Who needs an M-1310 form?

This form is used by the spouse, personal representative or claimant for the estate of the deceased taxpayer to claim a refund in the state of Massachusetts.

What is the purpose of the M-1310 form?

This statement is required to receive the tax refund on behalf of the deceased person. The right to get the tax refund have certain individuals connected to the deceased.

What other documents must accompany the M-1310 form?

As a rule, this form is accompanied by the copy of the death certificate or other proof of death. The Massachusetts Department of Revenue demands to attach the statement to the individual tax return. The personal representative also has to include a court certificate showing his appointment.

When is the M-1310 form due?

The statement should be completed when you claim a tax refund.

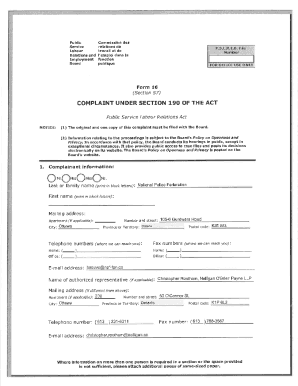

What information should be provided in the M-1310 form?

The taxpayer has to provide the following details in the statement:

- Name of the decedent

- Name of the claimant

- Date of the death

- Social Security Number of the claimant

- Address of the claimant

- Reason for filing (check the appropriate box)

Schedule A is a part of the statement which must be completed if the claimant is not the decedent’s spouse or personal representative. This person has to indicate the name of the widow or widower, names of surviving children, name of person supporting the children, names of decedent’s living father and mother, name of decedent’s living brothers and sisters and their addresses.

What do I do with the statement after its completion?

The completed form is attached to the individual’s tax return to claim a tax refund.