Get the free SNT Beneficiary Death Notification Form - HMS.com

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign snt beneficiary death notification

Edit your snt beneficiary death notification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your snt beneficiary death notification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit snt beneficiary death notification online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit snt beneficiary death notification. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out snt beneficiary death notification

How to fill out snt beneficiary death notification:

01

Start by gathering all relevant information about the deceased beneficiary, including their full name, social security number, and date of death. This information is crucial for accurately filling out the notification form.

02

Ensure that you have the necessary documentation to support the beneficiary's death, such as a death certificate or a letter from the attending physician. These documents will verify the death and enable the Social Security Administration (SSA) to process the notification promptly.

03

Obtain a copy of the SNT beneficiary death notification form from the SSA's official website or by visiting your local SSA office. The form can usually be found under the section for beneficiaries or in the forms and publications section.

04

Carefully read through the instructions provided on the form. This will give you a clear understanding of the information required and how to fill out each section accurately. Follow the instructions step-by-step to ensure completeness and correctness.

05

Begin filling out the form by providing the primary information about the deceased beneficiary in the designated fields. Enter their full name, social security number, and date of birth. Double-check these details for accuracy before proceeding.

06

Move on to the section where you will provide the necessary details regarding the beneficiary's death. Include the date and place of death, as well as any additional information requested, such as the cause of death or any contributing factors.

07

If there are any specific instructions or requests provided by the SSA, make sure to address them accordingly. These may include additional supporting documentation or any other relevant information that could expedite the processing of the notification.

08

Check for any required signatures on the form. You may need to sign as the legal representative of the deceased beneficiary or provide proof of your authority to act on their behalf. Follow the instructions provided to complete this step correctly.

Who needs snt beneficiary death notification:

01

The person responsible for managing the Special Needs Trust (SNT) should complete the beneficiary death notification promptly after the beneficiary's passing. This individual is typically referred to as the trustee or the person appointed to oversee the trust's assets and distributions.

02

It is essential to notify the Social Security Administration (SSA) about the beneficiary's death so that any ongoing benefits from Supplemental Security Income (SSI) or Medicaid can be stopped or adjusted accordingly. Failure to notify the SSA promptly could result in unnecessary overpayments or complications with future benefits.

03

In some cases, the trustee may need to notify other government agencies or organizations that were providing benefits or assistance to the deceased beneficiary, such as state disability or housing programs. This ensures that those benefits can also be appropriately addressed and terminated if necessary.

04

Additionally, the trustee should inform any medical providers or healthcare professionals involved in the beneficiary's care about their passing. This helps prevent any confusion or potential billing issues and ensures that the deceased beneficiary's medical records are updated correctly.

Note: It is always recommended to consult with an attorney or a professional experienced in special needs planning to ensure compliance with all regulations and legal obligations when filling out an SNT beneficiary death notification.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete snt beneficiary death notification online?

pdfFiller makes it easy to finish and sign snt beneficiary death notification online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in snt beneficiary death notification?

The editing procedure is simple with pdfFiller. Open your snt beneficiary death notification in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit snt beneficiary death notification on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign snt beneficiary death notification. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

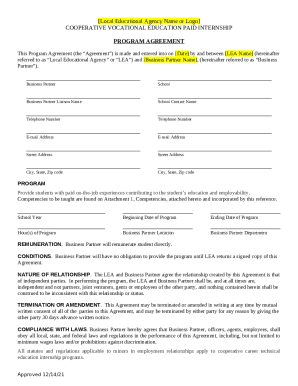

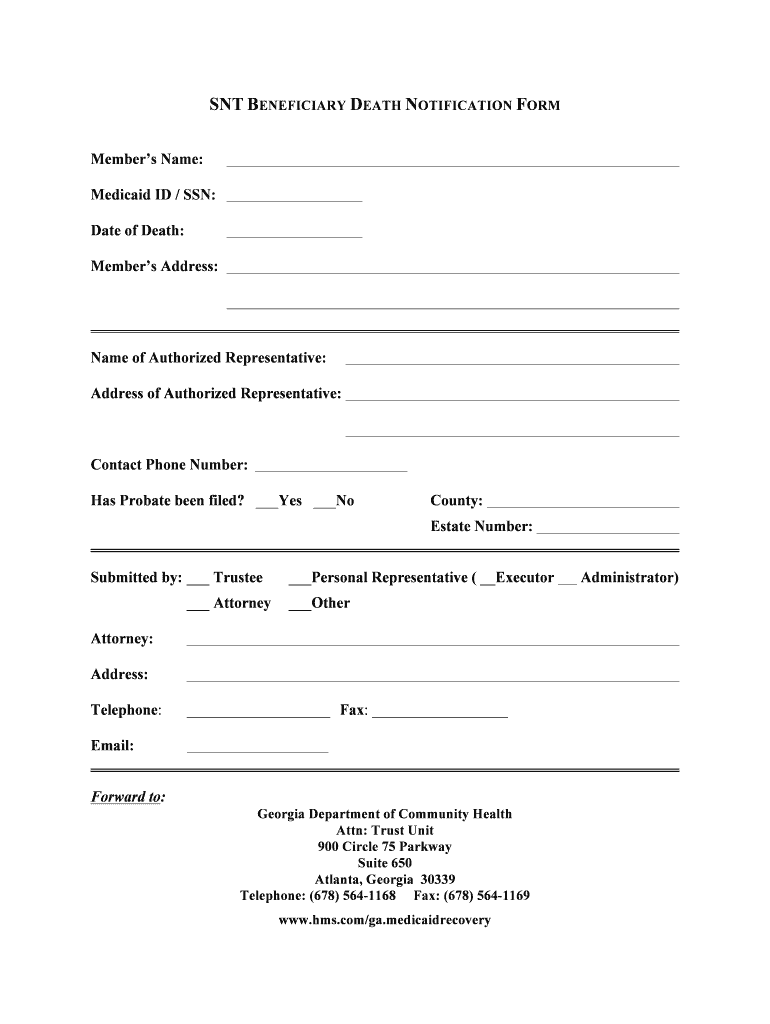

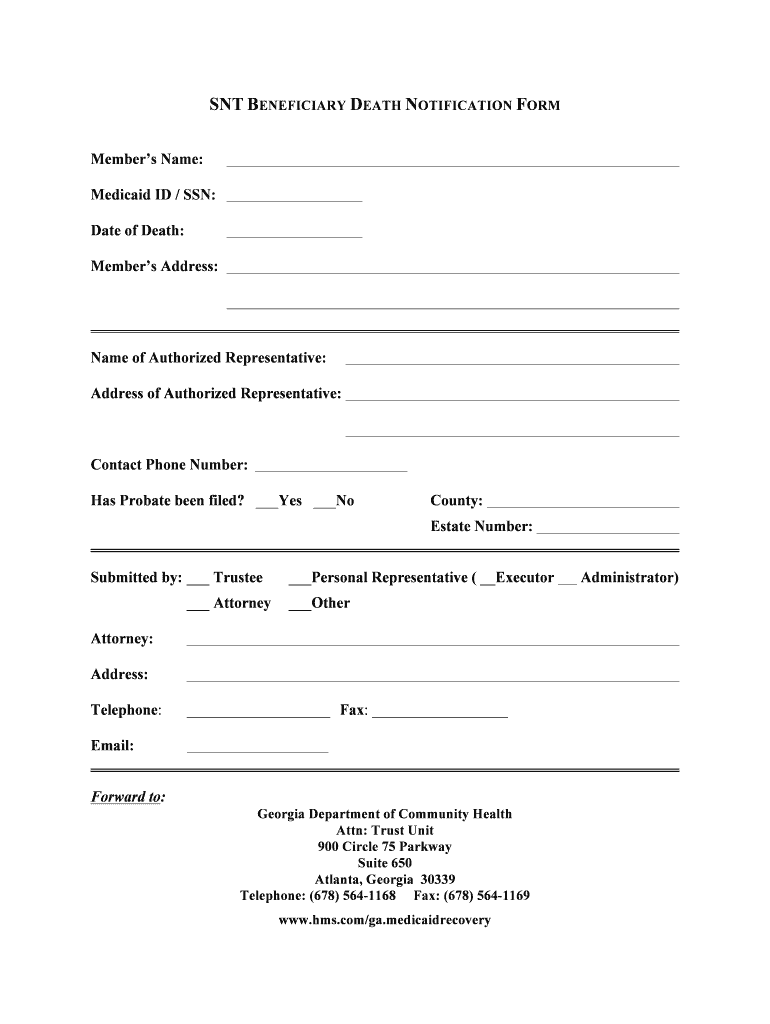

What is snt beneficiary death notification?

SNT beneficiary death notification is a form that must be submitted to notify the Social Security Administration of the death of a Special Needs Trust beneficiary.

Who is required to file snt beneficiary death notification?

The trustee or executor of the Special Needs Trust is required to file the beneficiary death notification.

How to fill out snt beneficiary death notification?

The death notification form can typically be filled out online or by mail, providing information such as the beneficiary's name, date of death, and Social Security number.

What is the purpose of snt beneficiary death notification?

The purpose of the notification is to inform the SSA that the beneficiary has passed away, so that any benefits or payments can be appropriately adjusted or terminated.

What information must be reported on snt beneficiary death notification?

The death notification form typically requires information such as the beneficiary's name, date of death, Social Security number, and contact information for the trustee or executor.

Fill out your snt beneficiary death notification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Snt Beneficiary Death Notification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.