Get the free Microbusiness Loan Application - louisvilleky

Show details

Advocacy and Empowerment Division Microbusiness Loan Application Louisville Metro Department of Community Services 810 Barrel Avenue Louisville, KY 40204 www.LouisvilleKy.gov/communityservices The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign microbusiness loan application

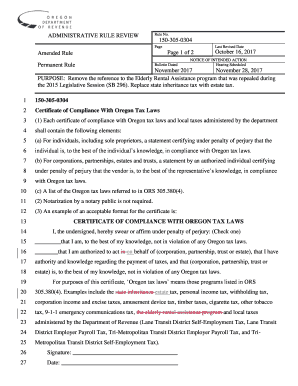

Edit your microbusiness loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your microbusiness loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

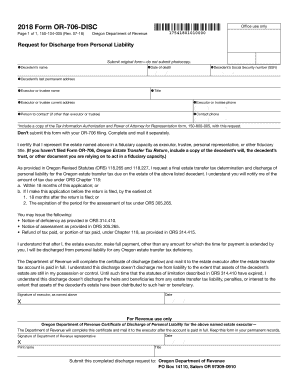

Editing microbusiness loan application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit microbusiness loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

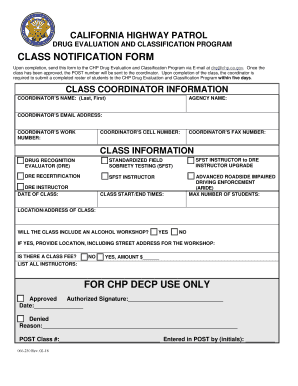

How to fill out microbusiness loan application

How to fill out a microbusiness loan application:

01

Gather all necessary documents: Before starting the application, make sure you have all the required documents such as financial statements, tax returns, business plan, personal identification, and any other relevant paperwork. Check the specific requirements of the lender to ensure you have everything in order.

02

Research different lenders: Not all lenders offer microbusiness loans, so it's important to research and find ones that specialize in this type of financing. Look for lenders that have experience working with small businesses and understand the unique challenges they face.

03

Understand the application process: Familiarize yourself with the application process before starting. Read through the instructions provided by the lender and make note of any specific requirements or forms that need to be completed.

04

Complete the personal information section: Start by filling out your personal information accurately and completely. This includes your full name, contact information, social security number, date of birth, and any other requested details. Double-check for any errors or missing information.

05

Provide business details: Provide detailed information about your business, such as its legal structure, industry, location, years in operation, and number of employees. Include a brief overview of your products or services and explain your business goals and plans for growth.

06

Include financial information: Prepare your financial statements, including income statements, balance sheets, and cash flow statements. These documents should accurately reflect your business's financial health and provide lenders with a clear picture of your ability to repay the loan.

07

Write a comprehensive business plan: A business plan is crucial to any loan application. It should outline your business's mission, target market, competition analysis, marketing strategies, and financial projections. Be sure to include details about how the loan will be used and how it will benefit your business.

08

Provide collateral and personal guarantee: Depending on the lender, you may be required to offer collateral or a personal guarantee to secure the loan. Prepare any necessary documentation regarding the assets you are willing to pledge or any personal assets that can serve as a guarantee.

09

Submit the application: Carefully review your application for accuracy and completeness before submitting it to the lender. Attach all the necessary documents as requested. Keep copies of everything for your records.

Who needs a microbusiness loan application?

01

Small business owners looking to start or expand their businesses: A microbusiness loan application is necessary for entrepreneurs who require financing to start a new business venture or expand an existing one. It allows them to access the necessary funds to purchase equipment, hire employees, increase inventory, or invest in marketing, among other things.

02

Individuals with limited financial resources: Microbusiness loans are often sought by individuals who lack substantial personal savings or cannot secure financing from traditional sources due to strict requirements or credit history limitations. These loans provide an opportunity for individuals with limited financial resources to access capital and achieve their business goals.

03

Entrepreneurs seeking specialized funding for their niche businesses: Some entrepreneurs have unique business ideas or operate within specific industries that may not be as appealing to traditional lenders. A microbusiness loan application allows these individuals to find lenders who specialize in their particular niche and understand their business model, increasing their chances of securing financing.

04

Small businesses facing challenging economic conditions: Microbusiness loans can be a lifeline for small businesses struggling to navigate challenging economic conditions. Whether it's surviving a recession, recovering from a natural disaster, or adapting to a changing market, these loans can provide the financial support needed to keep the business afloat and implement necessary changes for long-term sustainability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the microbusiness loan application electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your microbusiness loan application in seconds.

How do I fill out microbusiness loan application using my mobile device?

Use the pdfFiller mobile app to fill out and sign microbusiness loan application on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I fill out microbusiness loan application on an Android device?

Use the pdfFiller mobile app to complete your microbusiness loan application on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

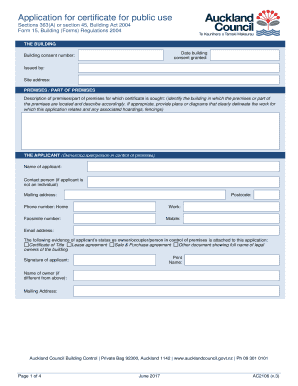

What is microbusiness loan application?

A microbusiness loan application is a formal request for financial assistance specifically designed for small businesses with fewer than a certain number of employees.

Who is required to file microbusiness loan application?

Small business owners or entrepreneurs who meet the eligibility criteria are required to file a microbusiness loan application.

How to fill out microbusiness loan application?

To fill out a microbusiness loan application, applicants can usually do so online or in person by providing all required information and supporting documents.

What is the purpose of microbusiness loan application?

The purpose of a microbusiness loan application is to request funding to support and grow a small business, typically for expenses such as inventory, equipment, or expansion.

What information must be reported on microbusiness loan application?

Information required on a microbusiness loan application may include business details, financial statements, credit history, and a business plan.

Fill out your microbusiness loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Microbusiness Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.