Kansas law provides a form with which a subcontractor may claim a lien for labor and/or materials provided to new residential property. This Notice of Intent to Provide is filed in the office of the clerk of the district court of the county where the property is located. After the lien claimant is paid in full, the lien claimant is required to also file a form releasing the previous Notice and waiving any lien.

Get the free Kansas Release of Notice and Waiver of Lien by Corporation

Show details

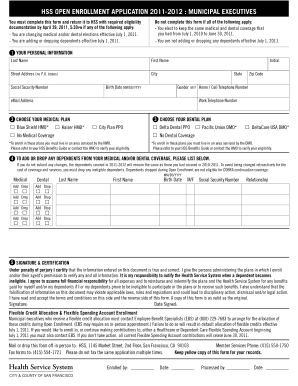

Prepared by, recording requested by and return to: Name: Company: Address: City: State: Phone: Fax: Zip: ----------------------Above this Line for Official Use Only--------------------- RELEASE OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kansas release of notice

Edit your kansas release of notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas release of notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kansas release of notice

How to fill out kansas release of notice:

01

Start by downloading the kansas release of notice form from a reliable source, such as the official website of the Kansas Department of Revenue.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Begin by providing your personal information, including your full name, address, and contact details.

04

If applicable, enter any business information, such as the name and address of your company.

05

Specify the type of tax that the release of notice relates to, such as income tax, sales tax, or property tax.

06

Enter the tax period or year to which the release of notice applies.

07

Provide the specific notice number or account number related to the tax notice that you are releasing.

08

Include a brief explanation or reason for releasing the notice, if required.

09

Sign and date the form, indicating that the information provided is true and accurate.

10

Determine whether any supporting documentation is required, such as a notarized signature or additional forms, and include them with the release of notice if necessary.

Who needs kansas release of notice?

01

Individuals who have received a tax notice from the Kansas Department of Revenue and wish to release it.

02

Business owners or representatives who have received a tax notice related to their company and want to release it.

03

Anyone who has resolved their tax obligations and wants to release any associated tax notices officially.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kansas release of notice?

Kansas release of notice is a form that is required to be filed with the Kansas Department of Revenue to release a lien on a particular property.

Who is required to file kansas release of notice?

Any individual or entity that has a lien on a property in Kansas is required to file a release of notice once the lien has been satisfied or released.

How to fill out kansas release of notice?

To fill out the Kansas release of notice form, you will need to provide information such as the property owner's name, property description, lienholder's information, and details of the lien. The form must be completed accurately and signed by the authorized party.

What is the purpose of kansas release of notice?

The purpose of the Kansas release of notice is to officially release a lien on a property, indicating that the debt has been paid or satisfied. This allows the property owner to clear the title and sell or transfer the property.

What information must be reported on kansas release of notice?

The Kansas release of notice form requires information such as the property owner's name, property description, lienholder's information, details of the lien, and the date the lien was satisfied or released.

Fill out your kansas release of notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Release Of Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.