Get the free additional individual account opening form - Access Bank

Show details

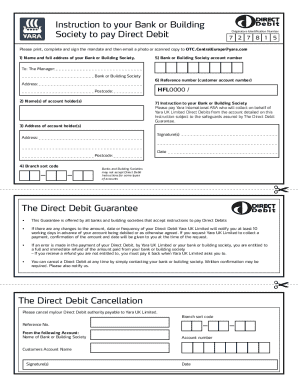

ADDITIONAL INDIVIDUAL ACCOUNT OPENING FORM Please tick to indicate your preference. Account Type Standard Current Account Solo Account Call Account Standard Savings Account Access Advantage (Individual)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign additional individual account opening

Edit your additional individual account opening form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your additional individual account opening form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing additional individual account opening online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit additional individual account opening. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out additional individual account opening

To fill out an additional individual account opening, follow these steps:

01

Begin by gathering all the necessary documents and information required for the account opening process. This may include identification proof, address proof, and other relevant documents as per the bank's requirements.

02

Visit the bank or financial institution where you wish to open the account. Approach the customer service desk or a bank representative to inquire about the specific procedures and forms needed for the additional individual account opening.

03

Fill out the account opening form accurately and completely. Provide your personal details, such as name, address, contact information, and any other requested information. Make sure to double-check the form for any errors or missing information before submitting it.

04

If required, submit the supporting documents along with the account opening form. This may include photocopies of identification proof, address proof, and any other relevant documents as specified by the bank.

05

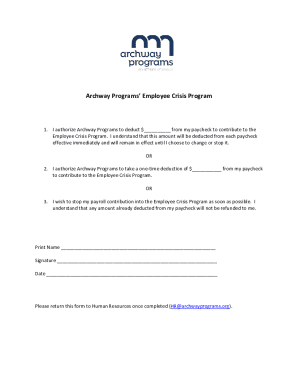

Review the terms and conditions associated with the account opening. Ensure that you understand the fee structure, minimum balance requirements, and any other relevant information before proceeding.

06

Sign the account opening form and any other necessary documents as indicated. Your signature serves as confirmation that all the information provided is true and accurate to the best of your knowledge.

07

Submit the completed account opening form and supporting documents to the bank representative. If there are any fees or initial deposit requirements, make sure to pay them at this time.

Who needs additional individual account opening?

Individuals who may require an additional individual account opening include:

01

Those who already have one account with a bank or financial institution but wish to open another account for a specific purpose. For example, they may want a separate account for savings, investments, or personal expenses.

02

Individuals who want to maintain separate accounts for different financial goals or to manage their finances more effectively. This can include individuals who want to segregate personal and business-related transactions, track specific expenses, or have better control over their finances.

03

Any individual who requires a new account due to a change in personal circumstances, such as marriage, relocation, or major life events. Opening a new account allows for a fresh start or for easier organization of financial matters.

04

Those who wish to take advantage of different account features or benefits offered by specific banks or financial institutions. This could include higher interest rates, special rewards programs, or tailored services based on individual needs or preferences.

Overall, the need for an additional individual account opening depends on personal requirements, financial goals, and the desire for flexibility and organization in managing finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my additional individual account opening directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your additional individual account opening and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send additional individual account opening to be eSigned by others?

To distribute your additional individual account opening, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get additional individual account opening?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific additional individual account opening and other forms. Find the template you need and change it using powerful tools.

What is additional individual account opening?

Additional individual account opening refers to the process of opening a new account for an individual who already has existing accounts within the same financial institution.

Who is required to file additional individual account opening?

Any individual who wishes to open a new account in addition to their existing accounts is required to file for additional individual account opening.

How to fill out additional individual account opening?

To fill out additional individual account opening, the individual must provide their personal information, such as name, address, identification documents, and any other required information by the financial institution.

What is the purpose of additional individual account opening?

The purpose of additional individual account opening is to allow individuals to diversify their accounts and access different financial products and services offered by the financial institution.

What information must be reported on additional individual account opening?

The information required to be reported on additional individual account opening includes personal details, identification documents, source of funds, and any other relevant information requested by the financial institution.

Fill out your additional individual account opening online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Additional Individual Account Opening is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.