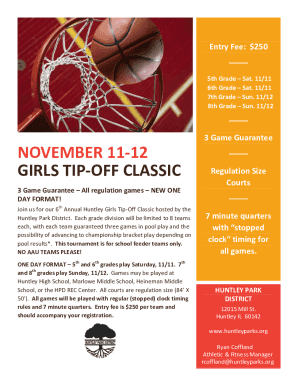

Get the free Tax on Hotel Room Occupancy Revised to Exempt

Show details

NYC DEPARTMENT OF FINANCE

165. May 24, 2016FINANCE MEMORANDUM

Tax on Hotel Room Occupancy Revised to Exempt

Certain Occupies Conveyed to Room RemarketersBackground:

New York State legislature recently

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax on hotel room

Edit your tax on hotel room form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax on hotel room form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax on hotel room online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax on hotel room. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax on hotel room

01

To fill out tax on a hotel room, you will need to gather the necessary information and follow these steps:

1.1

Start by obtaining the necessary tax forms specific to your location. These forms can usually be obtained from the local tax authority or downloaded from their website.

1.2

Once you have the tax forms, carefully read the instructions provided. Familiarize yourself with the information required and any specific guidelines or deadlines that need to be followed.

1.3

Begin filling out the tax form by entering your personal information, such as your name, address, and contact details. Ensure that all the information provided is accurate and up to date.

1.4

Next, you will need to provide details about the hotel room for which you are reporting the tax. This may include the hotel's name, address, and relevant dates of your stay.

1.5

Depending on your jurisdiction, you may need to specify the purpose of your stay, such as whether it was for business or personal reasons.

1.6

The tax forms may ask you to provide additional details about the payments made for the hotel room. This may include the total cost of the stay, any additional charges or fees, and how the payment was made (credit card, cash, etc.).

1.7

Make sure to keep any supporting documentation, such as receipts or invoices, as you may need to attach them to the tax form as proof of payment.

1.8

Once you have completed all the required sections of the tax form, double-check for any errors or omissions. It's crucial to ensure the accuracy of the information provided to avoid potential issues or delays.

1.9

Finally, sign and date the tax form as required. If necessary, make a copy of the completed form for your own records before submitting it to the appropriate tax authority.

02

The individuals who need to pay tax on a hotel room can vary depending on the jurisdiction and specific tax regulations. However, generally, anyone who stays in a hotel room for a certain period may be required to pay the applicable taxes.

2.1

Business travelers who book hotel rooms for work purposes may need to pay taxes on their lodging expenses. These taxes are often reimbursable by their company or can be claimed as a deductible business expense.

2.2

Vacationers or tourists who stay in hotels during their travels may also be subject to hotel room taxes. These taxes are typically imposed by the local government and help fund tourism-related initiatives or services in the area.

2.3

Sometimes, individuals attending conferences, seminars, or special events hosted at hotels may need to pay tax on their hotel accommodations.

2.4

It's important to note that the specific requirements and rates for hotel room taxes can vary significantly depending on the country, state, or city. Therefore, it's essential to consult the local tax authority or research the specific regulations in the jurisdiction where the hotel is located.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax on hotel room directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your tax on hotel room along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit tax on hotel room from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your tax on hotel room into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit tax on hotel room in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your tax on hotel room, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is tax on hotel room?

Tax on hotel room is a fee imposed by the government on the rental of a room in a hotel or lodging establishment.

Who is required to file tax on hotel room?

Hotel owners or operators are required to file tax on hotel room to report and remit the tax collected from guests.

How to fill out tax on hotel room?

To fill out tax on hotel room, hotel owners or operators need to accurately report the total room revenue, calculate the tax owed based on the tax rate, and submit the payment to the appropriate tax authority.

What is the purpose of tax on hotel room?

The purpose of tax on hotel room is to generate revenue for the government, support tourism-related initiatives, and fund local infrastructure projects.

What information must be reported on tax on hotel room?

Information that must be reported on tax on hotel room includes total room revenue, tax rate applicable, total tax collected, and any exemptions or credits claimed.

Fill out your tax on hotel room online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax On Hotel Room is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.