Get the free CHIEF CREDIT OFFICER JOB DESCRIPTION - Community Bank

Show details

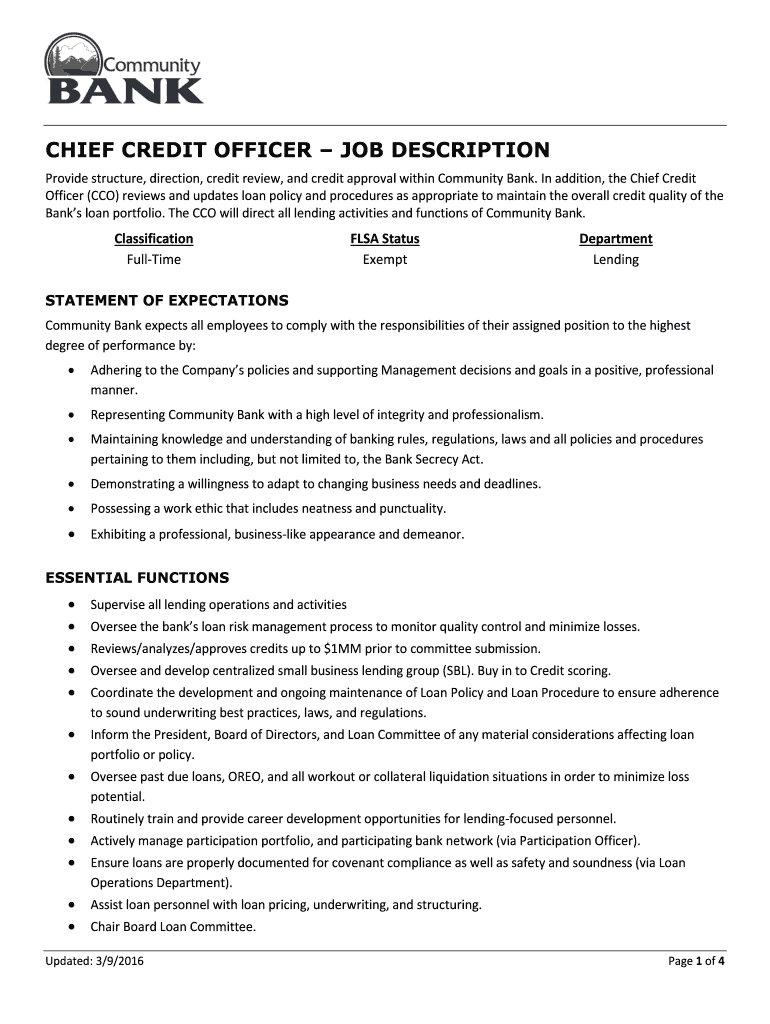

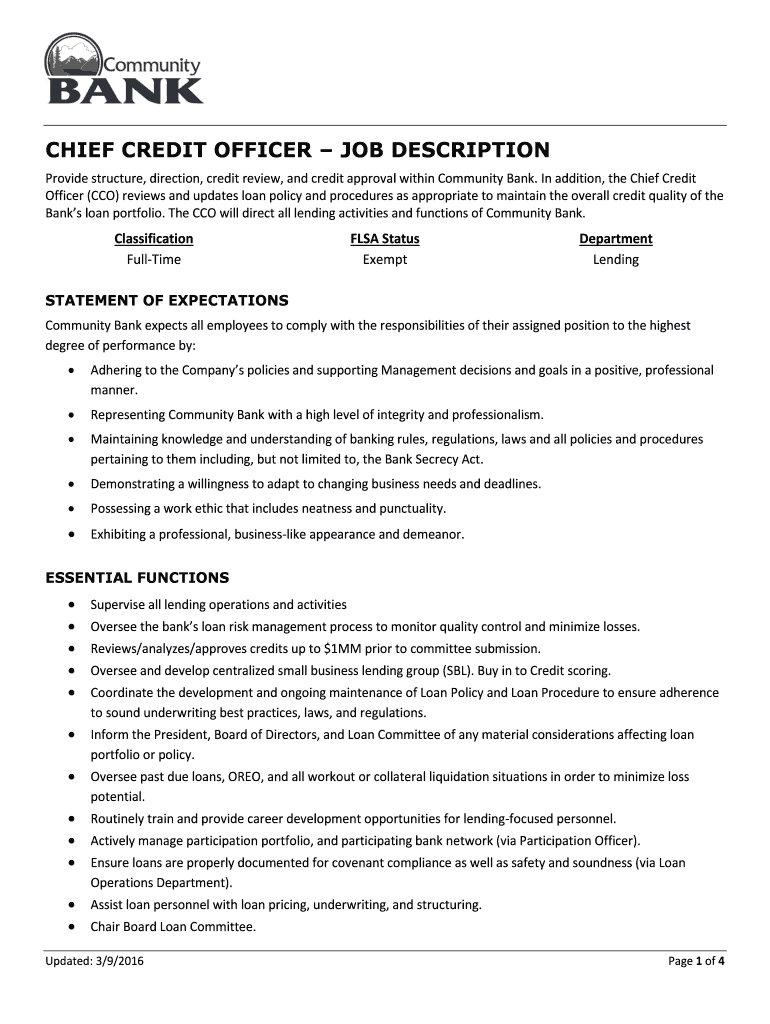

CHIEF CREDIT OFFICER JOB DESCRIPTION Provide structure, direction, credit review, and credit approval within Community Bank. In addition, the Chief Credit Officer (CCO) reviews and updates loan policy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chief credit officer job

Edit your chief credit officer job form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chief credit officer job form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chief credit officer job online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit chief credit officer job. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chief credit officer job

How to fill out chief credit officer job?

01

Research the role: Familiarize yourself with the responsibilities, qualifications, and requirements of a chief credit officer. Understand the key tasks such as managing credit risk, developing credit policies, and overseeing loan approvals.

02

Tailor your resume: Highlight relevant experience in credit risk management, lending operations, or financial analysis. Emphasize leadership skills, strategic thinking, and expertise in credit evaluation and decision-making.

03

Showcase your qualifications: Include certifications such as Certified Credit Executive (CCE) or Chartered Financial Analyst (CFA). Demonstrate proficiency in credit analysis software, financial modeling techniques, and regulatory compliance.

04

Highlight achievements: Discuss successful credit management projects, the implementation of effective risk mitigation strategies, or improvements in loan portfolio performance. Quantify results whenever possible.

05

Prepare for interviews: Research the company's credit policies, organizational structure, and industry trends. Be ready to discuss your approach to credit risk assessment, collaboration with stakeholders, and management of credit teams.

06

Communicate effectively: Display strong oral and written communication skills, as a chief credit officer must interact with various internal and external stakeholders. The ability to present complex credit information in a clear and concise manner is crucial.

07

Demonstrate leadership qualities: Showcase your ability to lead a credit team, develop credit strategies, and make informed decisions. Illustrate past experiences of managing and mentoring staff to achieve desired results.

08

Stay updated: Keep abreast of industry regulations, changes in credit standards, and emerging trends in credit risk management. Demonstrate a commitment to continuous learning and professional development.

Who needs chief credit officer job?

01

Financial institutions: Banks, credit unions, and other lending institutions rely on chief credit officers to manage credit portfolios, assess creditworthiness, and mitigate credit risk.

02

Corporations: Large corporations with extensive credit operations, such as retail or manufacturing companies, often recruit chief credit officers to oversee credit policies, manage collections, and ensure payment compliance.

03

Insurance companies: Insurance firms require chief credit officers to evaluate creditworthiness of policyholders, manage investments, and minimize potential credit losses.

04

Government agencies: Some government agencies involved in providing loans or grants to businesses or individuals also require chief credit officers to mitigate risks and monitor creditworthiness.

05

Consulting firms: Consulting firms specializing in financial risk management or credit advisory may have a need for chief credit officers to provide expertise and guidance to clients.

06

Fintech companies: As the financial technology sector grows, fintech firms offering various lending services also seek chief credit officers to develop credit strategies, establish risk assessment methodologies, and ensure compliance.

Note: The content provided here is for informational purposes only and should not be considered as professional or legal advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send chief credit officer job for eSignature?

To distribute your chief credit officer job, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit chief credit officer job in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing chief credit officer job and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit chief credit officer job straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing chief credit officer job, you need to install and log in to the app.

What is chief credit officer job?

The Chief Credit Officer is responsible for overseeing the credit risk management function within an organization.

Who is required to file chief credit officer job?

Chief Credit Officers or individuals in similar roles within financial institutions are required to file Chief Credit Officer job.

How to fill out chief credit officer job?

To fill out the Chief Credit Officer job, individuals must provide information on their credit risk management strategies, policies, and performance.

What is the purpose of chief credit officer job?

The purpose of the Chief Credit Officer job is to ensure that the organization's credit risk is effectively managed and in compliance with regulatory requirements.

What information must be reported on chief credit officer job?

Information such as credit risk policies, credit risk assessments, and credit risk mitigation strategies must be reported on the Chief Credit Officer job.

Fill out your chief credit officer job online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chief Credit Officer Job is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.