Get the free Accounts and Accounting Reference Dates - help....

Show details

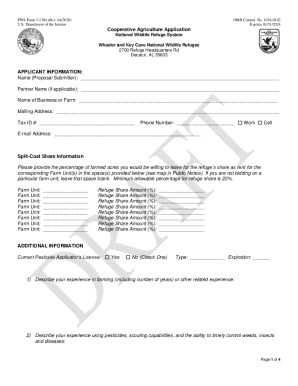

As modified by the Companies Act 2006 Accounts and Accounting Reference Dates GBA3 February 2009 Version 21 Is this guidance for you? This guidance will be relevant to you if you: are preparing accounts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts and accounting reference

Edit your accounts and accounting reference form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts and accounting reference form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounts and accounting reference online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounts and accounting reference. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts and accounting reference

How to fill out accounts and accounting reference:

01

Gather all relevant financial information: Before starting to fill out accounts and accounting reference, it is important to gather all the necessary financial information. This can include bank statements, income and expense records, invoices, receipts, and any other relevant financial documents.

02

Organize the information: Once you have gathered all the financial information, organize it in a systematic manner. You can use spreadsheets or accounting software to create categories and subcategories for different types of transactions. This will help you track and analyze your financial data effectively.

03

Record income and expenses: Start by recording all the income sources and expenses accurately. Make sure to include all sources of revenue and categorize expenses into different categories such as rent, utilities, office supplies, salaries, etc. Be thorough and ensure that every transaction is accounted for.

04

Reconcile bank accounts: Regularly reconcile your bank accounts to ensure that your records match the actual bank statements. This process involves comparing your recorded transactions with the bank statement and addressing any discrepancies. Reconciliation helps identify errors and ensures the accuracy of your financial records.

05

Prepare financial statements: Once you have recorded all the transactions and reconciled bank accounts, you can prepare financial statements. These statements include the income statement, balance sheet, and cash flow statement. They provide a snapshot of your financial position and performance.

06

Include necessary disclosures: Depending on your jurisdiction and industry, there may be specific disclosures that need to be included in your accounts and accounting reference. These can include information about related party transactions, contingent liabilities, and significant accounting policies. Research and comply with the relevant accounting standards and regulations.

Who needs accounts and accounting reference?

01

Businesses and corporations: Businesses of all sizes, ranging from small startups to large corporations, require accounts and accounting reference to maintain accurate financial records, analyze their performance, and fulfill legal obligations.

02

Self-employed individuals and freelancers: Sole proprietors, self-employed individuals, and freelancers also need accounts and accounting reference to keep track of their income and expenses, manage their tax obligations, and demonstrate financial stability when required.

03

Non-profit organizations: Non-profit organizations, including charities and community groups, need to maintain accounts and accounting reference to track their funding, expenses, and comply with legal and regulatory requirements.

04

Investors and lenders: Investors and lenders often require accounts and accounting reference to evaluate the financial health and stability of businesses and organizations they are considering investing in or providing loans to.

05

Government agencies and tax authorities: Government agencies and tax authorities may request accounts and accounting reference from businesses and individuals to ensure compliance with tax laws, assess the accuracy of financial reporting, and detect any potential fraud or non-compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send accounts and accounting reference to be eSigned by others?

To distribute your accounts and accounting reference, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find accounts and accounting reference?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the accounts and accounting reference in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out accounts and accounting reference on an Android device?

Use the pdfFiller mobile app to complete your accounts and accounting reference on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is accounts and accounting reference?

Accounts and accounting reference are financial documents that provide a summary of a company's financial transactions and position.

Who is required to file accounts and accounting reference?

Companies that are registered with the government and are subject to financial reporting requirements are required to file accounts and accounting reference.

How to fill out accounts and accounting reference?

Accounts and accounting reference can be filled out by compiling all financial transactions, preparing financial statements, and including relevant notes and disclosures.

What is the purpose of accounts and accounting reference?

The purpose of accounts and accounting reference is to provide transparency and accountability regarding a company's financial performance and position.

What information must be reported on accounts and accounting reference?

Information such as income, expenses, assets, liabilities, equity, cash flows, and notes to the financial statements must be reported on accounts and accounting reference.

Fill out your accounts and accounting reference online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts And Accounting Reference is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.