Get the free Petty Cash Form - Columbia Nano Initiative - Columbia University - nano columbia

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petty cash form

Edit your petty cash form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petty cash form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing petty cash form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit petty cash form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petty cash form

How to fill out petty cash form:

01

Enter the date: Start by inputting the date of the transaction on the petty cash form. This helps track when the cash was used.

02

Write the purpose: Specify the reason for using petty cash. Whether it's for office supplies, meal reimbursements, or miscellaneous expenses, clearly state the purpose on the form.

03

Provide the amount: Indicate the exact amount of money taken from the petty cash fund. It's important to be accurate and detailed to ensure proper record-keeping.

04

Document the recipient: Record the name of the person who is receiving the petty cash. This helps track who has the cash and who is responsible for it.

05

Provide details: Add a brief description or explanation of the expenses being reimbursed from petty cash. This provides clarity and transparency for auditing purposes.

06

Secure approvals: Obtain necessary approvals from supervisors or managers before submitting the petty cash form. This ensures that the expenses are authorized and within company guidelines.

07

Keep records: Make a copy of the completed petty cash form for your records. It's important to maintain a detailed trail of all petty cash transactions.

08

Return unused cash: If there is any unused cash, it should be returned to the petty cash fund along with the completed form. This keeps the cash readily available for other authorized expenses.

Who needs a petty cash form:

01

Small businesses: Petty cash forms are commonly used in small businesses where cash transactions may occur frequently and require immediate reimbursement.

02

Office administrators: Office administrators often utilize petty cash funds to cover small expenses and keep track of them through the use of petty cash forms.

03

Retail stores: Retail stores may use petty cash forms to handle cash transactions, such as providing change for customers or reimbursing employees for small expenses during their shifts.

04

Non-profit organizations: Non-profit organizations often use petty cash funds to cover small expenses, such as office supplies or minor repairs, and require petty cash forms to track these transactions accurately.

05

Educational institutions: Schools and universities may use petty cash forms to handle various expenses, such as field trips, classroom supplies, or reimbursements for teachers.

06

Event organizers: Those organizing events, conferences, or workshops may use petty cash forms to manage small expenses that arise during the event, such as catering or transportation costs.

So, anyone who deals with small cash transactions or needs to track expenses for reimbursement can benefit from the use of a petty cash form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my petty cash form in Gmail?

petty cash form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send petty cash form to be eSigned by others?

Once your petty cash form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the petty cash form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your petty cash form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

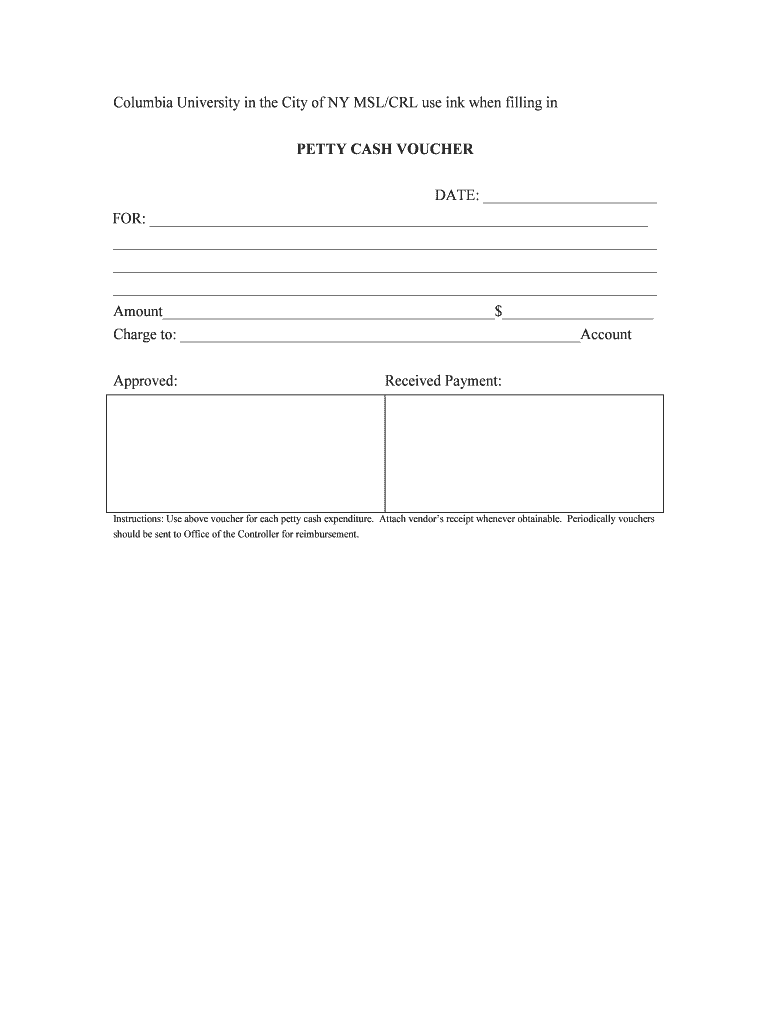

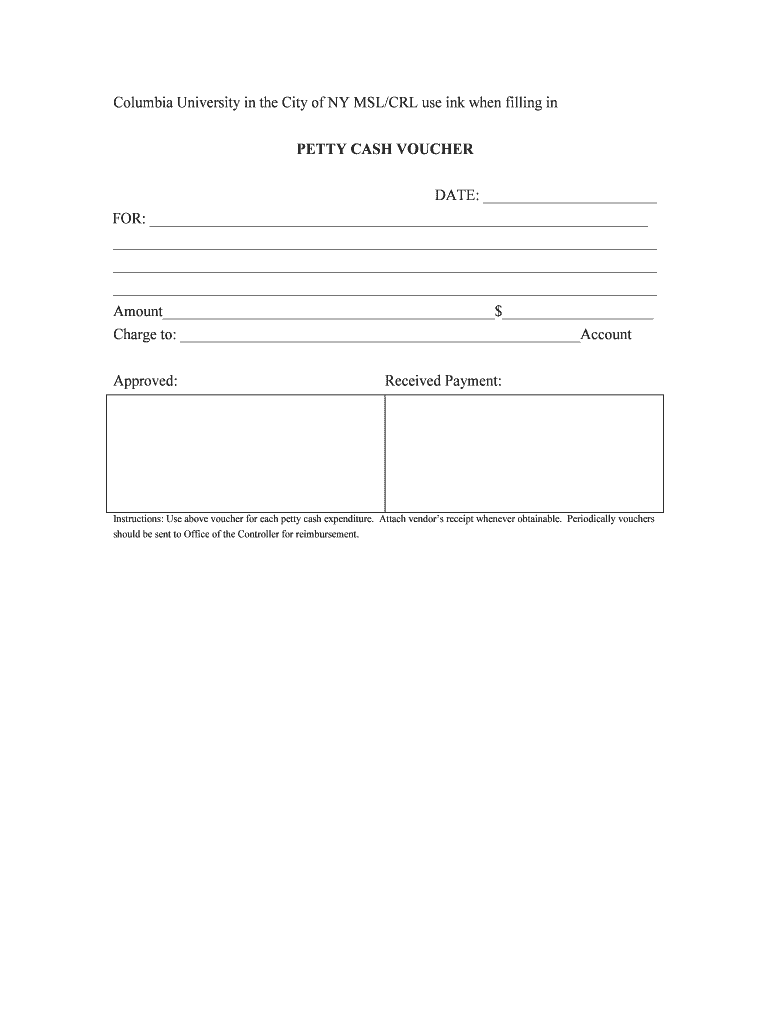

What is petty cash form?

Petty cash form is a document used to track small cash transactions within a business.

Who is required to file petty cash form?

Anyone who is responsible for managing petty cash funds within a company is required to file the petty cash form.

How to fill out petty cash form?

To fill out a petty cash form, one must record the date, amount, purpose, and recipient of each cash transaction.

What is the purpose of petty cash form?

The purpose of the petty cash form is to maintain a record of small cash expenditures and ensure accountability.

What information must be reported on petty cash form?

The petty cash form must include details such as date, amount, purpose, and recipient of each cash transaction.

Fill out your petty cash form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petty Cash Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.