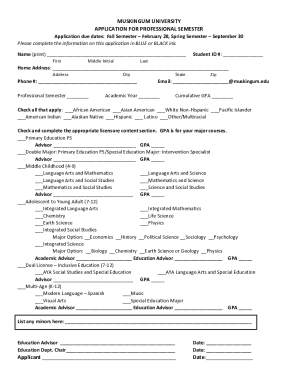

Get the free Tax Relief Programs - Weber County - co weber ut

Show details

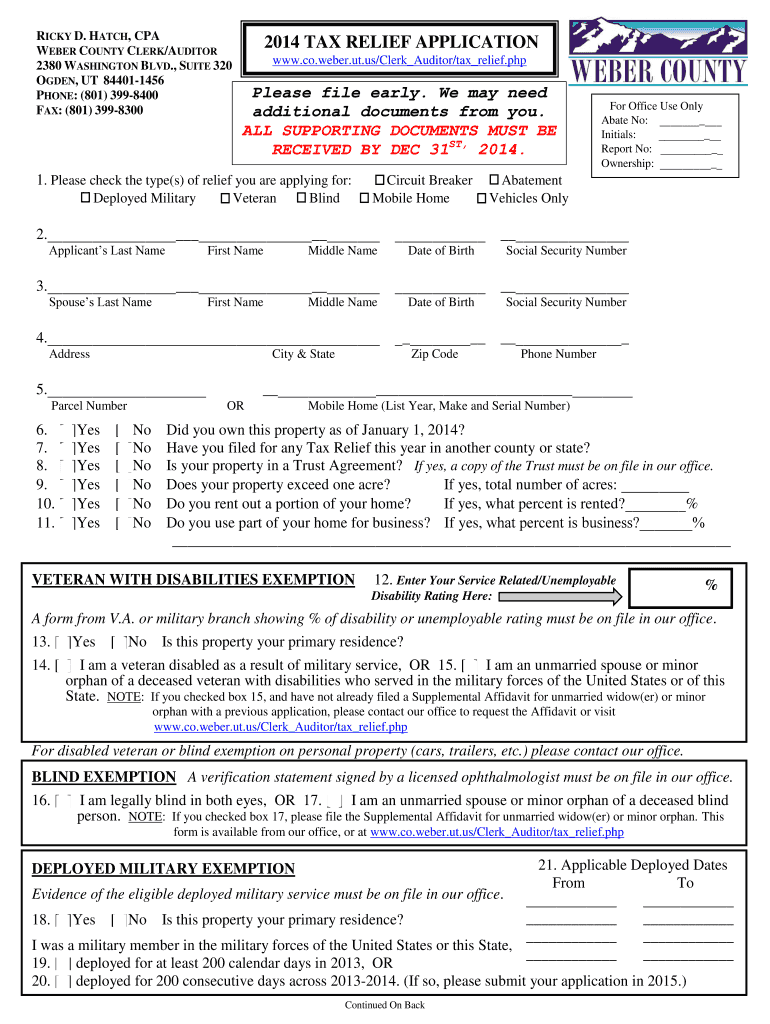

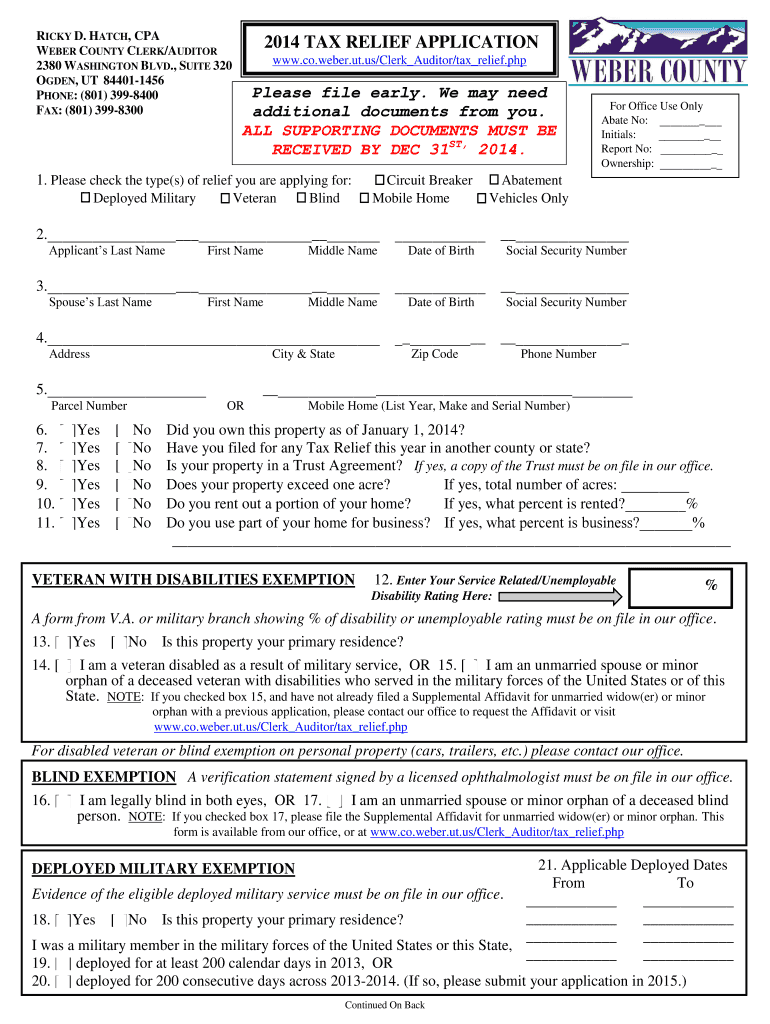

20. deployed for 200 consecutive days across 2013-2014. (If so, please submit your application in 2015.) 21. Applicable Deployed Dates.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax relief programs

Edit your tax relief programs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax relief programs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax relief programs online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax relief programs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax relief programs

How to fill out tax relief programs?

01

Gather all necessary documentation such as income statements, tax returns, and any relevant financial documents.

02

Research the specific tax relief program you are applying for to understand its eligibility requirements and application process.

03

Fill out the application form accurately, providing all the requested information and supporting documentation as required.

04

Double-check your application for any errors or missing information before submitting it.

05

Submit your completed application along with any required fees or additional documents either online or by mail, following the instructions provided by the tax relief program.

06

Keep copies of all the documents you submit for your records.

07

Wait for a response from the tax relief program. This may take some time, so be patient.

08

If your application is approved, carefully review any terms or conditions that come with the tax relief program.

09

Comply with all requirements and deadlines set by the tax relief program, such as regularly submitting updated financial information or attending mandatory workshops.

10

If your application is denied, review the reason provided and consider seeking professional advice or appealing the decision, if possible.

Who needs tax relief programs?

01

Individuals or families facing financial hardship or difficulty in paying their taxes may need tax relief programs.

02

Businesses or self-employed individuals who are struggling financially due to economic factors or unforeseen circumstances may also require tax relief programs.

03

Taxpayers who qualify for certain deductions, credits, or exemptions but are unsure of how to navigate the complex tax system could benefit from tax relief programs.

04

Individuals or businesses with significant tax debts may find tax relief programs helpful in reducing or eliminating their tax liabilities.

05

Taxpayers who have experienced a natural disaster or other catastrophic event that has resulted in financial loss may be eligible for tax relief programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax relief programs online?

pdfFiller has made it easy to fill out and sign tax relief programs. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in tax relief programs?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your tax relief programs and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete tax relief programs on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your tax relief programs. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is tax relief programs?

Tax relief programs are initiatives implemented by governments to provide taxpayers with incentives or benefits to reduce their tax burden.

Who is required to file tax relief programs?

Taxpayers who meet certain criteria or conditions set by the government may be required to file tax relief programs.

How to fill out tax relief programs?

Taxpayers can fill out tax relief programs by providing accurate information about their income, expenses, and any deductions or credits they may be eligible for.

What is the purpose of tax relief programs?

The purpose of tax relief programs is to help individuals and businesses reduce the amount of taxes they owe and to stimulate economic growth.

What information must be reported on tax relief programs?

Taxpayers must report their income, expenses, deductions, credits, and any other relevant financial information on tax relief programs.

Fill out your tax relief programs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Relief Programs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.