Get the free Form AS 2915.1 A SALES AND USE TAX MONTHLY RETURN... - hacienda pr

Show details

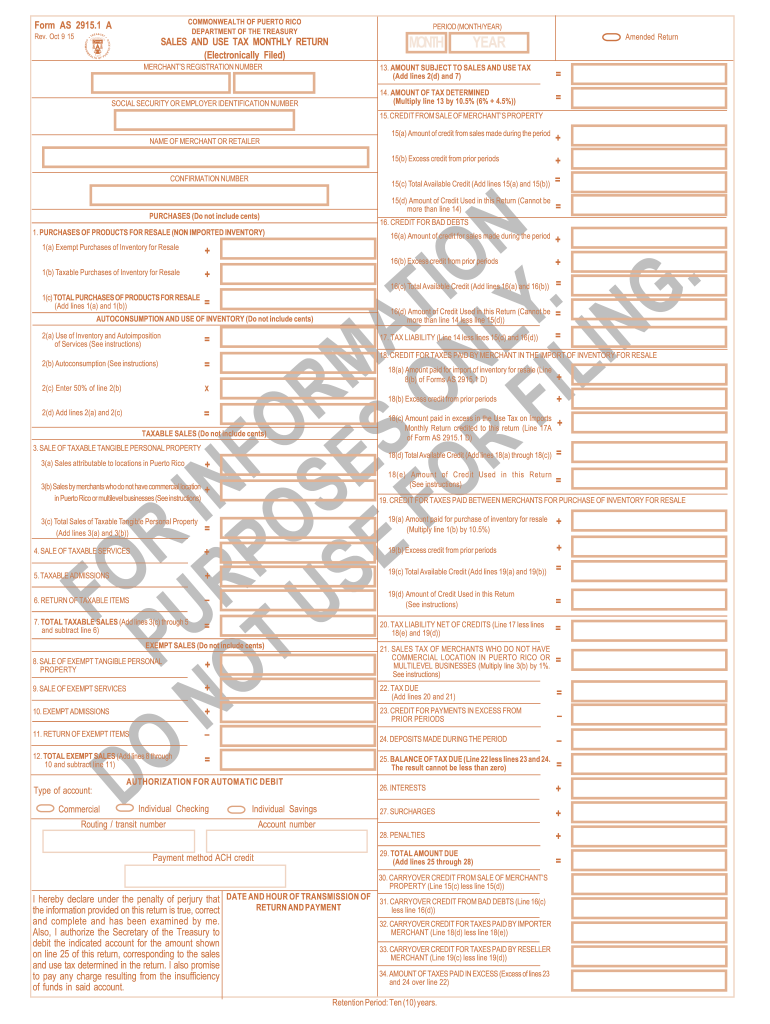

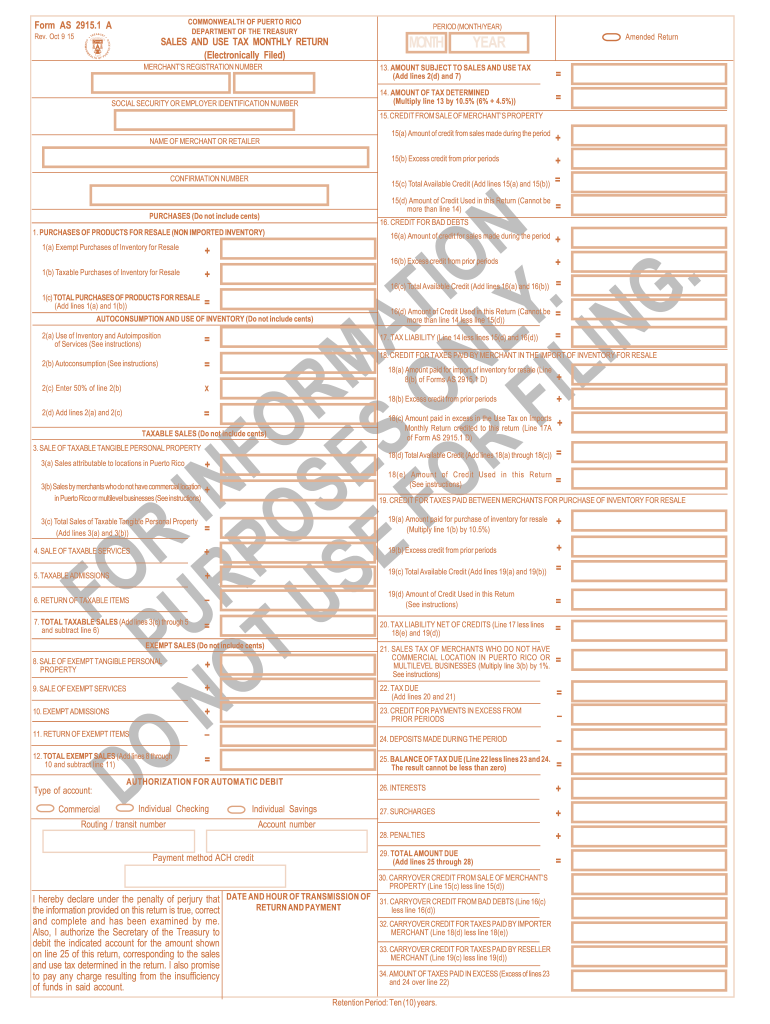

COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY Form AS 2915.1 A Rev. Oct 9 15 PERIOD (MONTH/YEAR) MONTH SALES AND USE TAX MONTHLY RETURN (Electronically Filed) MERCHANTS REGISTRATION NUMBER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form as 29151 a

Edit your form as 29151 a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form as 29151 a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form as 29151 a online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form as 29151 a. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form as 29151 a

How to fill out form as 29151 a:

01

Begin by reading the instructions carefully. Make sure you understand all the requirements and the information needed to complete the form.

02

Gather all the necessary documents and information before starting to fill out the form. This can include personal identification documents, financial statements, or any other supporting documentation required.

03

Start by filling out your personal information accurately. This may include your name, address, contact details, and any other relevant information.

04

Follow the instructions provided for each section of the form. Fill in all the required fields with the appropriate information.

05

Double-check your entries for any errors or omissions. It is important to ensure that all the information provided is correct and complete.

06

If there are any sections that you are unsure of or if you need further clarification, seek assistance from the appropriate authority or consult the instruction manual provided with the form.

07

Once you have completed all the required sections, review the entire form one last time to ensure accuracy.

08

Sign and date the form as required. Make sure to follow any additional guidelines or instructions related to signatures.

09

Make a copy of the filled-out form for your records before submitting it.

10

Finally, submit the completed form as instructed, whether it be through mail, in person, or electronically.

Who needs form as 29151 a:

01

Individuals or businesses who are required to provide specific information or fulfill certain criteria as outlined by the authorities.

02

It may be necessary for certain legal or administrative purposes, such as tax filing, licensing, or regulatory compliance.

03

The specific requirements for the form may vary depending on the jurisdiction, organization, or nature of the request. It is essential to consult the relevant guidelines or contact the appropriate authority to determine if this form is needed.

Fill

form

: Try Risk Free

People Also Ask about

Does Puerto Rico charge sales tax on food?

Municipalities that collect a local sales tax, however, may collect up to a 1.5% tax on groceries and unprocessed foods. If you are a Puerto Rico business owner, you can learn more about how to collect and file your Puerto Rico sales tax return at the 2023 Puerto Rico Sales Tax Handbook .

Do I need to collect sales tax in Puerto Rico?

Puerto Rico (PR) is not a state but a commonwealth. The Puerto Rico sales and use tax rate is 10.5%. Puerto Rico has been an unincorporated territory of the United States since 1898, when it was acquired from Spain in the aftermath of the Spanish American War.

Do you charge sales tax shipping to Puerto Rico?

As a U.S. territory, shipments to Puerto Rico are not considered exports so duties are not applied. There is, however, a state sales tax of 5.5% and a municipal sales tax that can vary from 0% to 1.5 percent.

What is exempt from sales tax in Puerto Rico?

Groceries, healthcare services, prescription medications, and some busineness-to-business services are exempt from part or all of the Puerto Rico sales tax.

What is Hacienda tax in Puerto Rico?

In Puerto Rico, the Hacienda requires that sales taxes on goods and services be collected by goods and services providers and paid to the Hacienda on a monthly basis. On the other hand, the use tax is the amount that a party must pay when introducing an item to Puerto Rico for use and consumption in Puerto Rico.

What are the tax exemptions for Puerto Rico?

U.S. citizens who become bona fide residents of Puerto Rico can maintain their U.S. citizenship, avoid U.S. federal income tax on capital gains, including U.S.-source capital gains, and avoid paying any income tax on interest and dividends from Puerto Rican sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form as 29151 a?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the form as 29151 a in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in form as 29151 a?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your form as 29151 a to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out form as 29151 a using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign form as 29151 a and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is form as 29151 a?

Form AS 29151 A is an official document used for specific reporting purposes, details of which may vary by context.

Who is required to file form as 29151 a?

Individuals or organizations that meet certain criteria as defined by the relevant governing body are required to file Form AS 29151 A.

How to fill out form as 29151 a?

To fill out Form AS 29151 A, enter the required information in the designated fields, ensuring accuracy and adherence to any guidelines provided.

What is the purpose of form as 29151 a?

The purpose of Form AS 29151 A is to collect specific information for regulatory compliance or reporting requirements.

What information must be reported on form as 29151 a?

Form AS 29151 A typically requires information such as personal identification details, financial data, or other metrics relevant to the reporting requirements.

Fill out your form as 29151 a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form As 29151 A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.