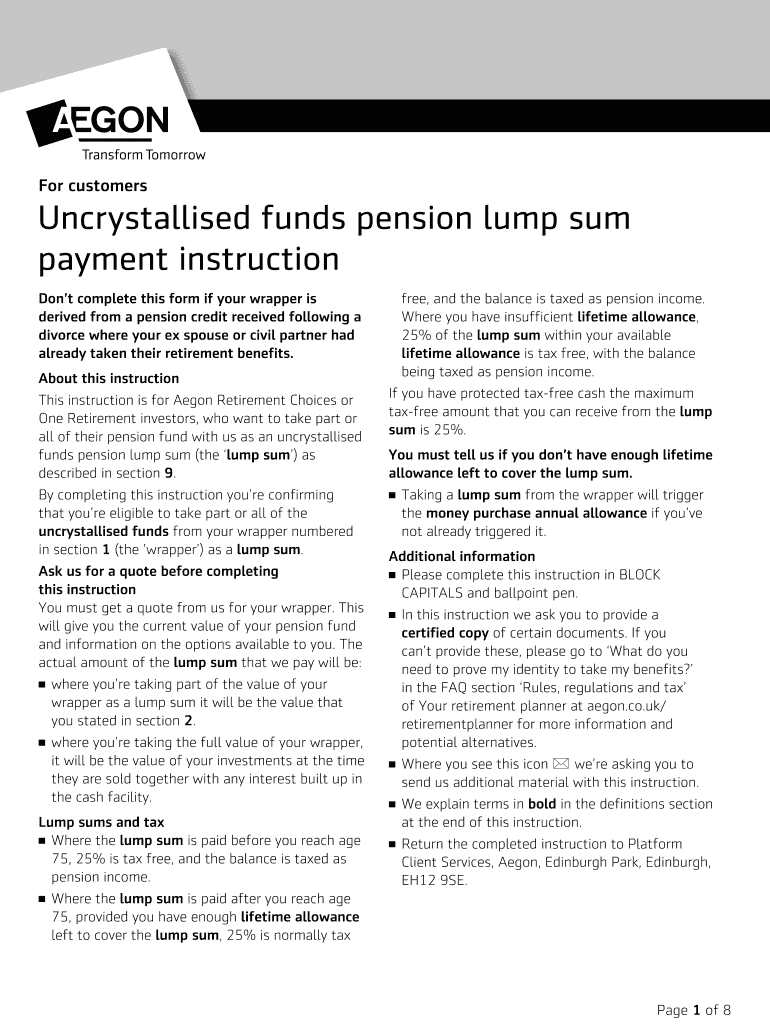

Uncrystallized funds pension lump sum payment instruction Page 1 of 8 For customers Don't complete this form if your wrapper is derived from a pension credit ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aegon lump sum payment

Edit your aegon lump sum payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aegon lump sum payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aegon lump sum payment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit aegon lump sum payment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aegon lump sum payment

How to fill out aegon lump sum payment:

01

Gather the necessary information: before filling out the aegon lump sum payment, make sure you have all the required information handy. This may include your personal details, policy number, and the amount you wish to contribute as a lump sum payment.

02

Access the aegon lump sum payment form: visit the official website of Aegon or contact their customer service to obtain the aegon lump sum payment form. This form will typically be available in a downloadable format or may be sent to you via email or regular mail.

03

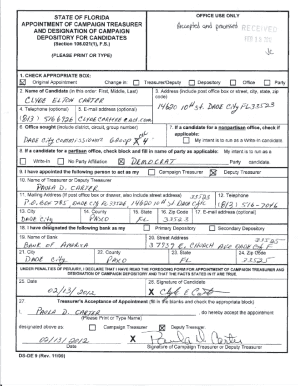

Fill in your personal details: carefully complete the form by providing accurate personal information such as your full name, address, contact details, and any other requested information. Double-check for any errors or missing information before proceeding.

04

Enter your policy details: accurately enter your aegon policy details, including the policy number, policy type, and any other relevant information. This will help ensure that your lump sum payment is correctly credited to the intended policy.

05

Specify the lump sum payment amount: clearly indicate the exact amount you wish to contribute as a lump sum payment. It is advisable to recheck this amount to prevent any discrepancies.

06

Review and sign the form: carefully review all the information provided on the form to ensure accuracy. Once you are satisfied, sign the form in the designated space. Make sure your signature matches the one on record to avoid any complications.

07

Submit the form: depending on the instructions provided by Aegon, you can submit the filled-out form via mail, email, or through an online portal. Follow the indicated submission process to successfully submit your aegon lump sum payment form.

Who needs aegon lump sum payment?

01

Individuals with an aegon policy: those who hold an aegon insurance policy and wish to make a one-time lump sum payment can benefit from the aegon lump sum payment option.

02

Policyholders seeking to increase their investments: if you have extra funds and want to maximize your investments, making a lump sum payment can help grow your policy’s value.

03

Individuals looking for an opportunity to save on future premiums: by contributing a lump sum payment, policyholders may be able to reduce their future premium payments or adjust the frequency of their payments.

It is always recommended to consult with a financial advisor or contact Aegon directly to understand the specific benefits and implications of making a lump sum payment based on individual circumstances.

Fill

form

: Try Risk Free

People Also Ask about

How do I take my pension as a lump sum?

Take cash lump sums You can take your whole pension pot as cash straight away if you want to, no matter what size it is. You can also take smaller sums as cash whenever you need to. 25% of your total pension pot will be tax-free. You'll pay tax on the rest as if it were income.

How do you take a lump sum out of your pension?

Take cash lump sums You can take your whole pension pot as cash straight away if you want to, no matter what size it is. You can also take smaller sums as cash whenever you need to. 25% of your total pension pot will be tax-free. You'll pay tax on the rest as if it were income.

Can I pay into my Aegon pension?

You can contribute personally to your own individual pension arrangement, or you can pay into a workplace pension provided by your employer.

Can I take my money out of Aegon pension?

You have control to start, stop or vary your income. Normally, you can take 25% as a tax-free cash lump sum, with the remainder going into your flexi-access drawdown account. Regular income and one-off lump sums paid from your flexi-access drawdown are taxed as income.

Can you get a lump sum payment?

A lump-sum payment is an amount paid all at once, as opposed to an amount that is paid in installments. A lump-sum payment is not the best choice for everyone; for some, it may make more sense for the funds to be annuitized as periodic payments.

Can you cash out lump sum pension?

If you take a lump sum in cash, it's immediately taxable, and you'll be subject to 20 percent federal (and potentially state) mandatory tax withholding. With a few exceptions, distributions taken prior to age 59½ are subject to a 10 percent IRS early withdrawal penalty. Withdrawals do not need to begin until age 72.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify aegon lump sum payment without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your aegon lump sum payment into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find aegon lump sum payment?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific aegon lump sum payment and other forms. Find the template you need and change it using powerful tools.

How do I make edits in aegon lump sum payment without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit aegon lump sum payment and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is aegon lump sum payment?

Aegon lump sum payment refers to a one-time payment made by Aegon, typically related to insurance policies or retirement funds, where the amount is distributed as a single total rather than in installments.

Who is required to file aegon lump sum payment?

Individuals or entities receiving the lump sum payment from Aegon are generally required to file it, particularly if it affects their taxable income or financial disclosures.

How to fill out aegon lump sum payment?

To fill out the Aegon lump sum payment forms, provide personal details such as your name, address, Social Security number, and any relevant policy or account numbers, as well as information about the payment amount and purpose.

What is the purpose of aegon lump sum payment?

The purpose of the Aegon lump sum payment is to settle benefits or payouts earned through insurance or pension policies, allowing the recipient immediate access to funds for personal or investment use.

What information must be reported on aegon lump sum payment?

The information that must be reported includes the total payment amount, the reason for the payment, the recipient’s tax identification number, and any pertinent financial details related to the account or policy.

Fill out your aegon lump sum payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aegon Lump Sum Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.