Get the free PDS 401(K) PLAN FOR AVIATION EMPLOYEES

Show details

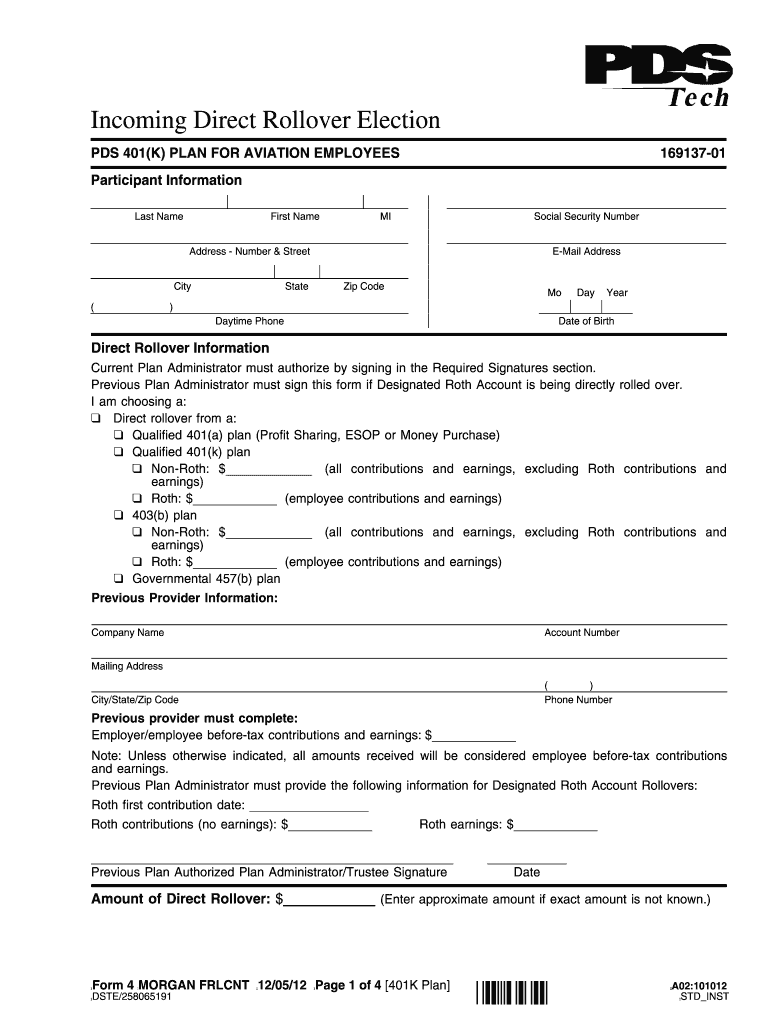

Incoming Direct Rollover Election PDS 401(K) PLAN FOR AVIATION EMPLOYEES Participant Information Direct Rollover Information 16913701 Current Plan Administrator must authorize by signing in the Required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pds 401k plan for

Edit your pds 401k plan for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pds 401k plan for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pds 401k plan for online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pds 401k plan for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pds 401k plan for

How to fill out a PDS 401k plan:

01

Begin by gathering all the necessary information and documents, such as your Social Security number, employment details, and beneficiary information. These details will be required to complete the enrollment process.

02

Read through the PDS 401k plan documentation carefully. Understand the terms, conditions, and key features of the plan, including contribution limits, investment options, and any matching contributions from your employer.

03

Evaluate your financial situation and set clear goals for your retirement savings. Determine how much you can comfortably contribute to your 401k plan each pay period.

04

Contact your employer's HR department or the plan administrator to obtain the necessary enrollment forms. These forms may be available online or in paper format.

05

Fill out the enrollment forms accurately and legibly. Provide all the required information, including your personal details, contribution percentage, beneficiary designation, and investment selections.

06

If you have any questions or are unsure about certain sections of the enrollment forms, reach out to your HR department or plan administrator for assistance. It's crucial to ensure that you fully understand the implications and choices associated with your 401k plan.

07

Double-check the information you have provided on the forms to ensure its accuracy. Mistakes or incomplete information may delay the enrollment process or cause issues in the future.

08

Sign and date the enrollment forms as required. Additionally, if there are any sections that require a witness or notary, make sure to comply with those requirements.

09

Submit the completed enrollment forms to your HR department or plan administrator by the specified deadline. Keep a copy of the forms for your records.

10

Review your first paycheck after enrolling in the PDS 401k plan to ensure that your contributions are being deducted correctly. If you notice any discrepancies, contact the appropriate department immediately to rectify the issue.

Who needs a PDS 401k plan?

01

Employees: The PDS 401k plan is primarily designed for employees who want to save for retirement in a tax-advantaged manner. Regardless of age or income level, individuals who wish to start building a nest egg for their future can benefit from a 401k plan.

02

Self-employed individuals: If you are self-employed or a small business owner, you can also establish a PDS 401k plan for yourself. This allows you to save for retirement while taking advantage of the tax benefits associated with 401k plans.

03

Job changers: When transitioning from one job to another, individuals often have the option to roll over their previous employer's 401k plan into a PDS 401k plan. This helps consolidate retirement savings and provides more control over investment choices.

04

Those seeking tax advantages: Contributions to a traditional PDS 401k plan are made pre-tax, reducing your taxable income for the year. This can potentially lower your tax liability and provide yearly tax savings.

05

Individuals seeking employer matching contributions: Many employers offer matching contributions to employees who contribute to their 401k plans. These matching contributions can significantly boost your retirement savings. Therefore, individuals looking to take advantage of employer matches should consider enrolling in a PDS 401k plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pds 401k plan for for eSignature?

Once your pds 401k plan for is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete pds 401k plan for online?

pdfFiller makes it easy to finish and sign pds 401k plan for online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my pds 401k plan for in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your pds 401k plan for and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is pds 401k plan for?

The pds 401k plan is designed to help individuals save for retirement by allowing them to contribute a portion of their salary to a retirement account.

Who is required to file pds 401k plan for?

Employers who offer a 401k plan to their employees are required to file the pds 401k plan on behalf of their employees.

How to fill out pds 401k plan for?

To fill out the pds 401k plan, employers need to gather information about employee contributions, investment options, and other relevant details. They then need to submit this information to the appropriate regulatory authority.

What is the purpose of pds 401k plan for?

The purpose of the pds 401k plan is to help employees save for retirement in a tax-advantaged manner.

What information must be reported on pds 401k plan for?

The pds 401k plan must report information about employee contributions, employer contributions, investment performance, fees, and other relevant details.

Fill out your pds 401k plan for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pds 401k Plan For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.