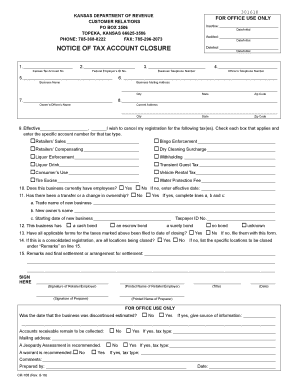

KS DoR CR-108 2015 free printable template

Get, Create, Make and Sign KS DoR CR-108

Editing KS DoR CR-108 online

Uncompromising security for your PDF editing and eSignature needs

KS DoR CR-108 Form Versions

How to fill out KS DoR CR-108

How to fill out KS DoR CR-108

Who needs KS DoR CR-108?

Instructions and Help about KS DoR CR-108

What they do by its just going to be a quick pretty quick video about 30 seconds 50 seconds Sean you all showing my subscribers that I'm CR 108 let you all see every piece is 94 uh yeah I have no cooler, so I'm using flex I have to get some out the league bank in a few but um yeah pretty much you can hit one too late what I was getting a light one last piece but you just gotta have six months up and let you all see the stats or whatever pretty good stuff um yeah over this her, so I guess this the maximum see how I want to wait I know it's a gold net piece that dry I don't know if that's going to change anything but um yeah that's pretty much it mans you all need to just uh basically run the race with your legs, and I'll do some alert I'm chilling with God that's all I wanted to show you are mine I know its one more thing I want to say oh that's all I want to say I want to tell you I got a lot of content but my internet and my laptop that can crazy so, and you know them reeds are like 30 minutes long it's always hard for me to like to convert those videos is taking forever but um I'm going to be uploading a lot soon, so it is bed with me yeah

People Also Ask about

How do I get a tax certificate in Kansas?

How do I get a tax ID number in Kansas?

How do I get a sales tax certificate in Kansas?

How do I get a copy of my Kansas sales tax certificate?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit KS DoR CR-108 online?

How do I edit KS DoR CR-108 in Chrome?

How can I fill out KS DoR CR-108 on an iOS device?

What is KS DoR CR-108?

Who is required to file KS DoR CR-108?

How to fill out KS DoR CR-108?

What is the purpose of KS DoR CR-108?

What information must be reported on KS DoR CR-108?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.