PR Form AS 2920.1 2015-2025 free printable template

Show details

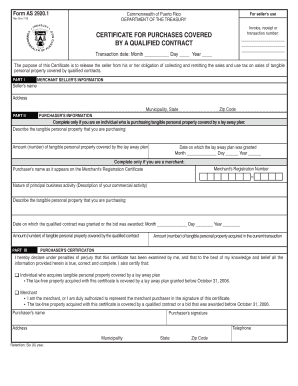

Form AS 2920.1 Auction number Commonwealth of Puerto Rico DEPARTMENT OF THE TREASURY Rev. Jun 26 15 PURCHASE DECLARATION FOR A QUALIFIED CONTRACT GRANTED UNDER AN AUCTION Date in which the auction

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign as 29201 rev 26

Edit your as 29201 rev 26 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your as 29201 rev 26 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing as 29201 rev 26 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit as 29201 rev 26. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR Form AS 2920.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out as 29201 rev 26

How to fill out PR Form AS 2920.1

01

Obtain PR Form AS 2920.1 from the official website or relevant office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal details, including name and contact information.

04

Provide any necessary identification numbers, as specified in the form.

05

Complete the section concerning the purpose of the application.

06

Sign and date the form at the designated area.

07

Review all entries for accuracy and completeness.

08

Submit the form as directed, whether electronically or through postal mail.

Who needs PR Form AS 2920.1?

01

Individuals or organizations seeking a specific government service or benefit that requires documentation.

02

Applicants who need to formalize an application process through PR Form AS 2920.1.

Fill

form

: Try Risk Free

People Also Ask about

Is Puerto Rico sales tax exempt?

Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT. 4 percent on designated professional services and services rendered to other merchants (Special SUT).

What are the sales tax rules in Puerto Rico?

Puerto Rico sales tax details Puerto Rico (PR) is not a state but a commonwealth. The Puerto Rico sales and use tax rate is 10.5%.

How can I move to Puerto Rico to avoid taxes?

If you move to the island, you can legally pay none. There's also no capital gains tax. You just have to give 4 percent of your income to Puerto Rico. The tax break was started by a Puerto Rican politician who'd watched years of high taxes fail to improve life on the island.

Does Puerto Rico have a sales tax exemption certificate?

If you buy products at retail in Puerto Rico in order to resell them, you can often avoid paying sales tax when purchasing those products by using a Puerto Rico resale certificate, otherwise known as an exemption certificate.

What age is tax exemption in Puerto Rico?

An exemption of the income tax withholding is provided for employees from ages 16 to 26 on the first $40,000 of taxable wages. The withholding rates depend upon the personal exemption and credits for dependents claimed in the withholding exemption certificate (Form 499R4l) to be completed by every employee.

Who qualifies for Puerto Rico tax exemption?

An individual is considered to be a bona fide resident of Puerto Rico only if he or she satisfies all of the following three conditions: (1) physical presence test, (2) tax home test, and (3) closer connection test.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit as 29201 rev 26 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your as 29201 rev 26 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the as 29201 rev 26 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the as 29201 rev 26 form on my smartphone?

Use the pdfFiller mobile app to complete and sign as 29201 rev 26 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is PR Form AS 2920.1?

PR Form AS 2920.1 is a compliance form used by organizations to report specific financial or operational information as required by regulatory authorities.

Who is required to file PR Form AS 2920.1?

Entities and organizations that meet certain regulatory criteria or thresholds set by the governing body are required to file PR Form AS 2920.1.

How to fill out PR Form AS 2920.1?

To fill out PR Form AS 2920.1, entities must provide accurate information as per the instructions included on the form, adhering to any outlined deadlines and submission formats.

What is the purpose of PR Form AS 2920.1?

The purpose of PR Form AS 2920.1 is to ensure transparency and accountability in financial reporting and to facilitate compliance with applicable laws and regulations.

What information must be reported on PR Form AS 2920.1?

PR Form AS 2920.1 typically requires information such as financial statements, operational details, and any other specific data mandated by the regulatory authorities.

Fill out your as 29201 rev 26 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

As 29201 Rev 26 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.