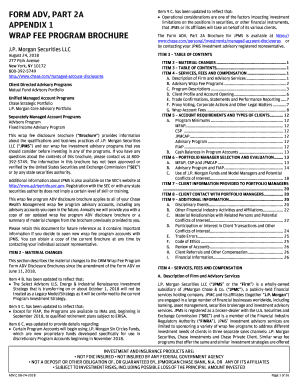

Get the free U.S. TREAS Form treas-irs-6781-1995 - usa-federal-forms.com

Show details

U.S. TREAS Form treasirs67811995 Form 6781 OMB No. 15450644 Gains and Losses From Section 1256 Contracts and Straddles Department of the Treasury Internal Revenue Service Attachment Sequence No. Attach

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us treas form treas-irs-6781-1995

Edit your us treas form treas-irs-6781-1995 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treas form treas-irs-6781-1995 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us treas form treas-irs-6781-1995 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us treas form treas-irs-6781-1995. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us treas form treas-irs-6781-1995

How to fill out Form Treas-IRS-6781-1995?

01

Start by entering your personal information in the designated spaces, such as your name, social security number, and address.

02

Provide details about the tax year for which you are filing this form. Specify whether it is a calendar year or a fiscal year.

03

If you had any transactions related to Section 1256 contracts, mark the appropriate box and provide the required information about each contract you were involved in. Include details like the description of the contract, the date it was acquired, and the date it was sold or closed.

04

Indicate any gains or losses you incurred from these transactions in the respective sections of the form. This includes gains and losses from regulated futures contracts, foreign currency contracts, and non-equity options.

05

If you had any straddling transactions during the tax year, report them in the relevant section. Provide details about the property involved in the straddle, the date it was acquired, and the date it was disposed of.

06

Calculate the net section 1256 contracts gain or loss by adding up all the gains and losses you reported earlier in the form. Enter this result in the appropriate space.

07

If you have any unrecaptured section 1256 losses or any section 988 transactions, provide the necessary information in the relevant sections of the form.

Who needs Form Treas-IRS-6781-1995?

Individuals or entities engaged in certain financial transactions, such as trading section 1256 contracts or conducting straddle transactions, may need to fill out Form Treas-IRS-6781-1995. This form is required to report gains, losses, and other relevant information related to these specific types of financial activities.

It is important to consult the instructions for the form to determine if you are eligible to use it and if it is applicable to your specific situation. If you are uncertain about whether you need to fill out this form, seeking professional tax advice or guidance from the Internal Revenue Service (IRS) would be advisable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify us treas form treas-irs-6781-1995 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like us treas form treas-irs-6781-1995, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the us treas form treas-irs-6781-1995 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your us treas form treas-irs-6781-1995 in seconds.

How do I complete us treas form treas-irs-6781-1995 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your us treas form treas-irs-6781-1995, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your us treas form treas-irs-6781-1995 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Treas Form Treas-Irs-6781-1995 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.