Get the free Post-Retirement Life Insurance Beneficiary Designation. The Ohio State University Of...

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign post-retirement life insurance beneficiary

Edit your post-retirement life insurance beneficiary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your post-retirement life insurance beneficiary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit post-retirement life insurance beneficiary online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit post-retirement life insurance beneficiary. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out post-retirement life insurance beneficiary

How to fill out post-retirement life insurance beneficiary:

01

Contact your life insurance provider: Begin the process by reaching out to your life insurance provider. They will provide you with the necessary forms and guidance to fill out the beneficiary information.

02

Gather important details: Collect all the essential information about your desired beneficiary, including their full name, date of birth, social security number, and contact information.

03

Determine the beneficiary's relationship to you: Specify the relationship between yourself and the beneficiary. It could be a spouse, child, sibling, or any other individual whom you want to designate as the recipient of the life insurance proceeds.

04

Include contingency beneficiaries: Consider adding secondary or contingent beneficiaries. These individuals will receive the benefit if the primary beneficiary is unable to claim it or predeceases you.

05

Specify the percentage or amount of allocation: Decide how the life insurance proceeds will be distributed among the beneficiaries. You can indicate a percentage or a specific amount for each beneficiary.

06

Review and sign the form: Carefully review all the details you have provided, ensuring accuracy. Once satisfied, sign the beneficiary form and submit it to your life insurance provider.

07

Keep your beneficiary information updated: Over time, your circumstances may change, necessitating updates to your post-retirement life insurance beneficiary. Regularly review and make changes to the beneficiary designation as needed.

Who needs post-retirement life insurance beneficiary?

01

Individuals with dependents: People who have dependents, such as spouses, children, or aging parents, should consider designating a post-retirement life insurance beneficiary. This ensures that their loved ones are financially protected in the event of their passing.

02

Retired individuals with life insurance coverage: If you have retired but still maintain a life insurance policy, it is crucial to designate a beneficiary. Without a designated beneficiary, the life insurance proceeds may be subject to lengthy legal processes or distributed according to default rules.

03

Individuals with specific financial obligations: Those who have outstanding debts, mortgages, or expenses that may outlive them should assign a post-retirement life insurance beneficiary. This ensures that these financial obligations are settled, providing peace of mind to the policyholder and their loved ones.

04

Individuals seeking to avoid probate: Appointing a post-retirement life insurance beneficiary helps bypass the probate process. This means that the life insurance payout can be disbursed directly to the beneficiary, avoiding delays and potential costs associated with probate court proceedings.

05

People desiring to leave a legacy: If you wish to leave a financial legacy or make charitable donations upon your passing, designating a post-retirement life insurance beneficiary allows you to fulfill these wishes while providing for your loved ones as well.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send post-retirement life insurance beneficiary for eSignature?

When your post-retirement life insurance beneficiary is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an eSignature for the post-retirement life insurance beneficiary in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your post-retirement life insurance beneficiary and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit post-retirement life insurance beneficiary straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing post-retirement life insurance beneficiary, you can start right away.

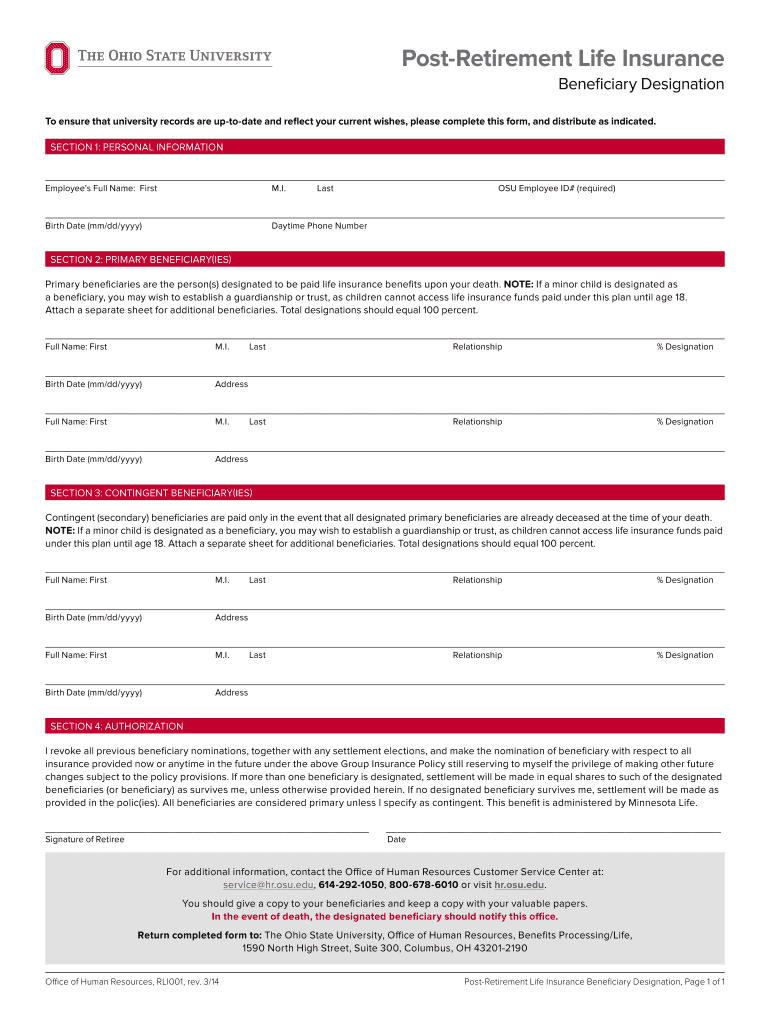

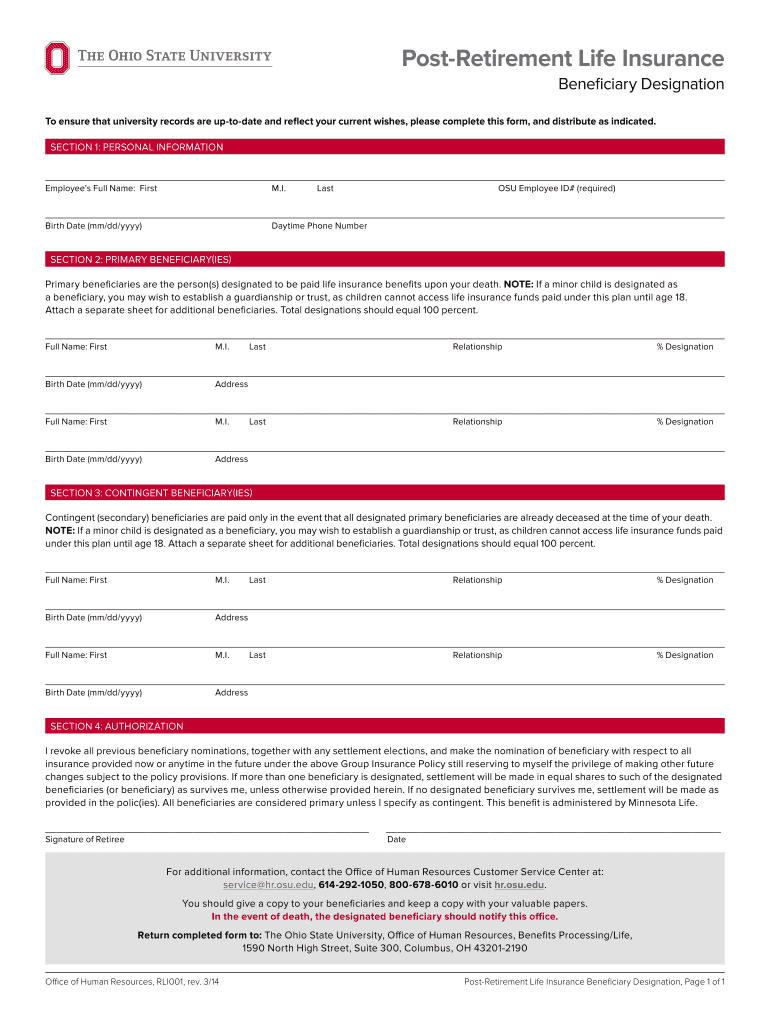

What is post-retirement life insurance beneficiary?

Post-retirement life insurance beneficiary is the individual designated to receive the benefits of a life insurance policy after the policyholder retires or passes away.

Who is required to file post-retirement life insurance beneficiary?

The policyholder is required to designate a post-retirement life insurance beneficiary.

How to fill out post-retirement life insurance beneficiary?

To fill out post-retirement life insurance beneficiary, the policyholder must provide the beneficiary's name, relationship to the policyholder, and contact information.

What is the purpose of post-retirement life insurance beneficiary?

The purpose of post-retirement life insurance beneficiary is to ensure that the benefits of the life insurance policy are distributed according to the policyholder's wishes.

What information must be reported on post-retirement life insurance beneficiary?

The information that must be reported on post-retirement life insurance beneficiary includes the beneficiary's full name, date of birth, social security number, and contact information.

Fill out your post-retirement life insurance beneficiary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Post-Retirement Life Insurance Beneficiary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.