Get the free IRREVOCABLE STANDBY LETTER OF CREDIT.doc

Show details

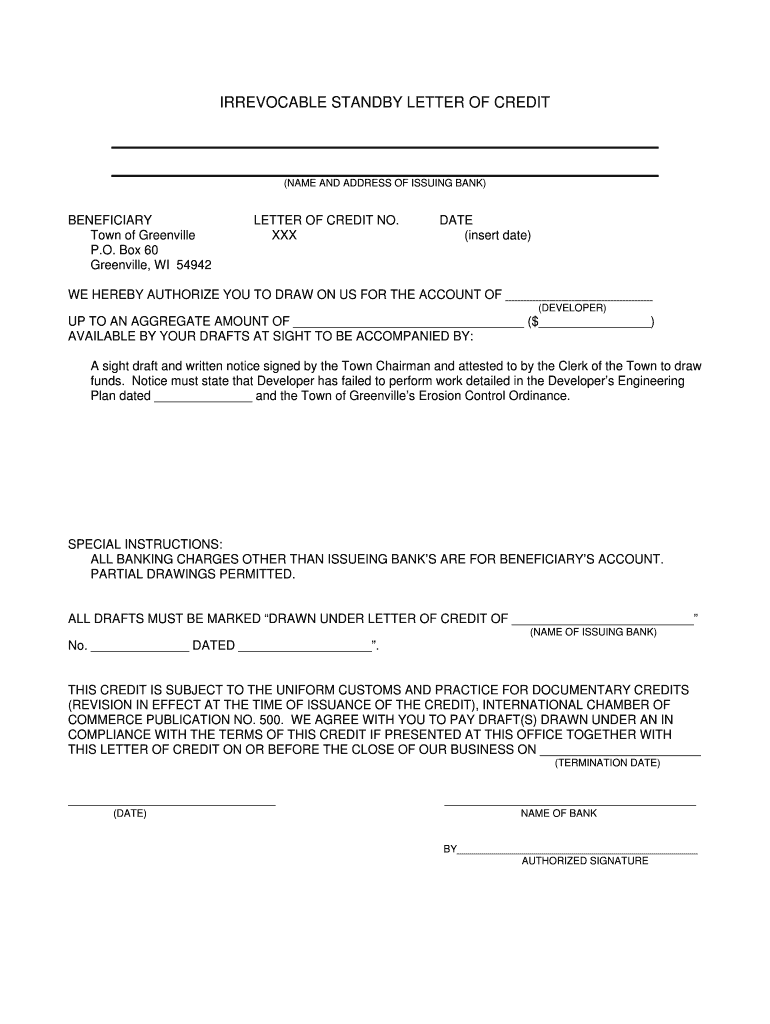

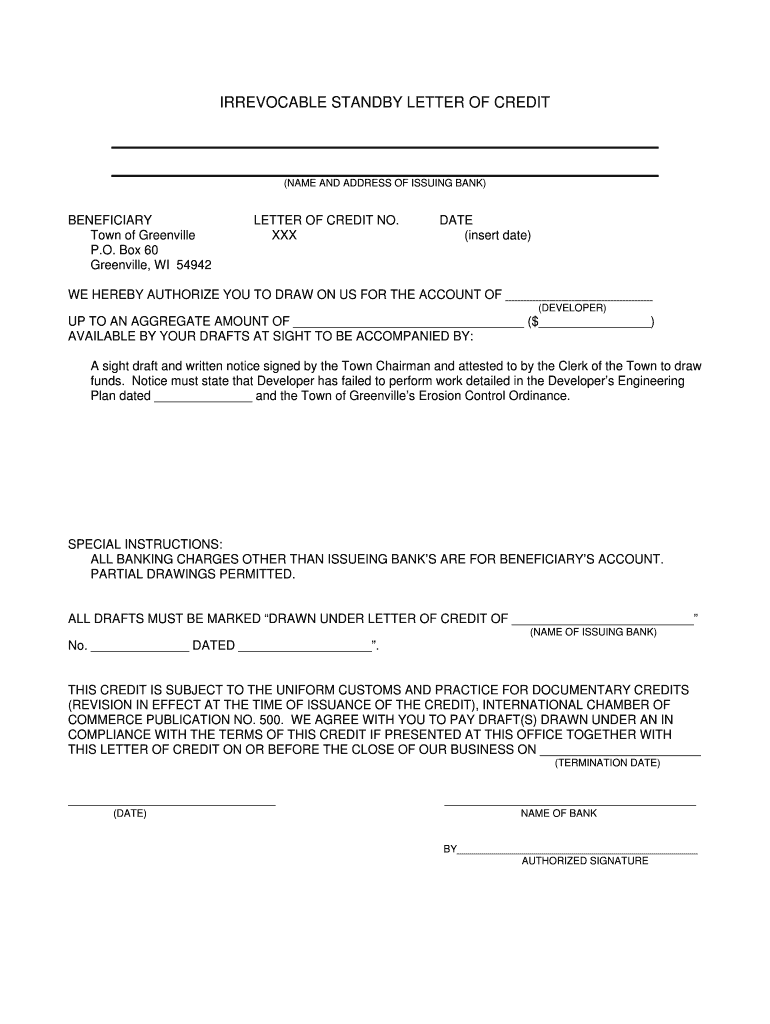

IRREVOCABLE STANDBY LETTER OF CREDIT (NAME AND ADDRESS OF ISSUING BANK) BENEFICIARY Town of Greenville P.O. Box 60 Greenville, WI 54942 LETTER OF CREDIT NO. XXX DATE (insert date) WE HEREBY AUTHORIZE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irrevocable standby letter of

Edit your irrevocable standby letter of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irrevocable standby letter of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irrevocable standby letter of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irrevocable standby letter of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irrevocable standby letter of

How to fill out an irrevocable standby letter of credit:

01

Begin by obtaining the necessary documentation and forms from the issuing bank. These typically include an application form and terms and conditions for the letter of credit.

02

Fill in the required information in the application form. This usually includes details such as the name and contact information of the applicant (usually the buyer), the beneficiary (usually the seller), and the amount of the standby letter of credit.

03

Provide the necessary collateral or security required by the issuing bank. This could be in the form of cash, a deposit, or other assets that can be easily converted to cash in case of default.

04

Specify the duration of the letter of credit. This can vary depending on the circumstances, but it is typically for a fixed period of time.

05

Clearly define the purpose of the letter of credit. This could be for a specific transaction, such as the purchase of goods or services, or to guarantee a payment obligation.

06

Include any additional terms or conditions that are agreed upon between the parties involved. These may include details about the delivery of goods, shipping documents, quality control, or any other requirements specific to the transaction.

07

Review the completed application form and supporting documents for accuracy and completeness. Ensure that all necessary signatures are obtained from the relevant parties.

08

Submit the filled-out application form and supporting documents to the issuing bank. Typically, this is done in person or through a secure online portal.

Who needs an irrevocable standby letter of credit:

01

Businesses engaged in international trade: Irrevocable standby letters of credit are commonly used in international trade to provide assurance to the seller that they will receive payment, and to the buyer that the seller will fulfill their obligations. This is particularly useful when dealing with unfamiliar parties or when trading with countries that have different legal systems or uncertain economic conditions.

02

Construction contractors or suppliers: Contractors or suppliers who are involved in large-scale projects, such as construction, often require a standby letter of credit as evidence of their financial capability to complete the project or deliver the required goods or services. This provides reassurance to the project owner or main contractor.

03

Service providers: Certain service providers, such as telecommunications companies or utility providers, may require a standby letter of credit as a guarantee of payment for their services. This helps protect them against non-payment or default by the customer.

In conclusion, filling out an irrevocable standby letter of credit involves obtaining the necessary forms, providing required information, and agreeing on the terms and conditions. This type of letter of credit is commonly used by businesses involved in international trade, construction, and certain service industries to provide assurance and mitigate risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the irrevocable standby letter of in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out irrevocable standby letter of using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign irrevocable standby letter of and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit irrevocable standby letter of on an Android device?

You can make any changes to PDF files, like irrevocable standby letter of, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is irrevocable standby letter of?

An irrevocable standby letter of credit is a guarantee of payment issued by a bank on behalf of a client.

Who is required to file irrevocable standby letter of?

Any party requiring a guarantee of payment may be required to file an irrevocable standby letter of credit.

How to fill out irrevocable standby letter of?

To fill out an irrevocable standby letter of credit, the issuing bank must provide a written guarantee of payment to the beneficiary upon presentation of specified documents.

What is the purpose of irrevocable standby letter of?

The purpose of an irrevocable standby letter of credit is to provide a guarantee of payment to the beneficiary in the event that the applicant fails to fulfill their obligations.

What information must be reported on irrevocable standby letter of?

The irrevocable standby letter of credit must include details such as the amount of the guarantee, the beneficiary's name, and the conditions for payment.

Fill out your irrevocable standby letter of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irrevocable Standby Letter Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.