Get the free Longleaf Partners Funds

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign longleaf partners funds

Edit your longleaf partners funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your longleaf partners funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit longleaf partners funds online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit longleaf partners funds. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out longleaf partners funds

How to fill out longleaf partners funds:

01

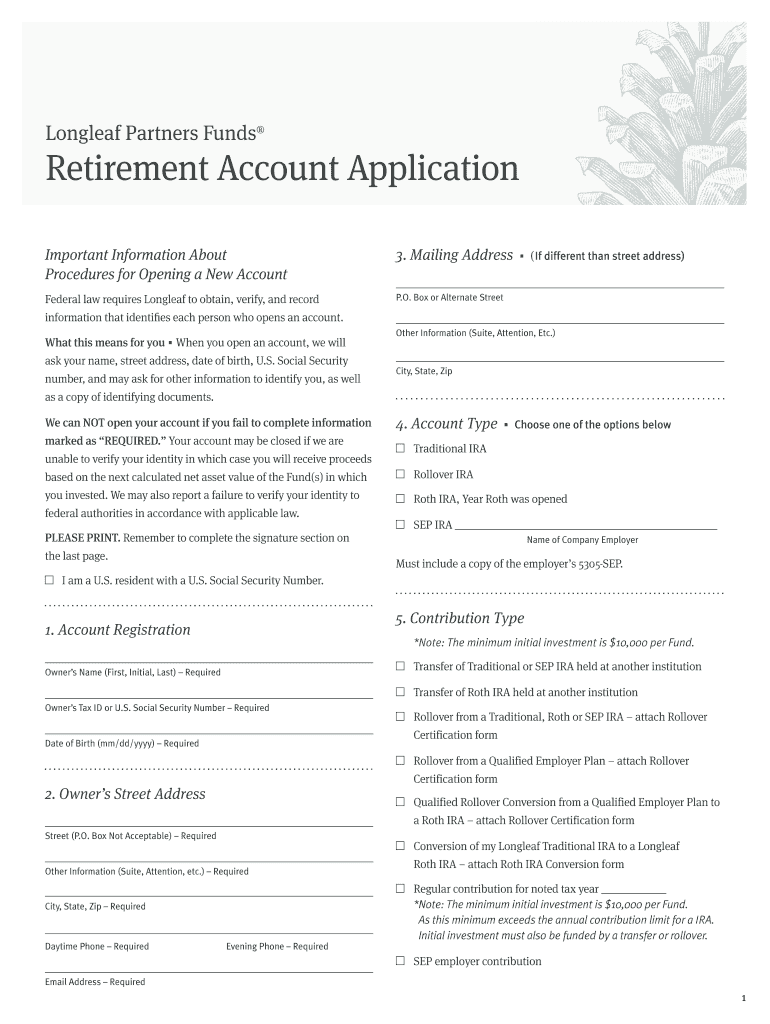

Obtain the necessary forms: Start by visiting the official website of longleaf partners funds to download or request the required forms. These forms may include an application form, prospectus, and any other relevant documents.

02

Fill in personal information: Begin by providing your personal details such as your full name, contact information, social security number, and date of birth. Ensure that you double-check the accuracy of the information before proceeding.

03

Determine the investment amount: Decide on the amount you wish to invest in longleaf partners funds. This can be a lump sum or regular contributions, depending on your financial goals and investing strategy.

04

Choose the fund(s): Longleaf partners funds offer different investment options, such as long-term appreciation and international funds. Evaluate your investment objectives and risk tolerance and select the fund(s) that align with your financial goals.

05

Complete investment instructions: Indicate how you want your investment to be allocated among the available funds. This can be done by specifying percentages or dollar amounts for each fund.

06

Consider additional options: Longleaf partners funds may offer other features or services, such as systematic investment plans or dividend reinvestment plans. Evaluate if any of these options align with your investment preferences and include them accordingly.

07

Review and sign the application: Carefully review all the information provided in the application form. Make sure all sections are completed accurately, and sign the form following the given instructions.

08

Attach any required documentation: Depending on your investor status or specific circumstances, there might be additional documents required. These could include a copy of your identification, proof of address, or other supporting documents. Ensure that you have included all the necessary paperwork.

Who needs longleaf partners funds?

01

Individual investors seeking long-term growth: Longleaf partners funds are suitable for individuals looking to grow their investments over a prolonged period. The funds offer different options, allowing investors to align their investment strategy with their financial goals.

02

Investors comfortable with a value-oriented approach: Longleaf partners funds follow a value-oriented investment philosophy, focusing on purchasing undervalued securities. Investors who believe in this approach and are willing to invest for the long term might find these funds appealing.

03

Those willing to research and analyze investments: Investing in longleaf partners funds requires investors to conduct proper research and analysis. This includes understanding the fund's investment strategy, analyzing the performance of the chosen funds, and staying updated with market trends.

04

Individuals looking for professional management: Longleaf partners funds are managed by experienced investment professionals who make informed decisions on behalf of the investors. This can be beneficial for individuals who prefer to have their investments managed by experts.

05

Investors with a medium to high risk tolerance: As with any investment, there are inherent risks involved. Longleaf partners funds may be more suitable for individuals with a medium to high risk tolerance, as these funds primarily focus on long-term appreciation and may experience short-term volatility.

Note: It's important to consult with a financial advisor or conduct thorough research before making any investment decisions. The information provided here is for informational purposes only and should not be considered as financial advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my longleaf partners funds directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your longleaf partners funds and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I fill out longleaf partners funds on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your longleaf partners funds by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit longleaf partners funds on an Android device?

You can make any changes to PDF files, like longleaf partners funds, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is longleaf partners funds?

Longleaf Partners Funds are a group of mutual funds managed by Longleaf Partners, a company specializing in value investing.

Who is required to file longleaf partners funds?

Investors who hold shares in Longleaf Partners Funds are required to file taxes on any income or gains realized from their investments.

How to fill out longleaf partners funds?

Investors can fill out Longleaf Partners Funds tax forms by following the instructions provided by the fund company or seeking assistance from a tax professional.

What is the purpose of longleaf partners funds?

The purpose of Longleaf Partners Funds is to provide investors with opportunities for long-term capital appreciation through value investing strategies.

What information must be reported on longleaf partners funds?

Investors must report any income, gains, and losses realized from their investments in Longleaf Partners Funds on their tax returns.

Fill out your longleaf partners funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Longleaf Partners Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.