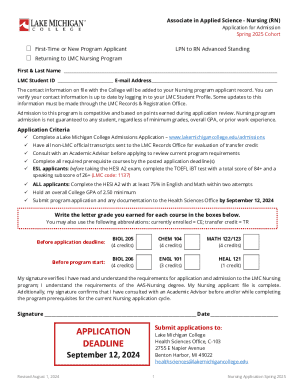

Get the free Dissolution and Winding up

Show details

Utah Depart 8

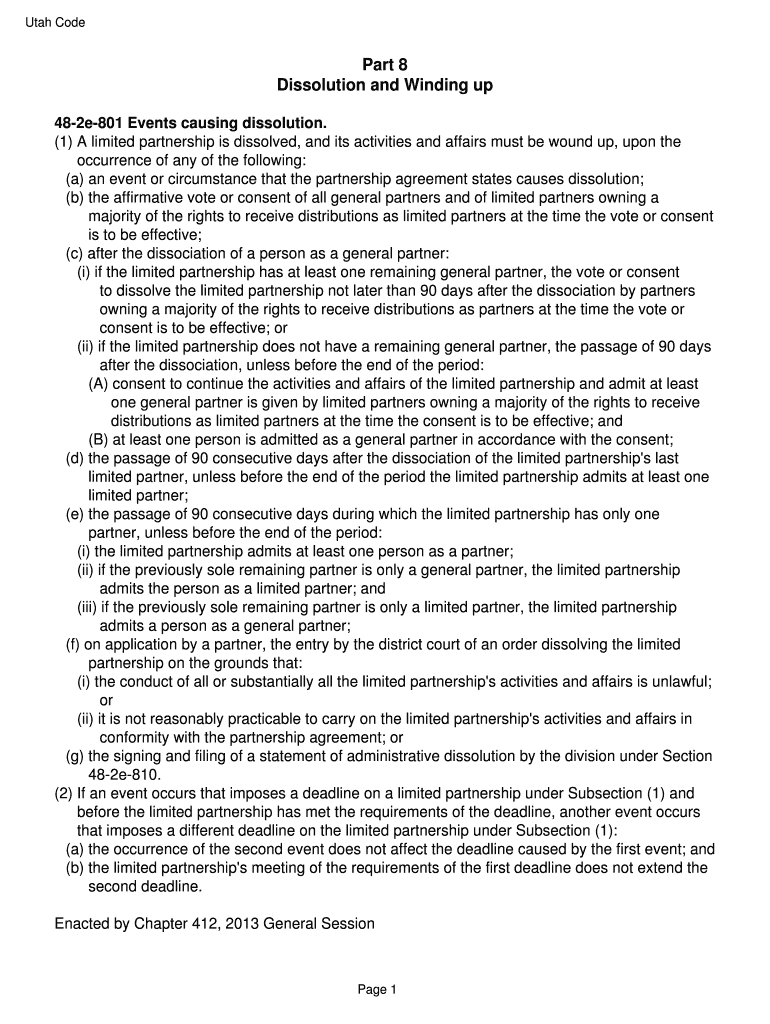

Dissolution and Winding up

482e801 Events causing dissolution.

(1) A limited partnership is dissolved, and its activities and affairs must be wound up, upon the

occurrence of the following:

(a)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dissolution and winding up

Edit your dissolution and winding up form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dissolution and winding up form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dissolution and winding up online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dissolution and winding up. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dissolution and winding up

How to fill out dissolution and winding up:

01

Begin by gathering all necessary documents. This may include the business's legal agreement or articles of incorporation, financial statements, and any other relevant paperwork.

02

Next, consult with a lawyer or legal professional to ensure you fully understand the dissolution and winding up process. They can provide guidance on specific steps, legal requirements, and potential consequences.

03

Prepare a resolution or shareholder agreement that outlines the decision to dissolve the business. This should include the reasons for dissolution, a timeline, and any necessary shareholder approvals.

04

Inform all relevant parties, including shareholders, employees, and customers, about the decision to dissolve and winding up. This may involve sending official notifications via mail or email, or holding a meeting to discuss the situation.

05

Address any outstanding debts or obligations. This includes notifying creditors and settling outstanding payments. It may also involve selling assets, closing bank accounts, and cancelling licenses or permits.

06

Follow all necessary legal procedures to officially wind up the business. This may involve filing dissolution documents with the appropriate government agencies or courts, depending on the jurisdiction.

07

Complete any final tax obligations. This includes filing final tax returns with the relevant tax authorities and settling any outstanding tax liabilities.

08

Distribute remaining assets to shareholders, as per the agreed-upon shareholder agreement or legal requirements.

Who needs dissolution and winding up:

01

Businesses that are no longer viable or profitable may opt for dissolution and winding up to formally close their operations. This could be due to financial difficulties, a change in industry trends, or other factors.

02

Partnerships or joint ventures that have reached the end of their agreed-upon term or objective may also need to undergo dissolution and winding up.

03

In some cases, a court order or legal requirement may necessitate the dissolution and winding up of a business. This could be due to insolvency, non-compliance with regulations, or other legal issues.

It is always advisable to consult with a legal professional or business advisor to determine if dissolution and winding up is the most suitable option for your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete dissolution and winding up online?

pdfFiller makes it easy to finish and sign dissolution and winding up online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit dissolution and winding up online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your dissolution and winding up to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit dissolution and winding up on an Android device?

You can make any changes to PDF files, such as dissolution and winding up, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is dissolution and winding up?

Dissolution and winding up refers to the process of formally closing a business entity and liquidating its assets.

Who is required to file dissolution and winding up?

All business entities that wish to cease operations are required to file dissolution and winding up.

How to fill out dissolution and winding up?

To fill out dissolution and winding up, one must submit the necessary forms and documents to the relevant government authority.

What is the purpose of dissolution and winding up?

The purpose of dissolution and winding up is to formally close a business entity and settle any outstanding debts or obligations.

What information must be reported on dissolution and winding up?

Information such as the company's name, address, directors, and shareholders must be reported on dissolution and winding up.

Fill out your dissolution and winding up online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dissolution And Winding Up is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.