Get the free HOME EQUITY LINE OF CREDIT (HELOC) - Denali State Bank

Show details

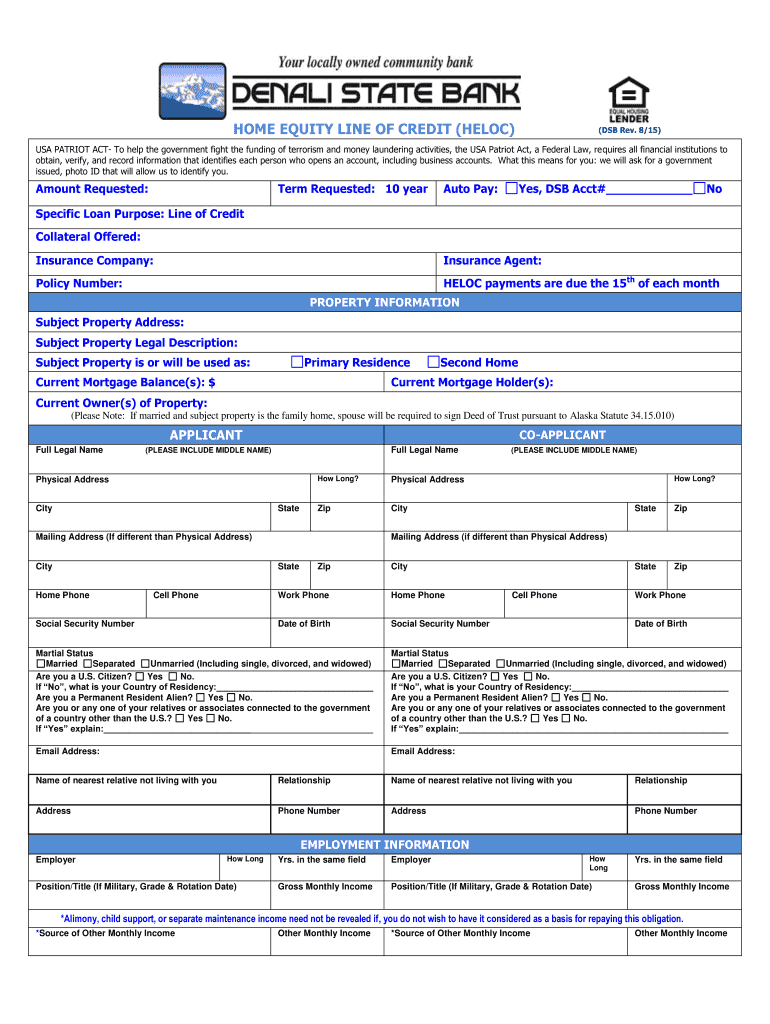

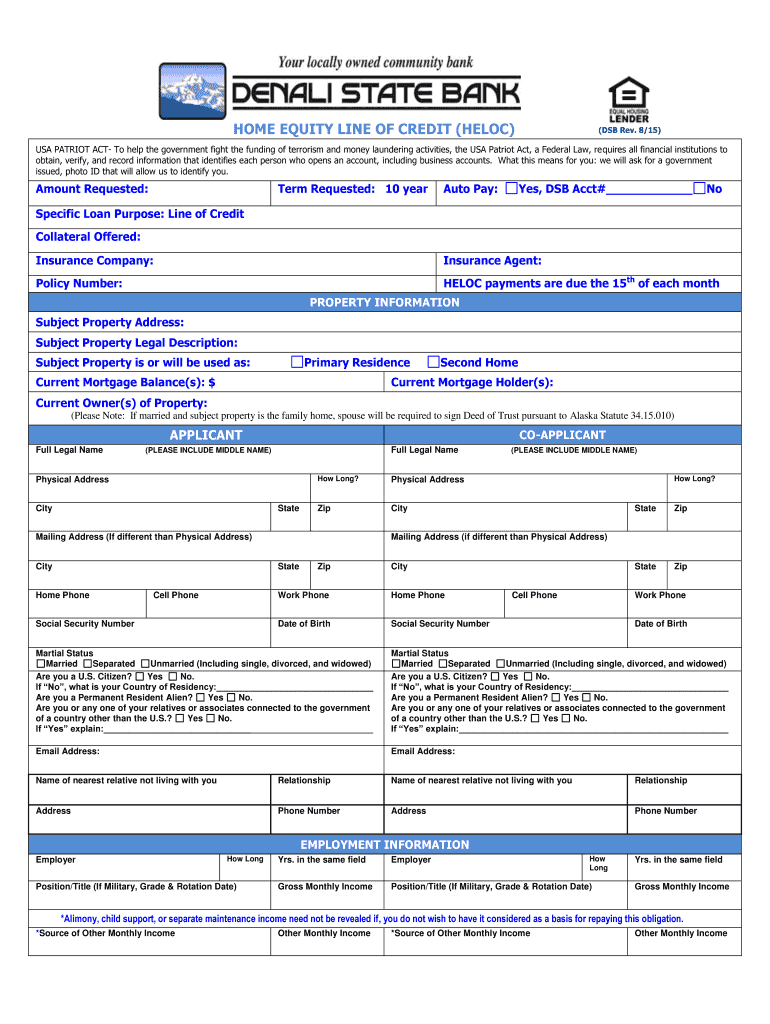

HOME EQUITY LINE OF CREDIT (HELOT) (DSB Rev. 8/15) USA PATRIOT ACT To help the government fight the funding of terrorism and money laundering activities, the USA Patriot Act, a Federal Law, requires

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home equity line of

Edit your home equity line of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home equity line of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home equity line of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit home equity line of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home equity line of

How to fill out a home equity line of:

Gather necessary documents:

01

Identification proof (such as a driver's license or passport)

02

Proof of income (pay stubs or tax returns)

03

Mortgage statement or deed of trust

04

Current property value estimate

05

Credit reports from all three major credit reporting agencies

06

Property insurance information

Research and choose a lender:

01

Compare interest rates, fees, and repayment terms from different lenders

02

Look for lenders with good customer reviews and a strong reputation

03

Consider the lender's eligibility requirements and closing timeline

Start the application process:

01

Contact the chosen lender to initiate the application

02

Complete the necessary forms and provide accurate information

03

Submit all required documents and disclosures promptly

Undergo a financial assessment:

01

The lender will review your income, debts, and credit history to determine your eligibility

02

They may request additional documentation or clarification during this stage

03

Be prepared to answer any questions about your financial situation

Appraisal and verification:

01

The lender may order an appraisal to determine the current value of your property

02

They will verify the details provided in the application, such as income and employment

Await approval and receive the terms:

01

Once the lender has reviewed all the information, they will make a decision on your application

02

If approved, you will receive the terms and conditions of the home equity line of credit

03

Take the time to carefully review the terms before proceeding

Signing the agreement:

01

If you agree with the terms, sign and return the agreement to the lender

02

Be sure to understand the repayment schedule, interest rates, and any fees associated with the line of credit

Who needs a home equity line of:

01

Homeowners who want to access the equity in their property without refinancing or selling

02

Individuals looking for funds to finance home improvements, education expenses, or debt consolidation

03

Those with a stable income and good credit history may find a home equity line of credit beneficial

04

It can be an alternative to traditional loans with potentially lower interest rates and tax-deductible interest payments

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my home equity line of in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your home equity line of right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out home equity line of using my mobile device?

Use the pdfFiller mobile app to fill out and sign home equity line of on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit home equity line of on an Android device?

With the pdfFiller Android app, you can edit, sign, and share home equity line of on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is home equity line of?

A home equity line of credit, also known as a HELOC, is a type of loan that allows homeowners to borrow against the equity in their home.

Who is required to file home equity line of?

Homeowners who have a HELOC are required to file the necessary paperwork with their lender.

How to fill out home equity line of?

To fill out a HELOC, homeowners must provide information about their income, assets, debts, and the value of their home.

What is the purpose of home equity line of?

The purpose of a HELOC is to give homeowners access to funds based on the equity they have built up in their home.

What information must be reported on home equity line of?

Homeowners must report their income, assets, debts, and the value of their home when applying for a HELOC.

Fill out your home equity line of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Equity Line Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.