Get the free INVENTORY - TAX

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign inventory - tax

Edit your inventory - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inventory - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit inventory - tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit inventory - tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out inventory - tax

How to Fill Out Inventory - Tax:

01

Determine the accounting method: Decide whether you will use the periodic inventory system or perpetual inventory system. The periodic system requires periodic physical counts, while the perpetual system tracks inventory in real-time using software or technology.

02

Gather necessary information: Collect all relevant documentation, such as sales records, purchase invoices, and any other records related to inventory. This information will be essential for accurately filling out the inventory tax form.

03

Calculate the beginning and ending inventory: Determine the value of your inventory at the beginning and end of the tax year. This can be done by adding up the cost of all items in your inventory at each point in time.

04

Determine the cost of goods sold (COGS): Calculate the cost of goods sold by subtracting the value of ending inventory from the sum of beginning inventory and purchases. This figure represents the cost of the products or services your business has sold during the tax year.

05

Understand tax regulations: Familiarize yourself with the specific tax regulations in your jurisdiction regarding inventory valuation and reporting. Different countries or states may have different rules and requirements, so it's essential to comply with the applicable regulations.

Who Needs Inventory - Tax:

01

Retail businesses: Retailers that carry physical inventory, such as clothing stores, supermarkets, or electronics stores, often need to report inventory for tax purposes. By accurately tracking and valuing their inventory, they can determine the cost of goods sold and calculate the taxable income correctly.

02

Manufacturers: Manufacturing companies that produce goods often require inventory tax reporting. They need to account for both the raw materials used to produce goods and the finished goods that are ready for sale. Proper inventory management allows manufacturers to determine their cost of production and comply with tax regulations.

03

Service-based businesses: Although service-based businesses may not have physical inventory like retailers or manufacturers, they may still need to report inventory for tax purposes. In these cases, inventory could include any supplies, equipment, or materials used in their business operations. Accurate inventory tracking ensures that the costs associated with these items are appropriately deducted.

In conclusion, individuals and businesses that engage in buying, selling, or producing goods, whether physical or intangible, are likely to need inventory for tax reporting. Understanding the inventory filling process and meeting the requirements helps ensure compliance with tax regulations and facilitates accurate financial reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my inventory - tax in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign inventory - tax and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make edits in inventory - tax without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your inventory - tax, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the inventory - tax in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your inventory - tax and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

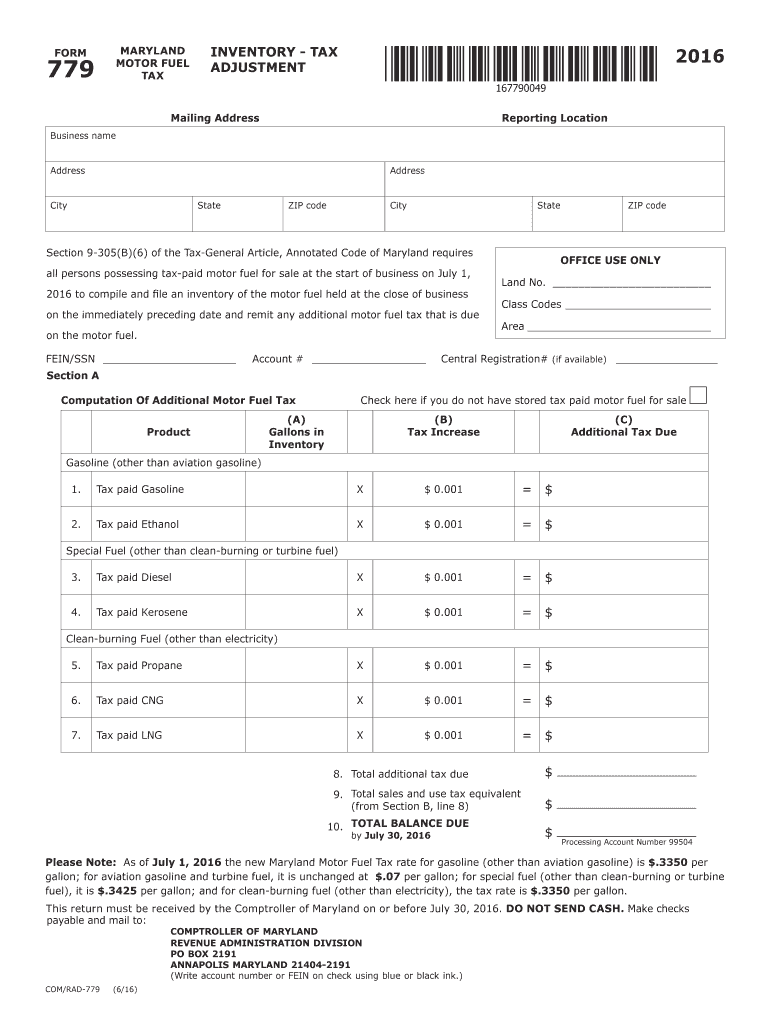

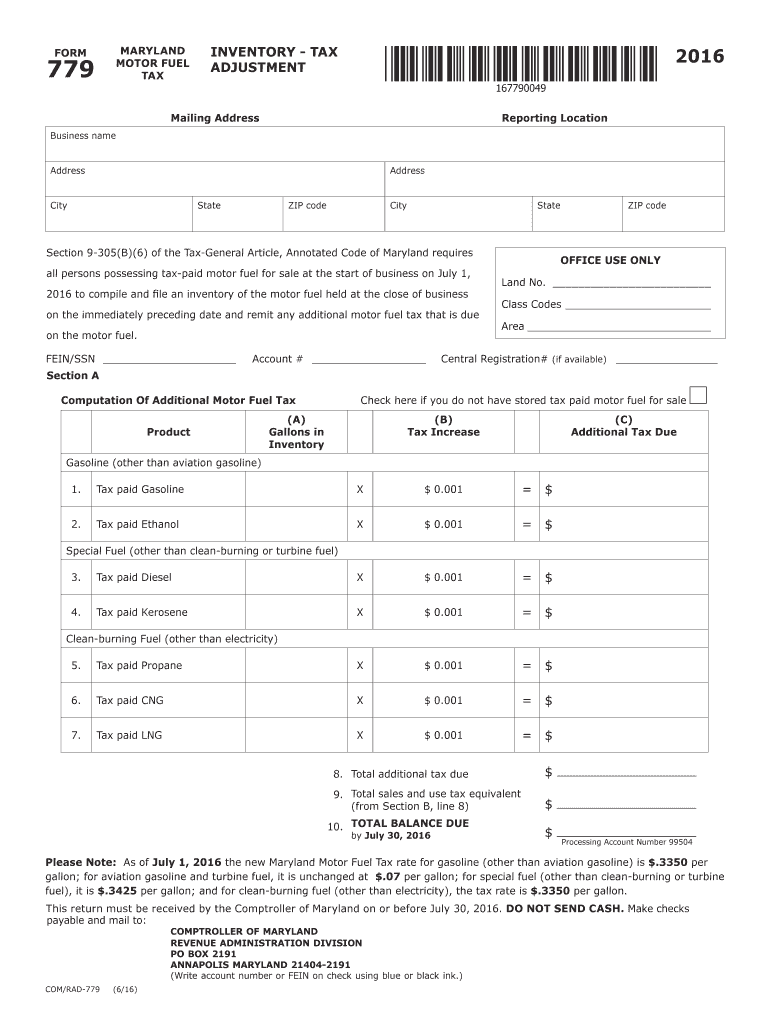

What is inventory - tax?

Inventory tax is a tax on the value of inventory that a business holds.

Who is required to file inventory - tax?

Businesses that hold inventory for resale are typically required to file inventory tax.

How to fill out inventory - tax?

Inventory tax forms can usually be filled out online or submitted through mail with information about the value of inventory held.

What is the purpose of inventory - tax?

The purpose of inventory tax is to generate revenue for the government based on the value of inventory businesses hold.

What information must be reported on inventory - tax?

Businesses must typically report the value of their inventory, including detailed information about the types of inventory held.

Fill out your inventory - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inventory - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.