Get the free ESTATE PLANNING WITH ANNUITIES & FINANCIAL PRODUCTS (60 ... - vtbar

Show details

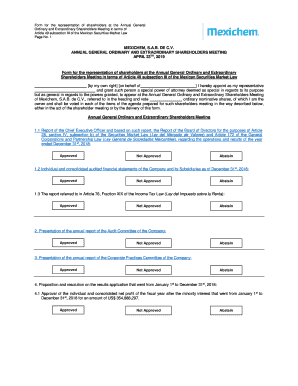

ESTATE PLANNING WITH ANNUITIES & FINANCIAL PRODUCTS First Run Broadcast: August 11, 2015 1:00 p.m. E.T./12:00 p.m. C.T./11:00 a.m. M.T./10:00 a.m. P.T. (60 minutes) Estate planning and complex financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate planning with annuities

Edit your estate planning with annuities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate planning with annuities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate planning with annuities online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit estate planning with annuities. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate planning with annuities

How to fill out estate planning with annuities:

01

Determine your financial goals: Begin by clarifying your financial goals and objectives. Identify what you want to achieve with your estate planning and how annuities can help you meet those goals. This could include providing income for retirement, ensuring a legacy for your heirs, or maximizing tax benefits.

02

Assess your current financial situation: Evaluate your current financial situation, including your assets, liabilities, and income sources. Consider any existing estate plans or insurance policies that you have in place. This will help you determine the appropriate annuity products to include in your estate plan.

03

Consult with a financial advisor or estate planning attorney: Seek expert advice from a qualified financial advisor or estate planning attorney who specializes in annuities. They can guide you through the process, explain different annuity options, and make recommendations based on your unique circumstances.

04

Choose the right annuity products: Select the annuity products that best align with your financial goals and risk tolerance. There are different types of annuities available, including fixed annuities, variable annuities, and indexed annuities. Consider factors such as guaranteed income, investment growth potential, and liquidity when making your decision.

05

Designate beneficiaries: Determine who you want to include as beneficiaries in your annuity contracts. This ensures that your assets will be passed on according to your wishes and can help minimize probate costs and delays.

06

Review and update regularly: Estate planning with annuities is not a one-time event. It is important to review and update your plan periodically to ensure it remains aligned with your financial goals and any changes in your personal circumstances or tax laws.

Who needs estate planning with annuities?

01

Individuals looking for guaranteed income in retirement: Annuities can provide a steady stream of income for life or a specified period, making them valuable for those who want to secure their financial future during retirement.

02

Individuals with significant assets to pass on: Estate planning with annuities can help individuals with substantial assets efficiently transfer wealth to their heirs while potentially minimizing taxes and avoiding probate.

03

Individuals seeking tax advantages: Certain types of annuities offer tax-deferred growth, which can be advantageous for individuals looking to minimize their tax liability and potentially reduce their overall estate taxes.

04

Individuals concerned about market volatility: Annuities can offer stability and protection against market downturns, making them attractive to individuals who want to safeguard their investments from market fluctuations.

05

Individuals looking for a legacy: Estate planning with annuities allows individuals to leave a lasting legacy by designating beneficiaries who will receive the annuity proceeds after their passing. This can provide financial security for loved ones or support charitable causes.

Remember, it is crucial to consult with a professional advisor who can assess your specific situation and provide personalized recommendations for estate planning with annuities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get estate planning with annuities?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific estate planning with annuities and other forms. Find the template you need and change it using powerful tools.

How do I fill out the estate planning with annuities form on my smartphone?

Use the pdfFiller mobile app to fill out and sign estate planning with annuities on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit estate planning with annuities on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign estate planning with annuities. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is estate planning with annuities?

Estate planning with annuities involves using annuities as part of a strategy to plan for the distribution of assets upon death.

Who is required to file estate planning with annuities?

Individuals who own annuities as part of their estate plan may be required to file estate planning with annuities.

How to fill out estate planning with annuities?

To fill out estate planning with annuities, individuals may need to provide details about their annuity contracts, beneficiaries, and distribution preferences.

What is the purpose of estate planning with annuities?

The purpose of estate planning with annuities is to ensure that assets held in annuities are properly distributed according to the individual's wishes upon death.

What information must be reported on estate planning with annuities?

Information such as the value of the annuity, beneficiaries, and any specific distribution instructions may need to be reported on estate planning with annuities.

Fill out your estate planning with annuities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Planning With Annuities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.