IRS 1099-CAP 2016 free printable template

Show details

Form 1099-CAP 2016. Cat. No. 35115M. Changes in Corporate Control and Capital Structure. Copy A. For Internal Revenue Service Center. Department of the.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1099-CAP

Edit your IRS 1099-CAP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1099-CAP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1099-CAP online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 1099-CAP. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1099-CAP Form Versions

Version

Form Popularity

Fillable & printabley

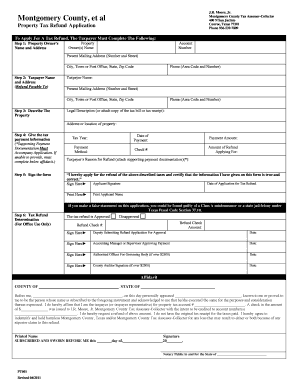

How to fill out IRS 1099-CAP

How to fill out IRS 1099-CAP

01

Obtain the IRS Form 1099-CAP from the IRS website or your tax software.

02

Enter the name and address of the corporation that underwent the change in control.

03

Fill in the tax identification number (TIN) of the corporation.

04

In Box 1, report the name of the issuer or the entity that made the payment.

05

In Box 2, report the date of the change in control.

06

In Box 3, report the amount of cash received by the shareholders.

07

In Box 4, report the fair market value of the property received, if applicable.

08

Complete the certification section at the bottom of the form.

09

Make sure to sign and date the form if required.

10

Send a copy of the form to the IRS and provide a copy to the shareholders involved.

Who needs IRS 1099-CAP?

01

Corporations that have undergone a change in control and have made payments to shareholders may need to file IRS 1099-CAP.

02

Shareholders who received cash or property as part of a change in control must also receive a copy of this form.

Fill

form

: Try Risk Free

People Also Ask about

What does a 1099 form tell you?

A 1099 form shows non-employment income, such as income earned by freelancers and independent contractors. On the other hand, a W-2 shows the annual wages or employment income that a taxpayer earned from a particular employer during the tax year.

What qualifies me for a 1099 form?

Examples of when you might get a 1099 Form If you earned $600 or more in nonemployee compensation from a person or business who isn't typically your employer, you should receive a Form 1099-NEC. If you earned $600 or more in rent or royalty payments, you should receive Form 1099-MISC.

What is a 1099-cap form?

This form is furnished to shareholders who receive cash, stock, or other property from an acquisition of control or a substantial change in capital structure.

How do I report a 1099-cap?

Shareholders who receive a 1099-CAP may be required to recognize gains from the receipt of cash, stock, or other property that was exchanged for the company's stock. If you do have a gain from the exchange, report it on IRS Form 8949 when you file your income tax return.

How much can you make on a 1099 before you have to claim it?

Normally income you received totaling over $600 for non-employee compensation (and/or at least $10 in royalties or broker payments) is reported on Form 1099-MISC. If you are self-employed, you are required to report your self-employment income if the amount you receive from all sources equals $400 or more.

What is 1099 income limit?

Usually, anyone who was paid $600 or more in non-employment income should receive a 1099. However, there are many types of 1099s for different situations. Also, there are many exceptions to the $600 rule, meaning you may receive a 1099 even if you were paid less than $600 in non-employment income during the tax year.

What happens if I don't file my 1099 K?

Once the IRS thinks that you owe additional tax on your unreported 1099 income, it will usually notify you and retroactively charge you penalties and interest beginning on the first day they think that you owed additional tax.

How do I report 1099 income to IRS?

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more. You may need to make estimated tax payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 1099-CAP for eSignature?

Once your IRS 1099-CAP is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete IRS 1099-CAP on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your IRS 1099-CAP. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete IRS 1099-CAP on an Android device?

Use the pdfFiller app for Android to finish your IRS 1099-CAP. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

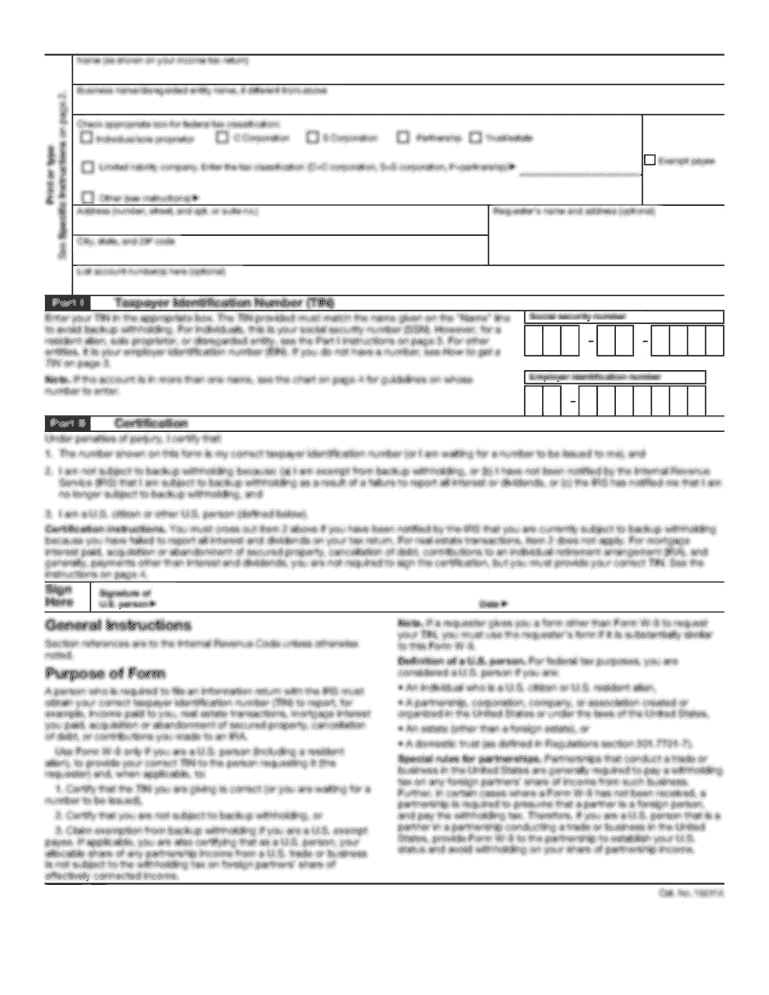

What is IRS 1099-CAP?

IRS 1099-CAP is a tax form used to report changes in the capital structure of a corporation, particularly in cases of stock acquisitions or corporate restructuring that lead to significant changes in ownership.

Who is required to file IRS 1099-CAP?

Corporations that make certain changes to their capital structure, such as issuing stock or making stock redemptions that trigger reporting requirements, are required to file IRS 1099-CAP.

How to fill out IRS 1099-CAP?

To fill out IRS 1099-CAP, the corporation must provide details such as its name, address, and employer identification number (EIN), along with information about the shareholders impacted, including the amount of stock acquired or the nature of the transaction.

What is the purpose of IRS 1099-CAP?

The purpose of IRS 1099-CAP is to inform the IRS and the shareholders about changes in the capital structure of a corporation, ensuring proper reporting of ownership changes for tax purposes.

What information must be reported on IRS 1099-CAP?

IRS 1099-CAP must report information such as the name and address of the corporation, the EIN, the date of the arrangement, the type of transaction, the number of shares issued or exchanged, and any other relevant details concerning capital changes.

Fill out your IRS 1099-CAP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1099-CAP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.