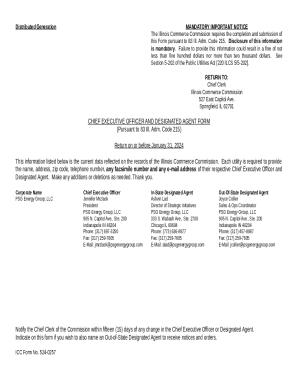

Get the free FAAA & MAAA rating affirmed

Show details

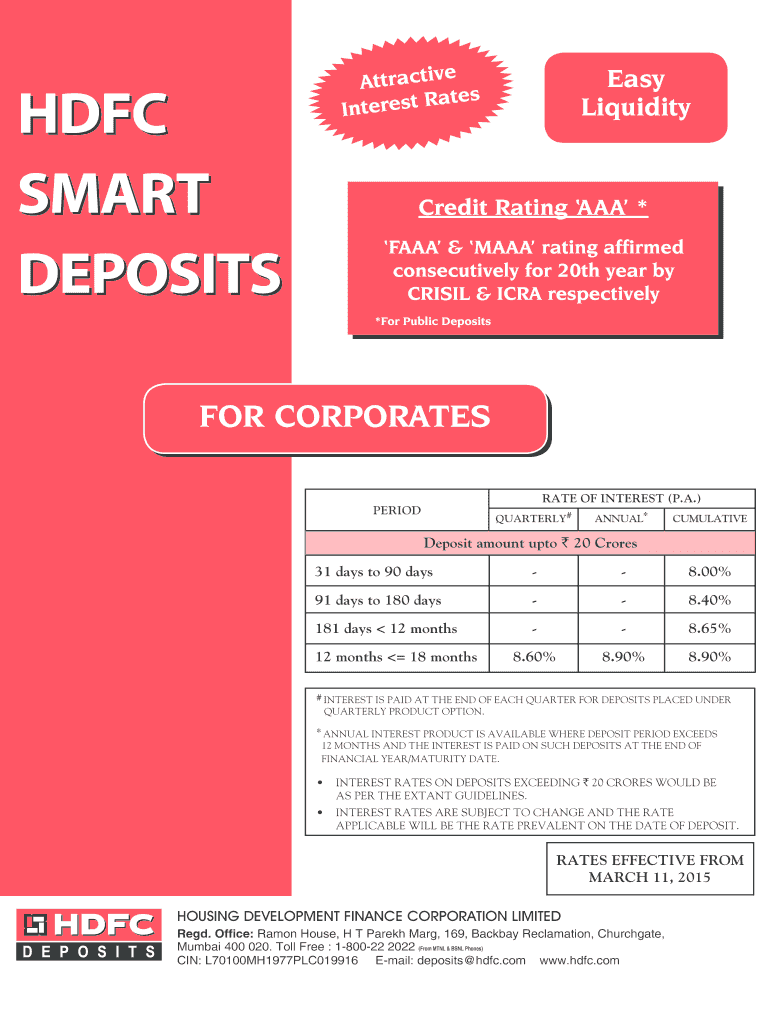

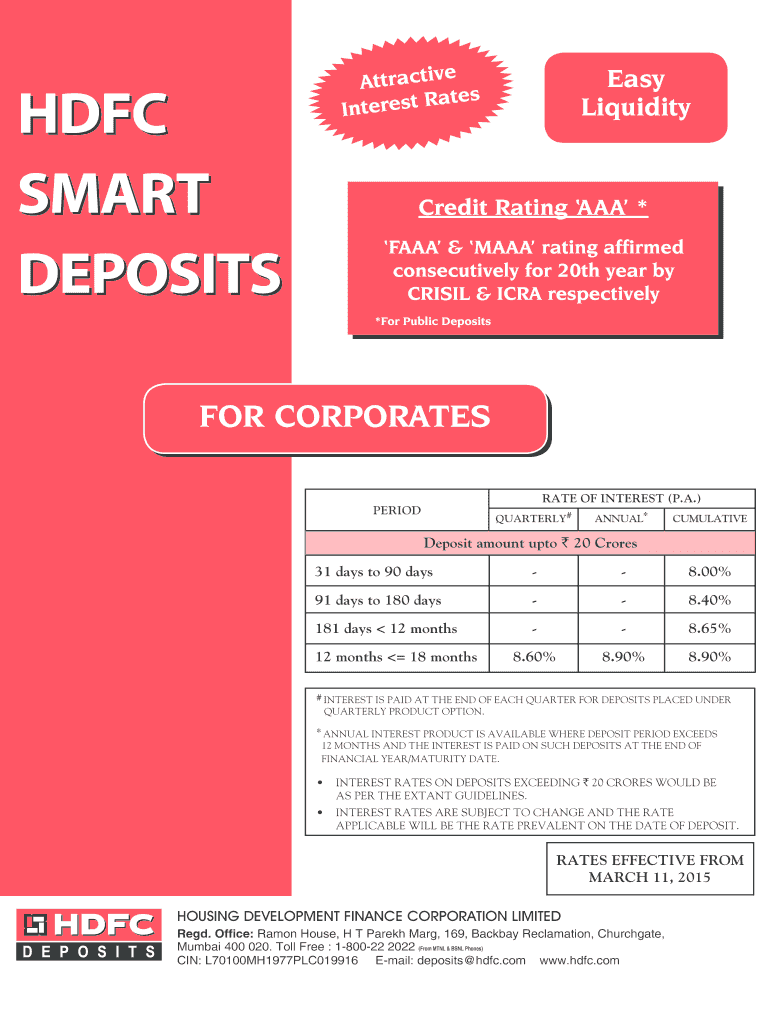

HDFC SMART DEPOSITS Attractive dates Interest R Easy Liquidity Credit Rating AAA * AAA & MAYA rating affirmed consecutively for 20th year by CRISIS & ICRA respectively *For Public Deposits FOR CORPORATES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign faaa amp maaa rating

Edit your faaa amp maaa rating form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your faaa amp maaa rating form via URL. You can also download, print, or export forms to your preferred cloud storage service.

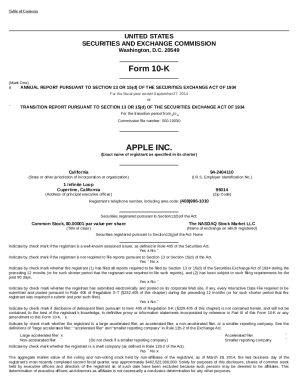

How to edit faaa amp maaa rating online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit faaa amp maaa rating. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

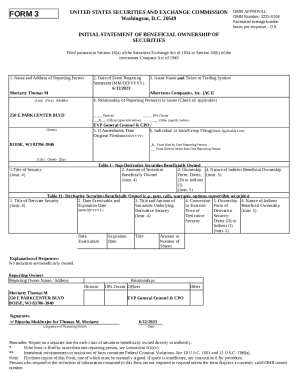

How to fill out faaa amp maaa rating

How to fill out faaa amp maaa rating:

01

Begin by gathering all the necessary information: To fill out the faaa amp maaa rating, you will need to collect relevant data such as financial statements, performance records, risk assessments, and other relevant documentation.

02

Understand the rating criteria: Familiarize yourself with the specific rating criteria for the faaa amp maaa rating. This may include factors such as financial stability, market competitiveness, management capabilities, and risk management practices.

03

Evaluate financial performance: Analyze the financial statements provided. Assess metrics such as liquidity, profitability, leverage, and cash flow to determine the financial health of the entity being rated. Consider factors such as revenue growth, expense control, and debt ratios.

04

Assess risk management practices: Review the risk management framework employed by the entity. Evaluate their ability to identify, measure, monitor, and mitigate risks effectively. Consider the entity's risk appetite, contingency plans, and risk management policies.

05

Evaluate management capabilities: Assess the skills and experience of the management team. Consider their track record, strategic decision-making abilities, and ability to adapt to market changes. Look for evidence of strong leadership and effective governance practices.

06

Consider market competitiveness: Analyze the entity's position within its industry or market. Evaluate its market share, competitive advantages, and ability to withstand potential challenges or disruptions. Consider factors such as market trends, competition, and innovation.

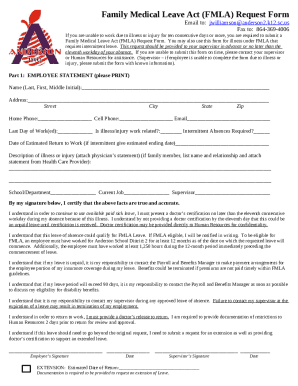

Who needs faaa amp maaa rating:

01

Financial institutions: Banks, credit unions, insurance companies, and other financial institutions often require faaa amp maaa ratings to assess the creditworthiness and risk profile of their clients or potential borrowers. This rating helps them make informed decisions about lending, investments, and insurance coverage.

02

Investors: Institutional and individual investors may rely on faaa amp maaa ratings to evaluate investment opportunities. These ratings provide insights into the financial stability and performance of entities, helping investors make more informed decisions about allocating their capital.

03

Regulators and government agencies: Regulatory bodies and government agencies may require faaa amp maaa ratings to assess the risk associated with specific entities or sectors. This information helps them determine appropriate regulatory requirements, monitor systemic risks, and ensure financial stability.

04

Business partners and vendors: Companies may request a faaa amp maaa rating from their business partners or vendors to evaluate the financial stability and reliability of working with them. This rating can impact decisions related to establishing partnerships, supply chain management, and contract negotiations.

05

Rating agencies: Rating agencies themselves use faaa amp maaa ratings to establish their credibility and reputation in the market. These ratings are a testament to their analytical rigor and can help attract clients and investors seeking reliable and independent assessment of creditworthiness.

In conclusion, filling out the faaa amp maaa rating involves gathering relevant information, understanding the rating criteria, evaluating financial performance and risk management practices, assessing management capabilities, and considering market competitiveness. This rating is valuable for various stakeholders, including financial institutions, investors, regulators, business partners, vendors, and rating agencies themselves.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my faaa amp maaa rating in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your faaa amp maaa rating as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send faaa amp maaa rating for eSignature?

When your faaa amp maaa rating is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute faaa amp maaa rating online?

Filling out and eSigning faaa amp maaa rating is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is faaa amp maaa rating?

FAAA and MAAA ratings are credit ratings provided by credit rating agencies to assess the creditworthiness of financial institutions or government entities.

Who is required to file faaa amp maaa rating?

Financial institutions or government entities are required to file FAAA and MAAA ratings.

How to fill out faaa amp maaa rating?

FAAA and MAAA ratings can be filled out by submitting financial data and other relevant information to credit rating agencies.

What is the purpose of faaa amp maaa rating?

The purpose of FAAA and MAAA ratings is to provide investors and stakeholders with an evaluation of the credit risk associated with a particular entity.

What information must be reported on faaa amp maaa rating?

Information such as financial statements, market data, and credit history must be reported on FAAA and MAAA ratings.

Fill out your faaa amp maaa rating online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Faaa Amp Maaa Rating is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.