Get the free Prepare a Supplemental Pay Request Form for Monthly Paid ... - samford

Show details

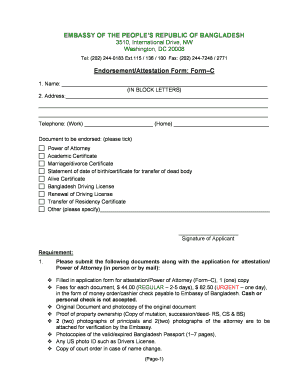

STAMFORD UNIVERSITY. Human Resources Department. Supplemental or Part- time Pay Request Form. For Monthly Paid Employees Only. NOTE: Use this form ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign prepare a supplemental pay

Edit your prepare a supplemental pay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your prepare a supplemental pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing prepare a supplemental pay online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit prepare a supplemental pay. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out prepare a supplemental pay

Preparing a supplemental pay requires careful attention to detail and adherence to specific guidelines. Here is a step-by-step guide on how to fill out and prepare a supplemental pay, along with information on who needs to do so:

01

Gather necessary information: Begin by collecting all relevant information related to the supplemental pay. This includes details such as the employee's name, employee ID, pay period, the nature of the supplemental pay (e.g., bonus, overtime, commission), and the reason behind it.

02

Determine the correct form or documentation: Depending on your organization's policies and procedures, there may be a specific form or document that needs to be completed to prepare the supplemental pay. Ensure that you have the correct form and carefully review its instructions.

03

Calculate the supplemental pay amount: Use the provided formula or method to accurately calculate the amount for the supplemental pay. This might involve factors such as the employee's base salary, specific percentages, or predetermined rates.

04

Double-check for accuracy: Before submitting any documents or initiating any payments, it is crucial to double-check all the information for accuracy. Make sure that all calculations are correct, and verify that the employee's details are accurate and up-to-date.

05

Seek necessary approvals: Depending on your organization's hierarchy and processes, you may need to seek approval from supervisors or relevant departments before processing the supplemental pay. Follow your organization's protocols to ensure proper authorization is obtained.

06

Complete the required documentation: Fill out all required sections of the supplemental pay form or document accurately and legibly. Provide any necessary explanations or additional information that may be required.

07

Submit the documentation: Once all the necessary steps are taken, submit the completed supplemental pay documentation to the appropriate department, such as payroll or human resources. Depending on your organization, this may be done electronically or through physical submission.

Who needs to prepare a supplemental pay?

Supplemental pay is often prepared and issued by employers to employees who are eligible for additional compensation beyond their regular salary or wages. The need to prepare a supplemental pay can arise in various situations such as:

01

Overtime payments: When employees work additional hours beyond their regular working hours, they may be entitled to receive overtime pay. Employers need to prepare supplemental pay to compensate employees accurately for these extra hours.

02

Bonuses and incentives: Employers may offer bonuses or incentives to recognize outstanding performance, achievement of goals, or as part of specific employee reward programs. To fulfill these monetary rewards, employers must prepare supplemental pay.

03

Commission payments: Employees who earn a commission based on sales or other performance metrics may require supplemental pay to receive their entitled commission amounts.

04

Retroactive payments: In cases where an employee is owed backdated pay adjustments, such as a salary increase or correction, employers need to prepare supplemental pay to issue the retroactive payment.

In summary, anyone responsible for processing payments and maintaining accurate compensation records within an organization may need to prepare a supplemental pay. It is crucial to follow proper procedures and guidelines to ensure accurate and timely payment disbursement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify prepare a supplemental pay without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your prepare a supplemental pay into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find prepare a supplemental pay?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the prepare a supplemental pay. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my prepare a supplemental pay in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your prepare a supplemental pay and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is prepare a supplemental pay?

Prepare a supplemental pay is the process of calculating and issuing additional compensation to an employee, usually outside of their regular salary or wages.

Who is required to file prepare a supplemental pay?

Employers are required to file prepare a supplemental pay for employees who have received additional compensation beyond their regular salary or wages.

How to fill out prepare a supplemental pay?

To fill out prepare a supplemental pay, employers need to gather information on the additional compensation provided to the employee and accurately report it on the necessary forms.

What is the purpose of prepare a supplemental pay?

The purpose of prepare a supplemental pay is to ensure that any additional compensation received by an employee is properly documented and reported for tax and regulatory purposes.

What information must be reported on prepare a supplemental pay?

Information such as the amount of additional compensation, the reason for the supplemental pay, and any applicable taxes or deductions must be reported on prepare a supplemental pay.

Fill out your prepare a supplemental pay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Prepare A Supplemental Pay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.