Get the free Net domestic and foreign life insurance tax (from Section I, line J) - revenue ky

Show details

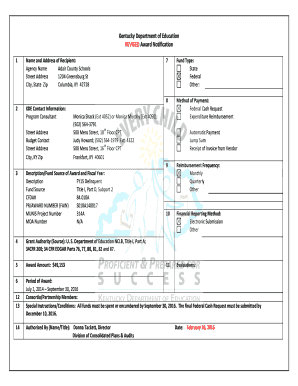

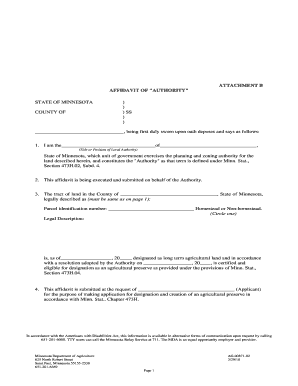

74A100 (116) INSURANCE PREMIUMS TAX RETURN Commonwealth of Kentucky DEPARTMENT OF REVENUE FOR OFFICIAL USE ONLY For Calendar Year 2015 Return Due March 1, 2016, VEIN 3 2 2015 * / / Tax Year Try. Account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign net domestic and foreign

Edit your net domestic and foreign form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your net domestic and foreign form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit net domestic and foreign online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit net domestic and foreign. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out net domestic and foreign

01

Net domestic and foreign need to be filled out accurately to understand a country's economic performance and its relationship with the rest of the world.

02

To fill out net domestic and foreign, begin by gathering data on domestic production, consumption, investment, and government spending. This information can be obtained from national accounts or economic surveys.

03

Calculate the gross domestic product (GDP) by summing up the values of all final goods and services produced within the country's borders in a given period. This figure represents the total value of domestic production.

04

Subtract imports from the GDP to account for foreign goods and services consumed domestically. This step is important to accurately measure net domestic production.

05

Add exports to account for domestic goods and services sold to foreign countries. This helps calculate net foreign production.

06

Subtract any income or transfers to foreign entities from the GDP to account for the outflow of funds from the domestic economy, also known as net factor income.

07

Finally, subtract any income or transfers from foreign entities to the domestic economy to account for the inflow of funds, also known as net transfers.

08

The resulting figure is the net domestic and foreign, representing the net impact of domestic and foreign economic activities on a country's GDP.

09

Net domestic and foreign are important indicators for policymakers, economists, investors, and researchers to analyze a country's economic performance, trade balance, and its interaction with the global economy.

10

Governments, central banks, and international organizations often rely on net domestic and foreign data to develop economic policies, assess economic stability, evaluate trade patterns, and monitor international economic relationships.

In conclusion, accurately filling out net domestic and foreign helps provide a comprehensive understanding of a country's economic performance and its integration into the global economy. This data is vital for various stakeholders in making informed decisions and formulating effective economic strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send net domestic and foreign to be eSigned by others?

Once your net domestic and foreign is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit net domestic and foreign online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your net domestic and foreign to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my net domestic and foreign in Gmail?

Create your eSignature using pdfFiller and then eSign your net domestic and foreign immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is net domestic and foreign?

Net domestic and foreign refers to the calculation of a person's total domestic income minus any foreign income.

Who is required to file net domestic and foreign?

Individuals who have both domestic and foreign income sources are required to file net domestic and foreign.

How to fill out net domestic and foreign?

Net domestic and foreign forms can be filled out online through the tax authority's website or submitted in person at their office.

What is the purpose of net domestic and foreign?

The purpose of net domestic and foreign is to accurately report all income sources, whether domestic or foreign, for tax assessment purposes.

What information must be reported on net domestic and foreign?

Information such as income earned from domestic sources, income earned from foreign sources, deductions, and tax credits must be reported on net domestic and foreign forms.

Fill out your net domestic and foreign online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Net Domestic And Foreign is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.