Get the free Australian Charities and Not-for-profit Commission - NSW Fair Trading - fairtrading ...

Show details

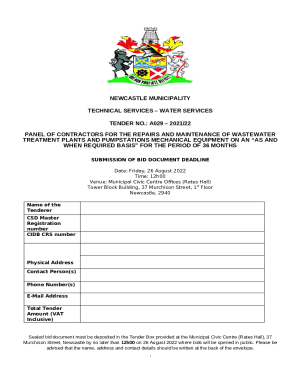

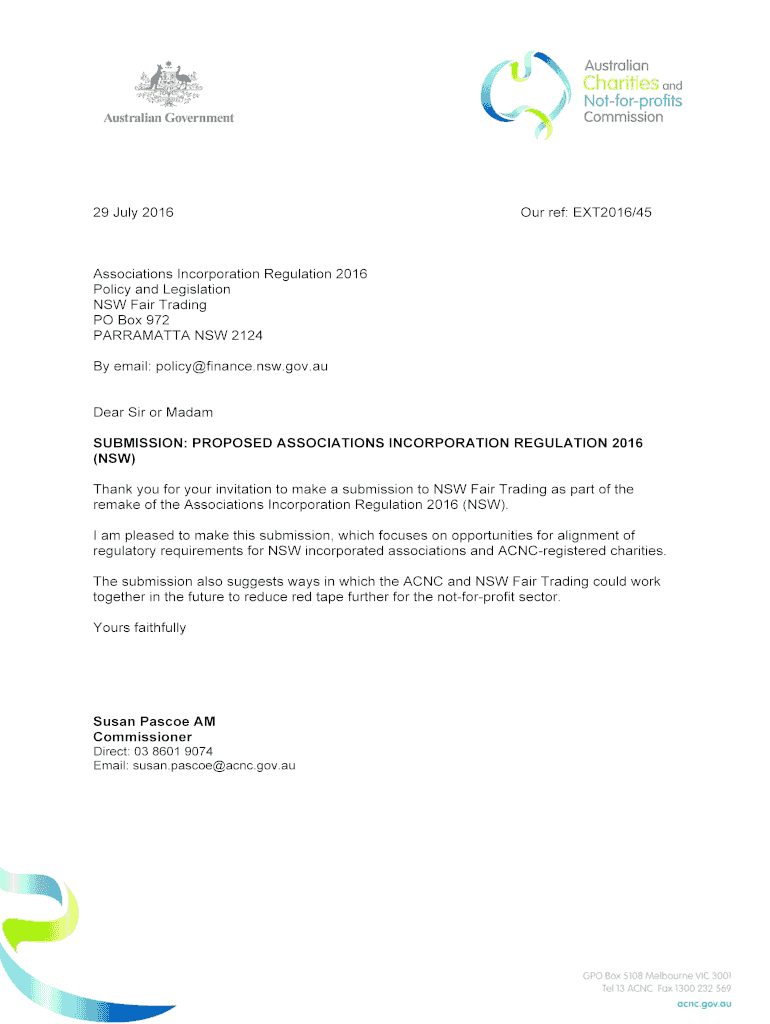

29 July 2016 Our ref: EXT2016/45 Associations Incorporation Regulation 2016 Policy and Legislation NSW Fair Trading PO Box 972 PARRAMATTA NSW 2124 By email: policy finance.NSW.gov.AU Dear Sir or Madam

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign australian charities and not-for-profit

Edit your australian charities and not-for-profit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australian charities and not-for-profit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing australian charities and not-for-profit online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit australian charities and not-for-profit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out australian charities and not-for-profit

How to fill out Australian charities and not-for-profit:

01

Research and understand the requirements: Before starting the application process, it is crucial to thoroughly research the guidelines and requirements set by the Australian government for charities and not-for-profit organizations. Familiarize yourself with the legal obligations, reporting requirements, and eligibility criteria.

02

Gather necessary documentation: To complete the application, you will typically need to provide various documents, including the organization's constitution, financial statements, governing documents, and details of the board members. Make sure you have all the required paperwork ready and organized.

03

Complete the application form: The Australian Charities and Not-for-profits Commission (ACNC) provides an application form that needs to be completed accurately and comprehensively. Carefully read through the form, providing all the necessary information about your organization, its purpose, activities, and finances. Avoid missing any sections or leaving out relevant details.

04

Prepare financial statements: Financial transparency is crucial for charities and not-for-profit organizations. Ensure that your financial statements are up-to-date and comply with accounting standards specified by the ACNC. These statements should clearly outline your organization's income, expenses, assets, and liabilities.

05

Seek professional assistance if needed: If you find the process overwhelming or complex, consider seeking professional help. Accountants, consultants, or legal advisors experienced in dealing with charities and not-for-profit organizations can provide guidance and support throughout the application process.

Who needs Australian charities and not-for-profit?

01

Non-profit organizations: Australian charities and not-for-profit registration is primarily aimed at non-profit organizations that operate for the public benefit. These can include community groups, religious organizations, educational institutions, healthcare services, and more.

02

Individuals with a charitable purpose: Individuals conducting activities with a charitable purpose, such as helping the disadvantaged or advancing the public's welfare, may also need to register their organization as an Australian charity or not-for-profit.

03

Organizations seeking tax-deductible status: Registering as an Australian charity or not-for-profit can provide the opportunity to obtain tax-deductible status. This is attractive to individuals and organizations looking to provide tax benefits to their donors or access government grants available exclusively to registered charities.

04

Entities seeking transparency and credibility: Becoming registered as an Australian charity or not-for-profit demonstrates a commitment to transparency, accountability, and adherence to good governance. Many donors and supporters prefer to contribute to organizations that are registered and regulated by the ACNC, as it enhances credibility and ensures funds are used appropriately.

In conclusion, filling out Australian charities and not-for-profit requires research, organization, and attention to detail. It is essential for non-profit organizations, individuals with a charitable purpose, those seeking tax-deductible status, and entities aiming to enhance transparency and credibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute australian charities and not-for-profit online?

pdfFiller has made filling out and eSigning australian charities and not-for-profit easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the australian charities and not-for-profit electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your australian charities and not-for-profit in seconds.

How do I complete australian charities and not-for-profit on an Android device?

On an Android device, use the pdfFiller mobile app to finish your australian charities and not-for-profit. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is australian charities and not-for-profit?

Australian charities and not-for-profits are organizations that operate for the benefit of the community and do not distribute any profits to members.

Who is required to file australian charities and not-for-profit?

Australian charities and not-for-profits are required to file their annual reports with the Australian Charities and Not-for-profits Commission (ACNC).

How to fill out australian charities and not-for-profit?

To fill out the annual report for Australian charities and not-for-profits, organizations must provide detailed information about their activities, finances, and governance.

What is the purpose of australian charities and not-for-profit?

The purpose of Australian charities and not-for-profits is to provide services and support to the community without seeking to make a profit for their members or shareholders.

What information must be reported on australian charities and not-for-profit?

Australian charities and not-for-profits must report on their activities, finances, governance structure, and any changes to their organization during the reporting period.

Fill out your australian charities and not-for-profit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Australian Charities And Not-For-Profit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.