Get the free Receivership Estate - Michigan Courts - State of Michigan - courts mi

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign receivership estate - michigan

Edit your receivership estate - michigan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your receivership estate - michigan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing receivership estate - michigan online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit receivership estate - michigan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out receivership estate - michigan

How to fill out receivership estate - Michigan:

01

Research the requirements: Before filling out the receivership estate forms, it is essential to understand the specific requirements and guidelines set by the Michigan state laws. Take the time to review these regulations to ensure accurate completion of the forms.

02

Gather necessary information: Collect all the relevant information required to fill out the receivership estate forms. This may include details such as the name and contact information of the receiver, the estate being placed in receivership, and any supporting documentation concerning the estate.

03

Obtain the appropriate forms: Visit the official website of the Michigan court system or contact the relevant court to obtain the necessary receivership estate forms. Make sure to obtain the correct forms as per the specific jurisdiction and type of estate being placed in receivership.

04

Complete the forms accurately: Carefully read through the instructions provided with the forms to ensure accurate completion. Provide all requested information, including the names and contact details of all parties involved, supporting documentation, and any other relevant information required by the forms.

05

Consult with legal professionals if needed: If you are uncertain about any aspect of filling out the receivership estate forms or have complex estate arrangements, it is advisable to consult with a qualified legal professional who specializes in receivership matters. They can provide guidance, review the forms, and ensure compliance with applicable laws.

Who needs receivership estate - Michigan:

01

Individuals facing financial distress: If an individual or business in Michigan is struggling with significant financial difficulties and is unable to pay its debts or meet financial obligations, they may consider placing their estate in receivership. This allows a court-appointed receiver to take control and manage the estate's assets in an orderly manner.

02

Creditors seeking to secure debts: Creditors who are owed money by an individual or business in Michigan may file for receivership to help secure the payment of their debts. By placing the estate in receivership, creditors gain assurance that the assets will be managed properly, and funds can be distributed appropriately.

03

Courts overseeing legal disputes: In certain legal cases, such as those involving disputes over assets or claims, the court may order the appointment of a receiver to oversee and manage the estate until the dispute is resolved. This ensures the fair distribution and protection of the estate's assets during litigation.

It is important to note that the need for a receivership estate in Michigan may vary depending on individual circumstances and specific legal situations. Seeking advice from legal professionals or consulting the Michigan state laws can provide further clarity on who may require a receivership estate.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit receivership estate - michigan from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including receivership estate - michigan, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get receivership estate - michigan?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the receivership estate - michigan in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my receivership estate - michigan in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your receivership estate - michigan and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

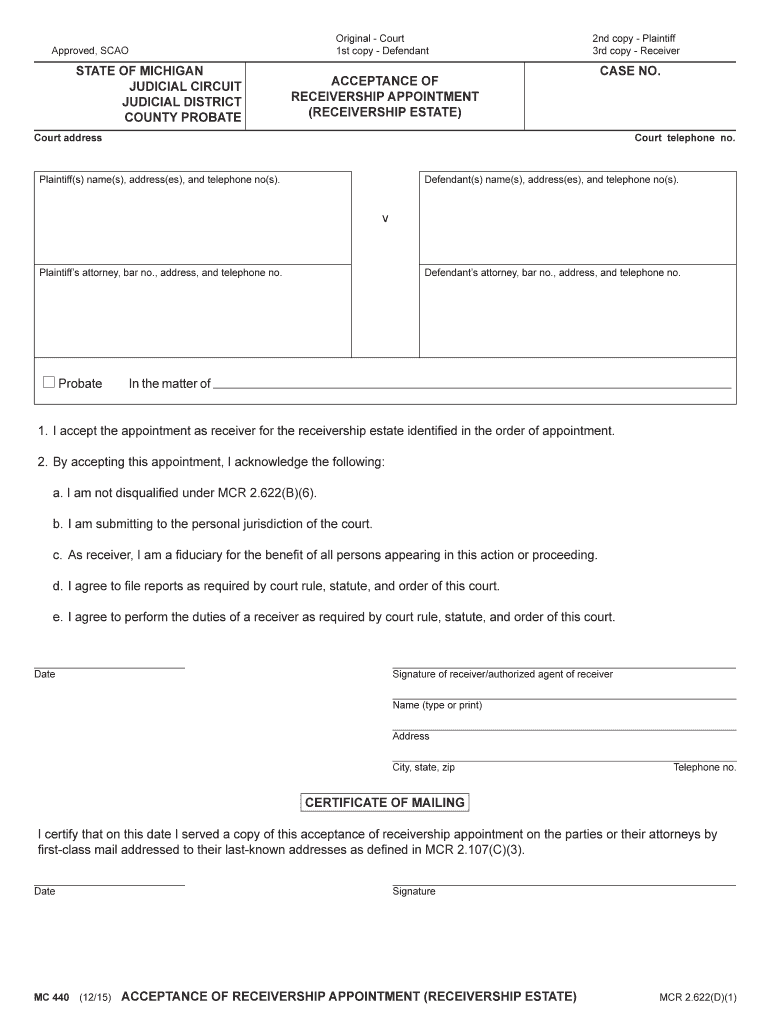

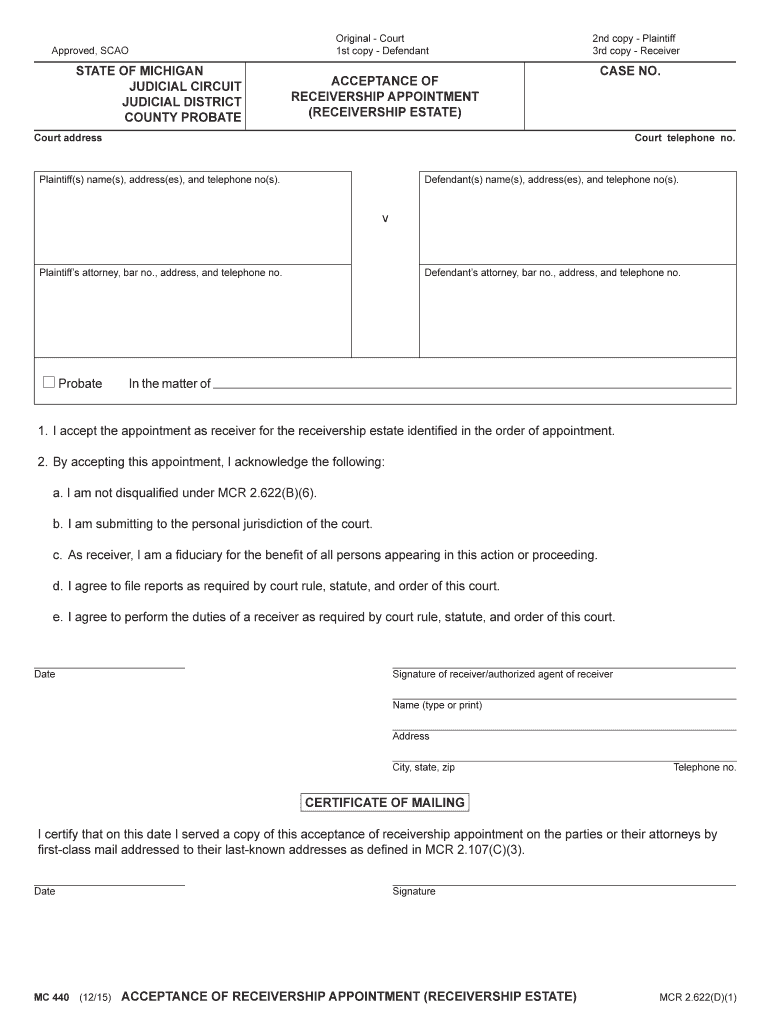

What is receivership estate - michigan?

Receivership estate in Michigan refers to the assets and property of an individual or entity that has been placed under the control of a court-appointed receiver.

Who is required to file receivership estate - michigan?

The receiver appointed by the court is responsible for filing receivership estate in Michigan.

How to fill out receivership estate - michigan?

To fill out receivership estate in Michigan, the receiver must provide detailed information about the assets, liabilities, income, and expenses of the estate.

What is the purpose of receivership estate - michigan?

The purpose of receivership estate in Michigan is to protect and manage the assets of an individual or entity involved in a legal proceeding.

What information must be reported on receivership estate - michigan?

The receiver must report information such as a list of assets, debts, income, expenses, and any actions taken on behalf of the estate.

Fill out your receivership estate - michigan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Receivership Estate - Michigan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.