Get the free TCAP & Tax Credit Exchange Owner 's Certificate of ...

Show details

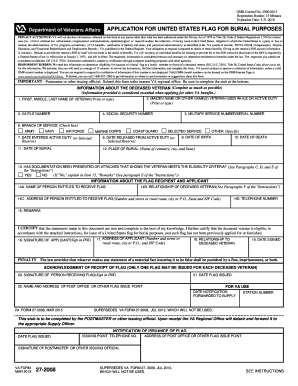

CAP & Tax Credit Exchange Owner's Certificate of Continuing Program Compliance Certification Dates: From: January 1, 20 To: December 31, 20 Project Names: Lowest BIN No: Tax ID# of Ownership Entity:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tcap amp tax credit

Edit your tcap amp tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tcap amp tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tcap amp tax credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tcap amp tax credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tcap amp tax credit

How to fill out tcap amp tax credit:

01

Gather necessary documents: Before starting the process, make sure you have all the required documents such as your income statements, tax returns, and any other relevant financial information.

02

Determine eligibility: Verify if you qualify for the tcap amp tax credit. Eligibility criteria may include your income level, marital status, and number of dependents. Review the official guidelines or consult a tax professional to ensure you meet the requirements.

03

Complete Form: Retrieve the tcap amp tax credit form from the official government website or obtain a physical copy from a tax office. Carefully fill out the form, providing accurate and up-to-date information. Double-check for any errors or missing fields before submission.

04

Calculate credits: Within the form, you might encounter specific sections for calculating the tcap amp tax credit. Follow the provided instructions or utilize available tools to accurately determine the credit amount for which you qualify.

05

Attach supporting documents: If required, attach relevant documents as proof of eligibility or income. These documents may include W-2 forms, 1099s, or other income-related statements. Ensure you have all necessary supporting paperwork before submitting your application.

06

Review and submit: Before submitting your tcap amp tax credit application, thoroughly review the information you provided. Check for any mistakes or inconsistencies, as typos or inaccuracies could lead to delays or potential complications.

07

Submit the application: Once you have reviewed your application and confirmed its accuracy, you can submit it. Depending on the procedure established by the tax authority, you may need to mail the physical form or file it electronically through their official website.

Who needs tcap amp tax credit:

01

Low-income individuals: The tcap amp tax credit is primarily designed to benefit individuals with low or moderate incomes. It provides financial relief by reducing the amount of tax owed or increasing the refund amount.

02

Families with dependents: Individuals who have dependents, such as children or elderly relatives, may benefit from the tcap amp tax credit. This credit aims to assist families in covering their living expenses, education costs, and other necessities.

03

Homeowners or renters: The tcap amp tax credit may also be beneficial for homeowners or renters who meet the eligibility criteria. It can help alleviate the financial burden associated with housing costs, such as property taxes or rent payments.

04

Self-employed individuals: Self-employed individuals who meet the income requirements may also qualify for the tcap amp tax credit. It is vital for freelancers, contractors, or small business owners to explore this credit to potentially reduce their tax liability.

05

Others in specific circumstances: Apart from the mentioned categories, there may be additional circumstances wherein individuals can benefit from the tcap amp tax credit. For example, individuals with disabilities or those with high medical expenses may find this credit helpful in managing their financial obligations.

It is crucial to consult with a tax professional or refer to the official guidelines to determine whether you are eligible for the tcap amp tax credit. They can provide personalized advice and guidance based on your unique situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out tcap amp tax credit using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign tcap amp tax credit and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit tcap amp tax credit on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share tcap amp tax credit from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit tcap amp tax credit on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tcap amp tax credit on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is tcap amp tax credit?

The TCAP AMP Tax Credit is a tax credit offered to investors in affordable housing projects.

Who is required to file tcap amp tax credit?

Developers and investors in affordable housing projects are required to file for TCAP AMP Tax Credit.

How to fill out tcap amp tax credit?

TCAP AMP Tax Credit forms are typically filled out by providing detailed information about the affordable housing project, including the amount of tax credit being claimed.

What is the purpose of tcap amp tax credit?

The purpose of TCAP AMP Tax Credit is to incentivize investment in affordable housing projects.

What information must be reported on tcap amp tax credit?

Information such as the total cost of the affordable housing project, amount of tax credit being claimed, and other project details must be reported on TCAP AMP Tax Credit forms.

Fill out your tcap amp tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tcap Amp Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.