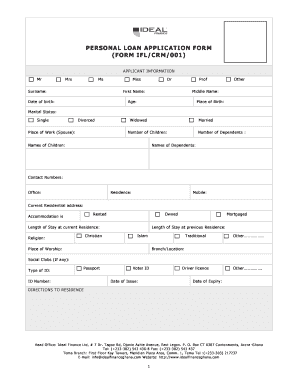

Get the free Personal Loan Application - Fayetteville Bank

Show details

We offer affordable financing and flexible terms on a variety of personal loans to make reaching your goals easy. ... plan your wedding, whatever you need; Very competitive rates; Affordable repayment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal loan application

Edit your personal loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal loan application online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit personal loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal loan application

How to fill out a personal loan application:

01

Start by gathering all the necessary documents and paperwork. This typically includes your identification documents (such as a driver's license or passport), proof of income (such as pay stubs or tax returns), and other financial information (such as bank statements or credit reports).

02

Read through the application carefully and make sure you understand all the questions and requirements. If you have any doubts or questions, don't hesitate to reach out to the lender for clarification.

03

Begin by providing your personal information, including your full name, address, contact information, and social security number. Make sure this information is accurate and up to date.

04

Fill out the section related to your employment and income. Include details about your current job, employer's contact information, and the amount of income you earn. If you have multiple sources of income, be sure to include them as well.

05

Provide information about your expenses, such as rent or mortgage payments, utility bills, and other monthly obligations. This helps the lender assess your financial situation and determine your ability to repay the loan.

06

If you have any existing debts or financial obligations, disclose them in the application. This includes credit card balances, student loans, car loans, or any other outstanding loans.

07

Fill out the section related to the loan details, such as the amount you wish to borrow, the purpose of the loan, and the desired repayment term. Be realistic about the amount you request and ensure it aligns with your financial capabilities.

08

Review the application thoroughly before submitting it. Make sure all the information provided is accurate and complete. Any errors or omissions can delay the loan approval process.

09

Sign and date the application as required. By doing so, you acknowledge that the information provided is true and accurate to the best of your knowledge.

Who needs a personal loan application:

01

Individuals looking to borrow money for personal reasons such as debt consolidation, home renovations, medical expenses, or major purchases may need a personal loan application. These loans are typically unsecured, meaning they do not require collateral.

02

People with good credit scores may find personal loans to be a more favorable option compared to other types of loans. Personal loan applications help lenders assess the borrower's creditworthiness and determine the interest rate and terms of the loan.

03

Some individuals who may benefit from personal loan applications include those who need quick access to funds, want to establish or rebuild credit, or prefer fixed monthly payments over variable interest rates.

Note: Before applying for a personal loan, it's advisable to shop around, compare different lenders and loan offers, and consider factors such as interest rates, fees, and eligibility criteria. Make sure to only borrow what you can comfortably repay.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send personal loan application to be eSigned by others?

Once your personal loan application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get personal loan application?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific personal loan application and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit personal loan application on an iOS device?

You certainly can. You can quickly edit, distribute, and sign personal loan application on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is personal loan application?

A personal loan application is a formal request submitted by an individual to a financial institution or lender to borrow a specific amount of money for personal use.

Who is required to file personal loan application?

Anyone who needs to borrow money for personal reasons, such as to cover unexpected expenses, consolidate debt, or make a large purchase, may be required to file a personal loan application.

How to fill out personal loan application?

To fill out a personal loan application, you will need to provide personal information, financial details, and any supporting documents requested by the lender. The application can usually be completed online or in person at a bank or other lending institution.

What is the purpose of personal loan application?

The purpose of a personal loan application is to request a specific amount of money from a lender for personal use, with an agreement to repay the loan amount plus interest over a set period of time.

What information must be reported on personal loan application?

Personal loan applications typically require information such as full name, contact details, employment details, income information, existing debts, and expenses. In addition, you may need to provide identification documents, bank statements, and proof of income.

Fill out your personal loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.