Get the free Closing Disclosure document with your Loan...

Show details

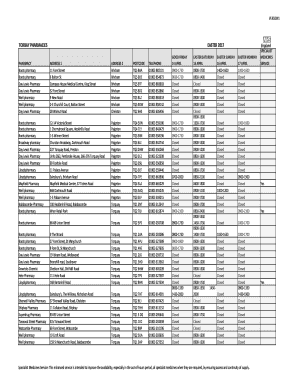

Page 1 This form is a statement of final loan terms and closing costs. Compare this document with your Loan Estimate. Closing Disclosure Closing Information Transaction Information Loan Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign closing disclosure document with

Edit your closing disclosure document with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your closing disclosure document with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing closing disclosure document with online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit closing disclosure document with. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out closing disclosure document with

Point by point guide on how to fill out closing disclosure document:

01

Obtain the closing disclosure form: The closing disclosure form is typically provided by the lender or mortgage company. Make sure you have the correct form and all the necessary pages.

02

Review the loan details: Check the loan amount, interest rate, and loan term mentioned in the document. Make sure they match the terms agreed upon in the loan agreement.

03

Verify the loan terms and fees: Look for any discrepancies in the loan terms and fees. Pay attention to items such as origination fees, appraisal fees, and prepaid interest. Ensure the amounts are accurate and in line with what you agreed upon.

04

Check the loan estimate and closing costs: Cross-reference the closing disclosure with the loan estimate document you received earlier. Verify that the closing costs and other fees mentioned in both documents align.

05

Review the loan summary: Evaluate the loan summary section carefully. It includes important details such as the total amount to be paid over the life of the loan, the estimated monthly payments, and the total amount due at closing. Ensure these figures are accurate.

06

Analyze the escrow account: If your loan involves an escrow account for property taxes and insurance, review the details provided. Double-check the projected payments and any required reserves.

07

Compare with previous versions: If you received an earlier version of the closing disclosure, compare it with the current one to identify any changes. Confirm that any modifications or adjustments are reasonable and have been appropriately explained.

08

Seek clarification if needed: If you come across any unfamiliar or confusing terms, fees, or numbers, don't hesitate to reach out to your lender for clarification. It's crucial to have a clear understanding of the document before signing.

Who needs closing disclosure document with?

01

Homebuyers: Closing disclosure documents are typically required for homebuyers who have obtained a mortgage loan to finance their home purchase. It provides a comprehensive breakdown of the loan terms, fees, and other crucial information.

02

Borrowers refinancing a mortgage: Individuals who are refinancing their existing mortgage also need a closing disclosure document. It outlines the terms and costs of the refinance loan, allowing borrowers to assess the overall impact and benefits of refinancing.

03

Lenders and mortgage companies: Lenders and mortgage companies must provide borrowers with a closing disclosure document to comply with the regulations set forth by the Consumer Financial Protection Bureau (CFPB). This document ensures transparency and helps borrowers make informed decisions about their loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute closing disclosure document with online?

Filling out and eSigning closing disclosure document with is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit closing disclosure document with online?

The editing procedure is simple with pdfFiller. Open your closing disclosure document with in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the closing disclosure document with form on my smartphone?

Use the pdfFiller mobile app to complete and sign closing disclosure document with on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is closing disclosure document with?

The closing disclosure document is a form that provides final details about the mortgage loan you have selected.

Who is required to file closing disclosure document with?

Lenders are required to provide the closing disclosure document to borrowers at least three business days before closing.

How to fill out closing disclosure document with?

To fill out the closing disclosure document, you will need to provide information about the loan terms, closing costs, and other details related to the mortgage.

What is the purpose of closing disclosure document with?

The purpose of the closing disclosure document is to help borrowers understand the terms of their mortgage loan and the costs associated with closing on the property.

What information must be reported on closing disclosure document with?

The closing disclosure document must include details such as the loan amount, interest rate, monthly payments, closing costs, and any other fees associated with the loan.

Fill out your closing disclosure document with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Closing Disclosure Document With is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.