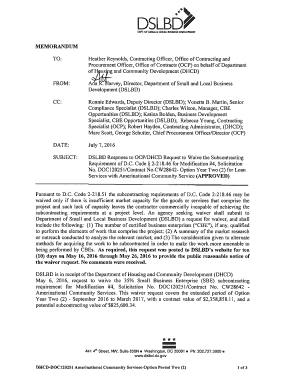

Get the free $35 or $45 Payable to Haywood County Bee Club More ... - hcbees

Show details

Beginning Beekeeping School Sponsored by Haywood County Bee Club & NC Cooperative Extension Saturdays, February 23 & March 2, 2013 9:00AM4:00PM Haywood County Extension Center 589 Raccoon Road Gainesville,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 35 or 45 payable

Edit your 35 or 45 payable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 35 or 45 payable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 35 or 45 payable online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 35 or 45 payable. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 35 or 45 payable

How to fill out 35 or 45 payable:

01

Start by taking a deep breath and gathering all the necessary information and documents for the form. This may include your personal information, such as name, address, and social security number, as well as any relevant financial information.

02

Carefully read the instructions provided on the form to understand the specific requirements for filling out the 35 or 45 payable. Make sure you have a clear understanding of each section and what information you need to provide.

03

Begin by filling out the header section of the form, which usually includes your personal information. Double-check the accuracy of the information you provide to avoid any errors or delays.

04

Move on to the main body of the form and fill out the required fields. These fields may vary depending on the purpose of the form. Pay close attention to any specific instructions or additional documents that may be required.

05

If there are any sections that you are unsure about or if you need assistance, don't hesitate to seek guidance from a professional, such as a tax advisor or a financial institution representative. It's better to ask for help than to make mistakes that could have consequences.

06

Once you have filled out all the necessary sections, review your entries to ensure accuracy. Double-check all the information provided, including numbers, names, and addresses, to avoid any potential errors that could cause complications or delays.

07

Before submitting the form, make copies of all the documents and keep them for your records. This way, you have a backup in case any issues arise or if you need to reference the information in the future.

Who needs 35 or 45 payable:

01

Individuals who are responsible for paying taxes or fees may need to fill out form 35 or 45 payable. These forms are commonly used in various taxation processes, such as income tax, property tax, or sales tax.

02

Businesses, both small and large, may also be required to fill out form 35 or 45 payable. This could include submitting taxes or payments related to the goods or services they provide.

03

Individuals or organizations involved in legal or financial transactions, such as estates, trusts, or investments, may also require form 35 or 45 payable as part of their obligations.

It is important to note that the specific situations and requirements for form 35 or 45 payable may vary depending on the jurisdiction or governing body responsible for tax or fee collection. It is advisable to consult with the appropriate authorities or seek professional advice to ensure compliance with the specific regulations in your area.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 35 or 45 payable without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 35 or 45 payable, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send 35 or 45 payable for eSignature?

To distribute your 35 or 45 payable, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the 35 or 45 payable in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 35 or 45 payable in seconds.

What is 35 or 45 payable?

35 or 45 payable refers to a financial obligation that must be fulfilled either in the amount of 35 or 45.

Who is required to file 35 or 45 payable?

Individuals or entities who have specific financial transactions requiring a payment of 35 or 45 are required to file 35 or 45 payable.

How to fill out 35 or 45 payable?

To fill out 35 or 45 payable, one must provide the necessary information related to the payment amount, purpose, and recipient.

What is the purpose of 35 or 45 payable?

The purpose of 35 or 45 payable is to ensure that financial obligations in the amounts of 35 or 45 are met within the specified time frame.

What information must be reported on 35 or 45 payable?

Information such as the payment amount, payment date, recipient details, and purpose of payment must be reported on 35 or 45 payable.

Fill out your 35 or 45 payable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

35 Or 45 Payable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.