Get the free UK Home Emergency Insurance For policies taken ... - Carole Nash

Show details

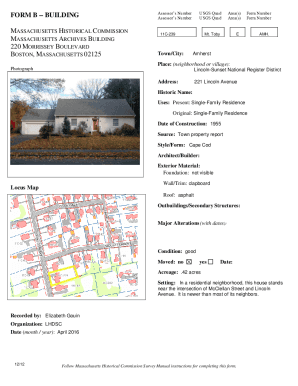

HOME EMERGENCY INSURANCE DOCUMENTS Contents INSURED DOMESTIC EMERGENCY INSURANCE POLICY DOCUMENT Insurance Domestic Emergency Insurance Policy Document Definition related to this Home Emergency policy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uk home emergency insurance

Edit your uk home emergency insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uk home emergency insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uk home emergency insurance online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit uk home emergency insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uk home emergency insurance

How to fill out UK home emergency insurance:

01

Start by gathering all the necessary information and documents. This may include personal details such as your name, address, and contact information, as well as details about your property, such as its size, age, and construction type.

02

Research and compare different insurance providers and their policies. Look for options that specifically offer home emergency cover and review the terms and conditions of each policy.

03

Once you have chosen a provider, visit their website or contact their customer service to begin the application process. They may provide an online form or send you a physical application form.

04

Fill out the application form accurately and honestly. Provide all the necessary information, including details about your property, any existing insurance policies you may have, and any past home emergency incidents.

05

Make sure to read and understand the terms and conditions of the policy, including coverage limits, exclusions, and any additional benefits or optional extras. If you have any questions, don't hesitate to reach out to the insurance provider for clarification.

06

Double-check all the information you have provided before submitting the application. Ensure that there are no errors or missing details that could potentially affect your coverage.

07

Once you are satisfied with the completed application, submit it to the insurance provider. They will review your application and may request additional information or documents if necessary.

08

Upon approval, carefully review the policy documents provided by the insurance provider. Familiarize yourself with the coverage, policy duration, renewal procedures, and any other important information.

09

Pay the required premium to activate the insurance coverage. Choose a payment method that is convenient for you, whether it's a one-time payment or a monthly installment plan.

10

Keep your insurance documents in a safe and easily accessible place. It's essential to have them readily available in case of an emergency or when making a claim.

Who needs UK home emergency insurance?

01

Homeowners: Anyone who owns a house or property in the UK may consider home emergency insurance to protect against unforeseen emergencies such as a burst pipe, boiler breakdown, or electrical failure.

02

Renters: Even if you are renting a property, you may still benefit from home emergency insurance. It can provide peace of mind knowing that you will have assistance in the event of emergencies, such as a blocked drain or a heating system breakdown.

03

Landlords: Landlords who rent out residential properties can also benefit from home emergency insurance. It can help cover the costs of urgent repairs and minimize potential financial losses resulting from emergencies that may disrupt the tenancy or property condition.

Remember, it's important to assess your individual needs and circumstances before deciding if home emergency insurance is right for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete uk home emergency insurance online?

pdfFiller makes it easy to finish and sign uk home emergency insurance online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete uk home emergency insurance on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your uk home emergency insurance, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete uk home emergency insurance on an Android device?

Complete uk home emergency insurance and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is uk home emergency insurance?

UK home emergency insurance provides coverage for unexpected situations such as boiler breakdowns, plumbing issues, and electrical failures.

Who is required to file uk home emergency insurance?

Homeowners are typically required to purchase home emergency insurance to protect their property from unforeseen emergencies.

How to fill out uk home emergency insurance?

To fill out UK home emergency insurance, homeowners typically need to provide information about their property, previous insurance claims, and desired coverage limits.

What is the purpose of uk home emergency insurance?

The purpose of UK home emergency insurance is to provide financial protection and peace of mind for homeowners in the event of unexpected emergencies.

What information must be reported on uk home emergency insurance?

Information such as the homeowner's contact details, property address, details of the emergency coverage needed, and any previous claims history may need to be reported on UK home emergency insurance.

Fill out your uk home emergency insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uk Home Emergency Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.